The Future of Sports Apps Marketing in 2026: What to Expect Next

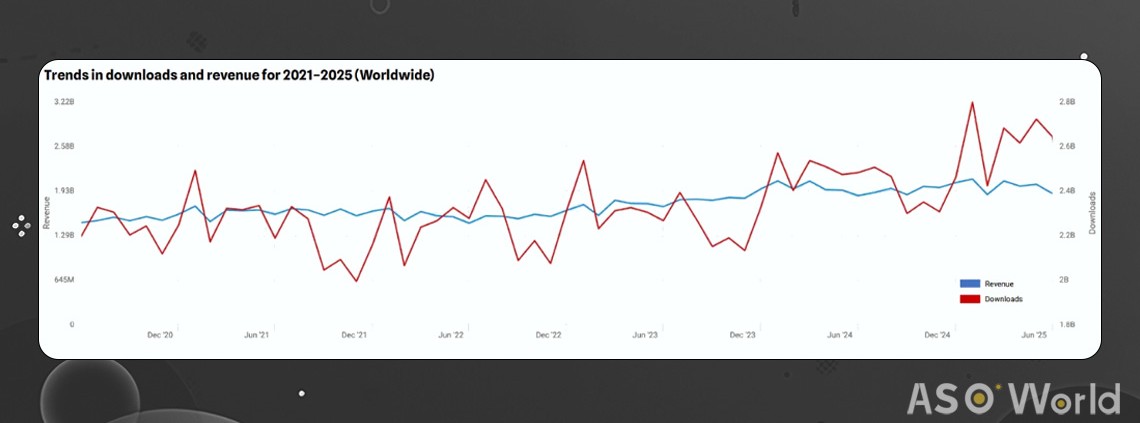

A report shows casual mobile game downloads rose 6% in 2025, but revenue growth lagged at 3.6%, with declines in the US and China offset by Japan’s gains.

The casual mobile gaming sector is witnessing a notable rise in downloads worldwide, yet revenue growth remains sluggish, according to a recent report from a mobile market intelligence firm.

In the first half of 2025, downloads of casual games increased by 6% year-over-year, reaching 30.2 billion compared to 28.4 billion in the same period of 2024.

However, revenue only grew by 3.6%, inching from $22.9 billion to $23.8 billion, with growth stalling at under 1% in the first half of the year.

The 6% surge in downloads reflects heightened player interest, particularly during winter months, a seasonal trend noted in the report. Despite this, the modest 3.6% revenue increase signals that monetization efforts are not fully capitalizing on the expanded audience.

In H1 2025, revenue growth was nearly flat at less than 1%, highlighting a disconnect between user acquisition and financial returns.

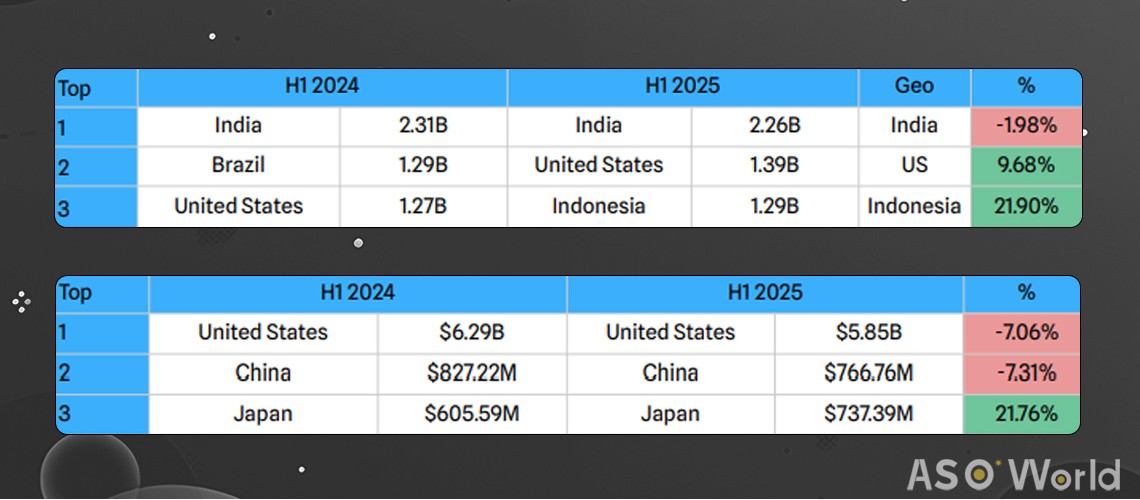

The United States and China, long the biggest revenue drivers, both saw declines in H1 2025. Revenue dropped by 7.06% in the US and 7.31% in China compared to H1 2024, suggesting challenges in sustaining earnings in these mature markets.

