With more and more consumers getting used to spending time and money online, the point of need for users is constantly changing, so why not try looking at online media?

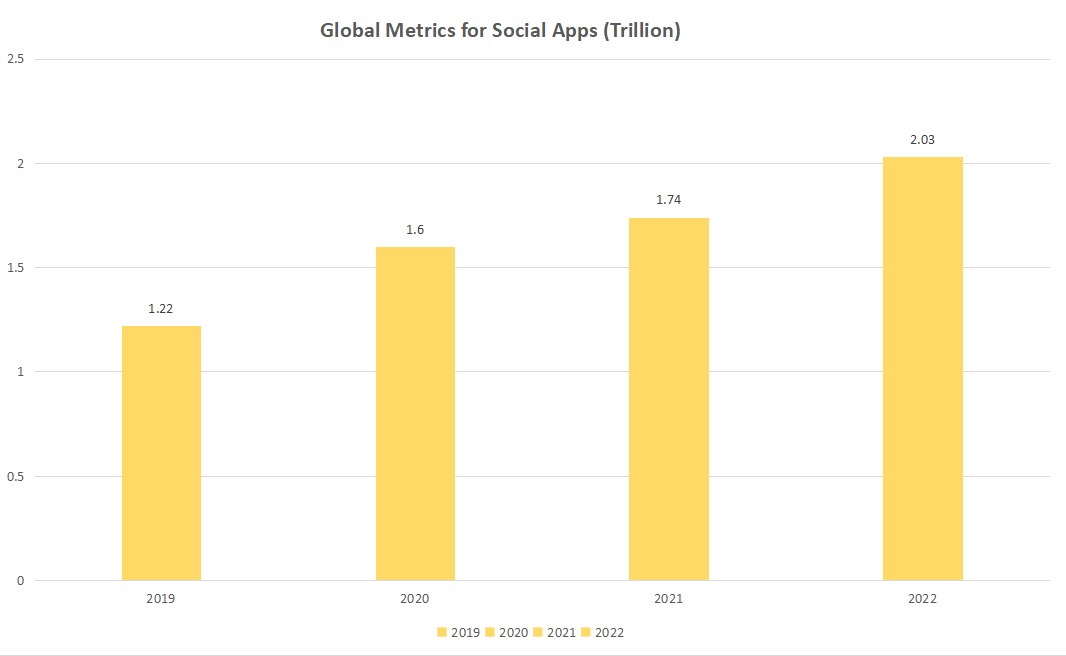

No one can leave without Social Apps

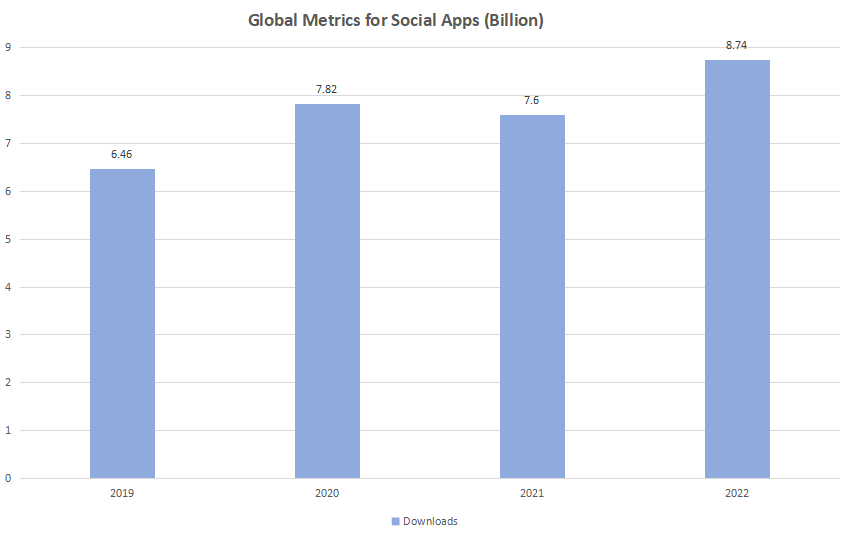

New media sharing network achieves breakthrough in 2022

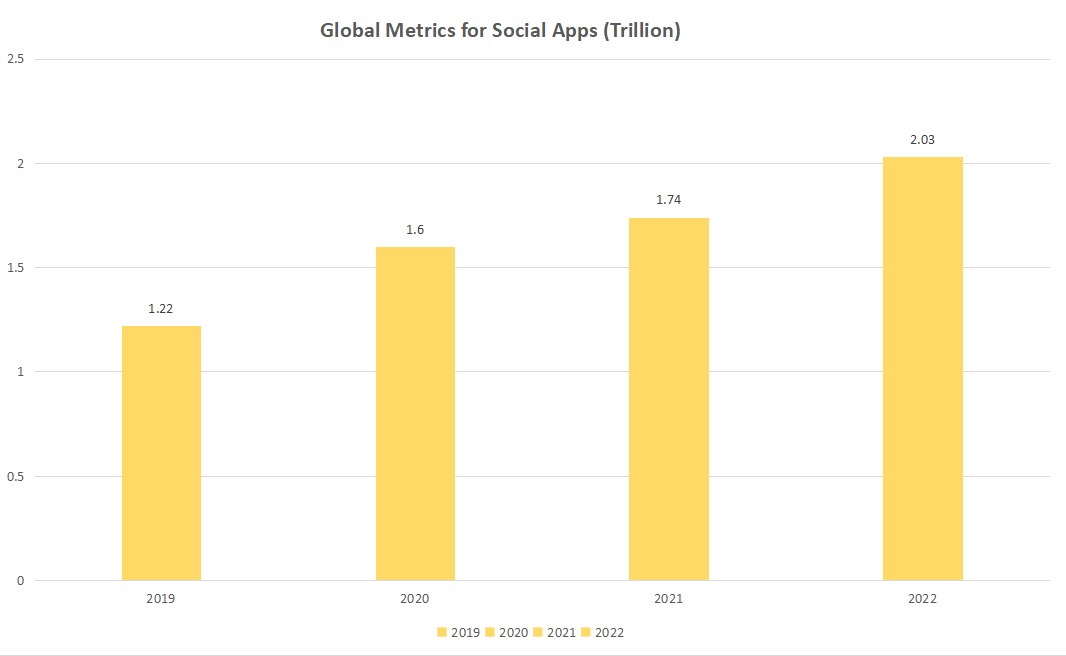

Global Time Spent in

Social Apps Surpassed

2 Trillion Hours in 2022, The total annual time spent

on social apps on Android phones climbed by 17 percentage points to over

2 trillion hours in 2022.

This growth is driven by a 15 percentage point increase in annual emerging app installs, with 25 percentage points of the increase coming from

China.

Growth in consumer spending was hampered in top markets such as the

US and Japan.

Seven of the top ten apps saw annual declines, including

LINE, Facebook, and QQ, but this was offset by strong growth in apps such as

TikTok, Snapchat, WePlay, and Zhihu.

In 2022, "tipping" content creators carves out

social media monetization pathways outside of advertising.

BeReal is making a splash in the

social media space in 2022, having attracted a legion of users with its more authentic and simple marketing strategy.

In fact, no

social app has been able to take on more new users in the

US in the last five years than BeReal, which managed to attract

5.3 million users in

August 2022.

BeReal motivates users by reminding them once a day to take a photo, thus giving each user of the new app a strong average number of active days.

BeReal will need to be more innovative to help increase user time while maintaining the originality and authenticity that it offers.

TikTok's monetization is unparalleled

TikTok's US average monthly revenue per user is much

higher than its

top social media competitor at nearly

85 cents per user, while

Snapchat is second at

5 cents per user based on its recently released subscription data. All of these apps have a relatively broad user base, meaning that if TikTok can find a way to effectively cash in, it could be poised to hit new highs in mobile spending.