In contrast, Japan posted a robust 21.8% revenue increase, emerging as a standout performer. This growth points to effective monetization strategies tailored to local preferences.

Download patterns also shifted, with Indonesia surpassing Brazil to rank among the top three download markets alongside India and the US. Indonesia’s downloads soared by 21%, while Brazil experienced a 20% decline.

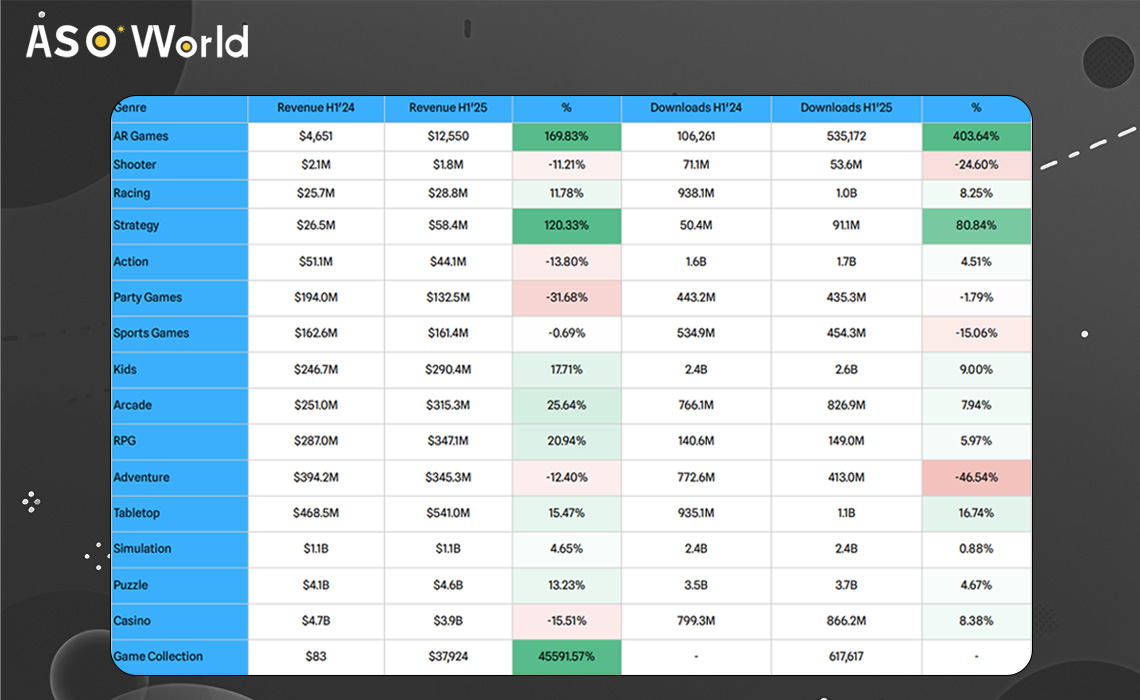

Puzzle, casino, and simulation games continue to lead revenue generation.

Puzzle games, in particular, enjoyed a 13.2% revenue boost year-over-year. Race mechanics dominate, appearing in 70% of top titles, while IP collaborations feature in 25%.

Meanwhile, fishing mechanics have lost traction, absent from new top-performing games in 2025.

Monetization strategies are evolving, with boosters and bundles holding steady as staples. Slot machine mini-games are gaining popularity, alongside retention tools like battle passes and surprise chests, aimed at boosting player engagement and session times.

👉 Casual Game Case Study: +120% First-time Deposit(FTD) Users by Optimizing Keyword Strategies

The casual mobile gaming market stands at a pivotal moment. Rising downloads signal enduring appeal, yet stagnant revenue in key regions like the US and China suggests monetization models may need rethinking. Japan's success could offer lessons in localized strategies, while the rise of IP collaborations hints at untapped potential.

Developers must adapt to shifting player tastes—evidenced by the decline of fishing mechanics—and refine revenue tactics to turn download gains into financial wins.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.