It is worth noting the discussions around

Twitter's alternative monetisation strategy since Elon Musk took over, that if Twitter can reach TikTok's ARPU and maintain its current level of user base, it could earn over $50 million per month in the US.

Although only

1% of TikTok's IAPs are at the

$250 price point, these purchases account for roughly a quarter of the

app's US iOS user spending. TikTok's rapid rise to become the world's best-selling app has been driven by its ability to sell IAPs through these high-value points.

Snapchat's early realisation results reveal some promise, with nearly half of its revenue generated through annual subscriptions. This subscription model has proven that it can help

OTT, health and fitness and even dating-type non-gaming apps to succeed.

Snapchat will be a good experiment in whether top social apps can replicate the same success story with subscriptions.

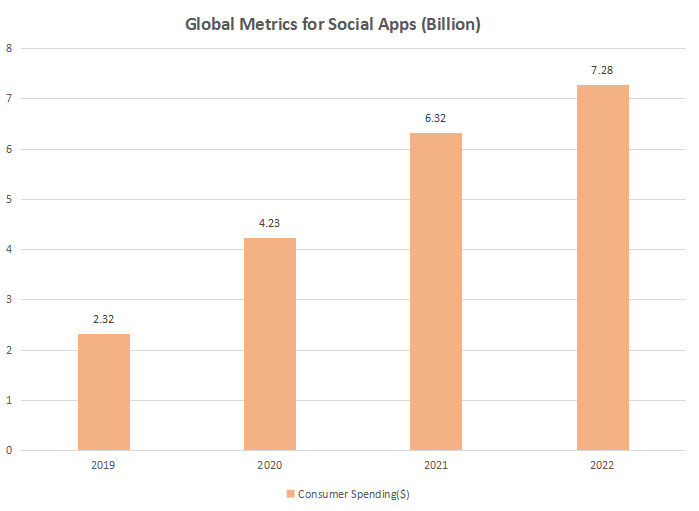

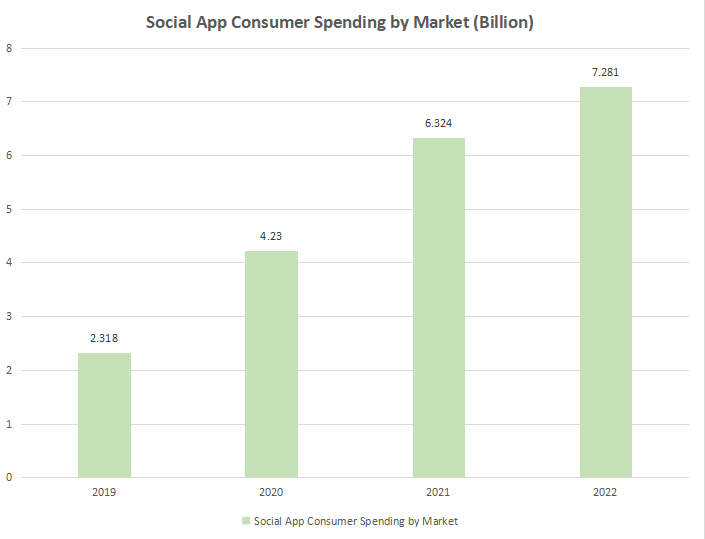

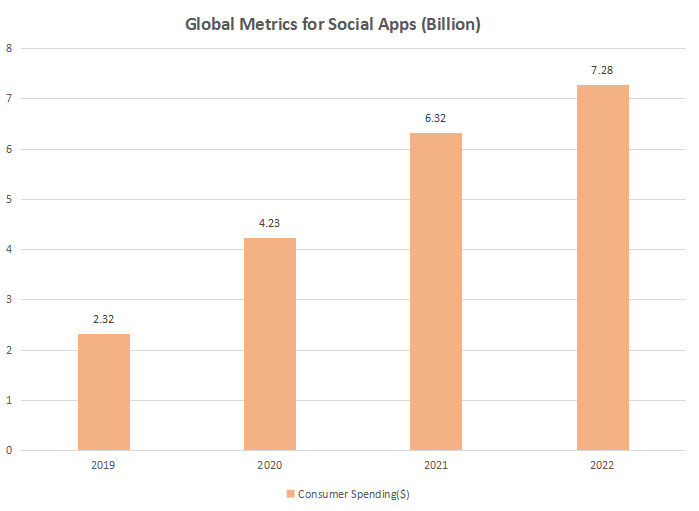

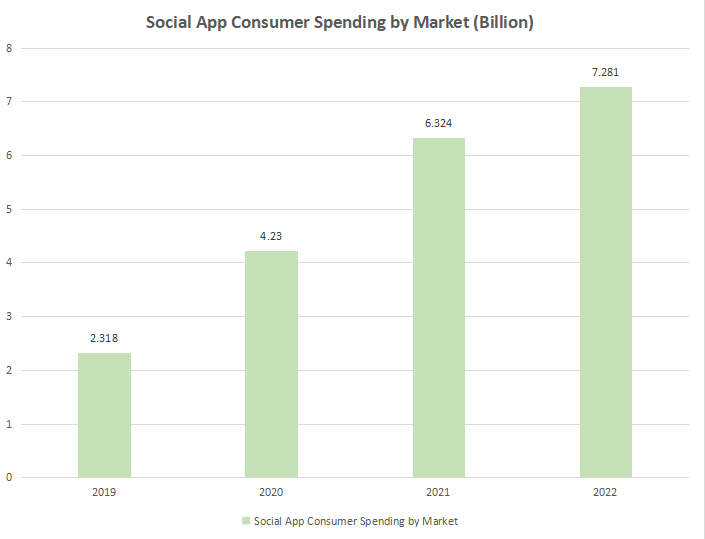

The US Now Accounts for More than 1/4 of Social App Consumer Spending

The US overtakes Japan and China as the top market in terms of social app user spending in 2020 and 2021 respectively (it is worth noting that China only has data from iOS as it is not open to Google Play).

Despite a slowdown in 2022, top apps such as Discord, Facebook and TikTok have managed to stabilise higher user spending from the early years of the epidemic. Social apps are also starting to expand into smaller markets. Markets outside the big three (US, China and Japan) will only account for a total of 30% of consumer spending in 2019. By 2022, that figure will be around 40%, and global spending will have tripled in that time.

TikTok's impressive growth in Video Streaming

TikTok encroaches on the video streaming space. TikTok has become the second largest non-gaming app, with historical spending totalling over $6 billion. TikTok shatters our original perceptions of how high consumer spending on apps, especially in areas other than mobile gaming.

User-Generated Content captures mobile-first audiences alongside exclusive content releases.

TikTok's recent success is far beyond that of other entertainment apps. Over the past 10 years TikTok's downloads have more than doubled that of YouTube, which is a close second. Although TikTok was never even in the top 100 apps (by consumer spending) until 2020, it has since made a name for itself, topping the list in 2022 with over $3 billion in total consumer spending. To date, only Tinder has been able to compete with it in terms of consumer spending.

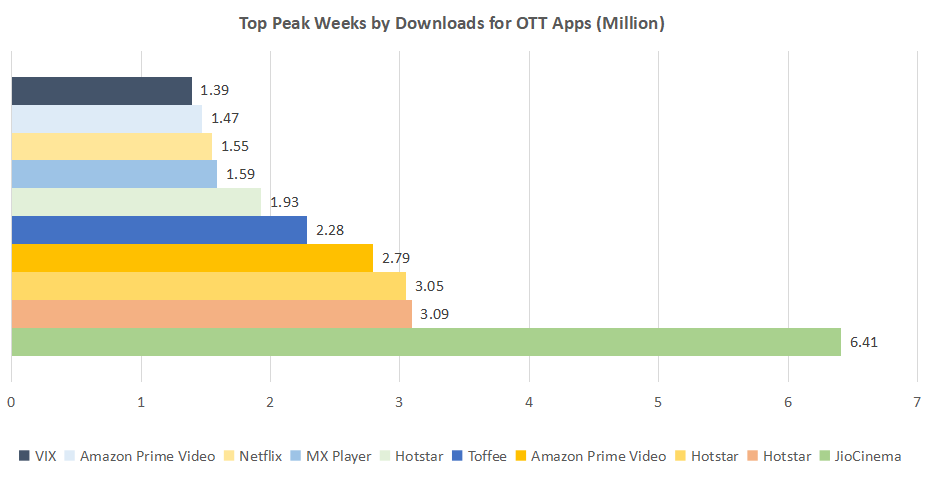

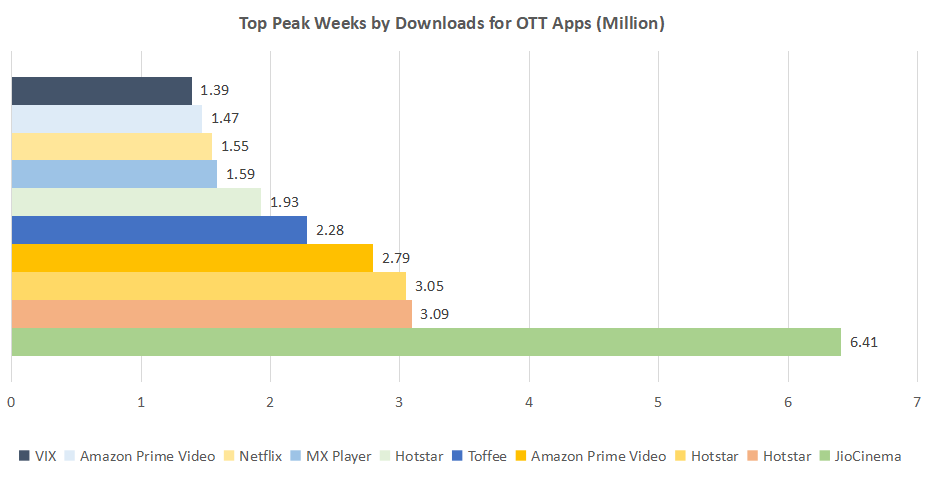

Adding coverage of major sporting events can be a very effective, if costly, way to add new subscribers to a popular streaming service. Globally, streaming events for the World Cup football tournament and India's top cricket tournament resulted in the largest ever increase in downloads.

In the US, the World Cup triggered a huge increase in the use of Peacock TV and fubo TV, with streaming partnerships with the NFL fuelling Peacock TV, Paramount Network and Amazon Prime Video.

Non-sports content that contributed to the unprecedented surge in downloads included the American drama Euohoria (HBO MAX), the film Halloween Ends (Peacock TV) and the film House of the Dragon (HBO MAX).

Mobile Banking is more attractive to users than traditional Banking

Crypto trading and Investing apps take a plunge, personal loans on the rise

Consumers are fond of

banking on their mobile devices, with mobile app usage in popular sub-categories such as

mobile banking,

digital wallets and payments and personal loans growing rapidly

in 2022, continuing to accelerate the wave of mobility that has been underway since the 2020 epidemic.

At the same time, economic issues such as hyperinflation are having an impact on the fintech sector. Personal loan apps are booming in

North America, Asia and Africa.

Cryptocurrency trading applications decline significantly in 2022, while turmoil in the cryptocurrency market leads to the collapse of cryptocurrencies such as Luna and cryptocurrency exchanges such as

FTX.

Fintech continues to exhibit a high degree of localisation, particularly in

Asia Pacific. Unlike other areas of the app economy, FinTech has always maintained

a high localisation trend, with the majority of downloads from countries belonging to

local market publishers. Given that understanding and adapting to the different financial laws and regulations of each country is a complex barrier to entry, it is not surprising that local companies hold such a huge advantage.

The local advantage is strongest in Asia Pacific, particularly in

China, Japan and South Korea. Over

99% of financial app downloads in

China belong to local companies, while local publishers in

Japan and South Korea have a share of over

93%.

Pressure from new banks forces traditional UK banks to enhance app experience

While the user base of

traditional banks dwarfs that of

new banks, new banks have managed to close the gap between them in terms of user engagement, with popular new banks trailing traditional banks by just four minutes per user per month in 2022.

Traditional banks will also have to

improve their mobile offerings as new sources of competition for users move closer to

online banking during the epidemic.

US neobanks improve but still lag UK success

The

top 5 new banks in the

US have seen their average monthly users climb from

1.4 million in 2020 to

2.2 million in 2022, with Chime the clear market leader in terms of active users and user engagement. However, the MAUs of the

top 5 traditional banks are still more than 10 times that of the new banks.

Similar to the

UK, most mobile banking apps see an increase in active users and average hours of use between

2020 and 2021 as consumers become more accustomed to using their mobile devices for banking.

While

banking apps are able to maintain positive momentum in terms of increasing the number of active users, the rate of growth in hours of use slows in 2022 as the US continues to open up.

US consumers look to prepaid cash apps as a way to ease inflationary pressures

Cash advances and early access to paychecks have been a common feature across fintech apps in the

US in recent years. For example, Dave advertises getting up to

$500 instantly.

US cash advance downloads spiked in 2022, increasing

44%. This aligns with the increased search traffic in the

App Store for "cash advance". In fact, the only dips in cash advance demand correspond with the COVID-19 stimulus checks, which eased the financial stress on US consumers during the beginning of the pandemic.

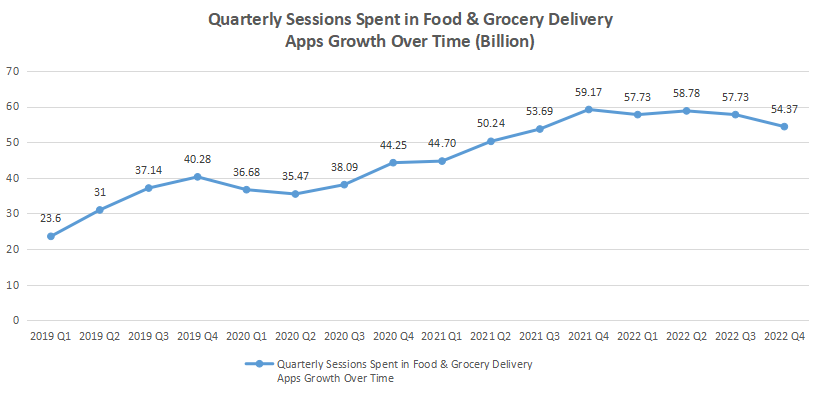

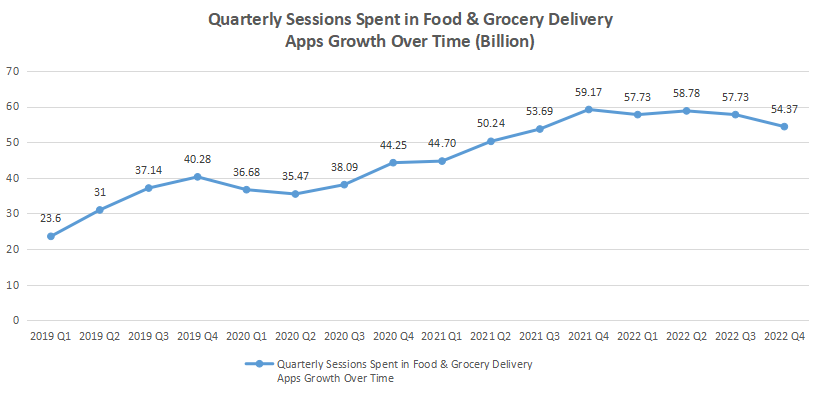

Delivery apps is still indispensable for consumers

Consumers have become accustomed to using

mobile apps for weekly takeaway orders as well as

food delivery. Although countries have reopened, consumers prefer the convenience of takeaway services. The use of restaurant and grocery

delivery apps has continued to climb since the accelerated growth seen at the start of the new coronavirus pandemic.

Globally, usage will grow by almost

10% year-on-year in 2022, compared to

35% and

17% in 2021 and 2020 respectively. Growth has levelled off in some markets, while others continue to thrive, with Brazil seeing a slight decline in usage in 2022, while other key markets such as

India (up 31% year-on-year),

Germany,

France,

Japan and Turkey maintain strong growth.

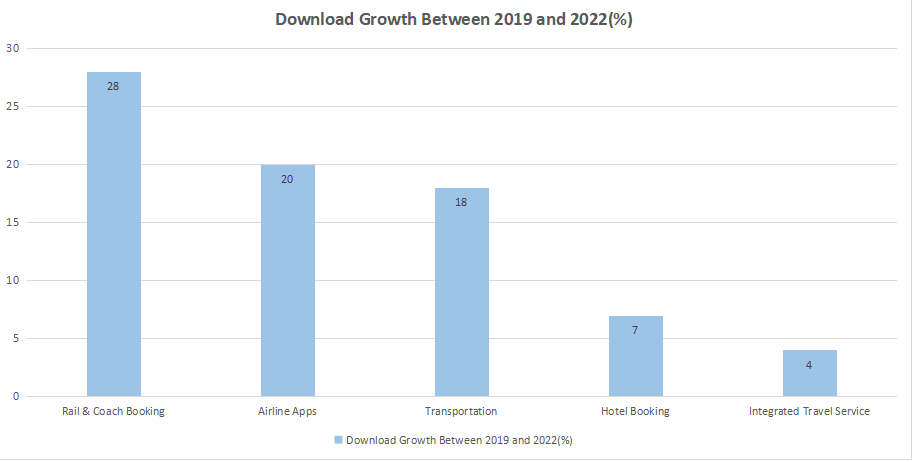

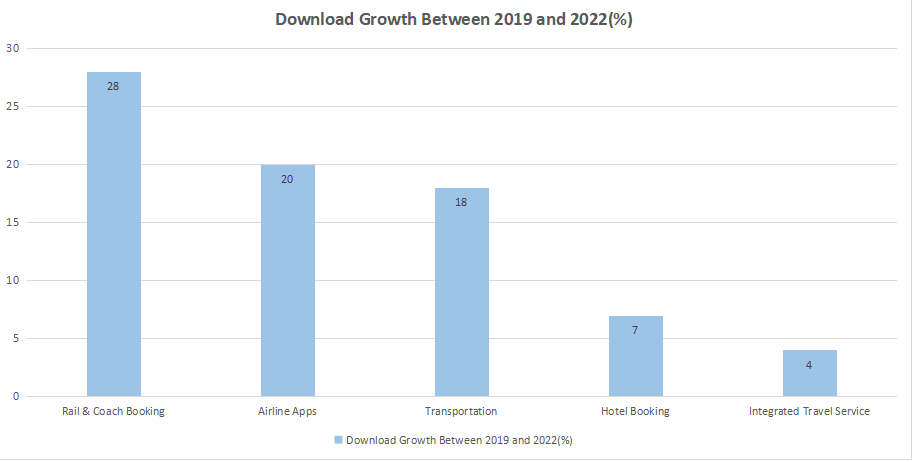

Travel service apps are gradual return to normality

The lifting of travel restrictions will reshape the spending priorities of consumers with the dampened demand for tourism travel. Travel is picking up, with all popular subtypes having surpassed their pre-New Coronavirus pandemic levels.

In 2022, the

top five travel subtypes all surpassed their

2019 totals, indicating a gradual improvement in the travel market overall after a difficult two-year period. Interestingly, at least

globally, hotel bookings as well as integrated travel service apps are lagging behind airline and transportation apps in terms of growth.