Discover key strategic insights into why Mobile Legends: Bang Bang outshines League of Legends: Wild Rift in the competitive Southeast Asian market, and learn how ASO World can elevate your mobile game's international presence.

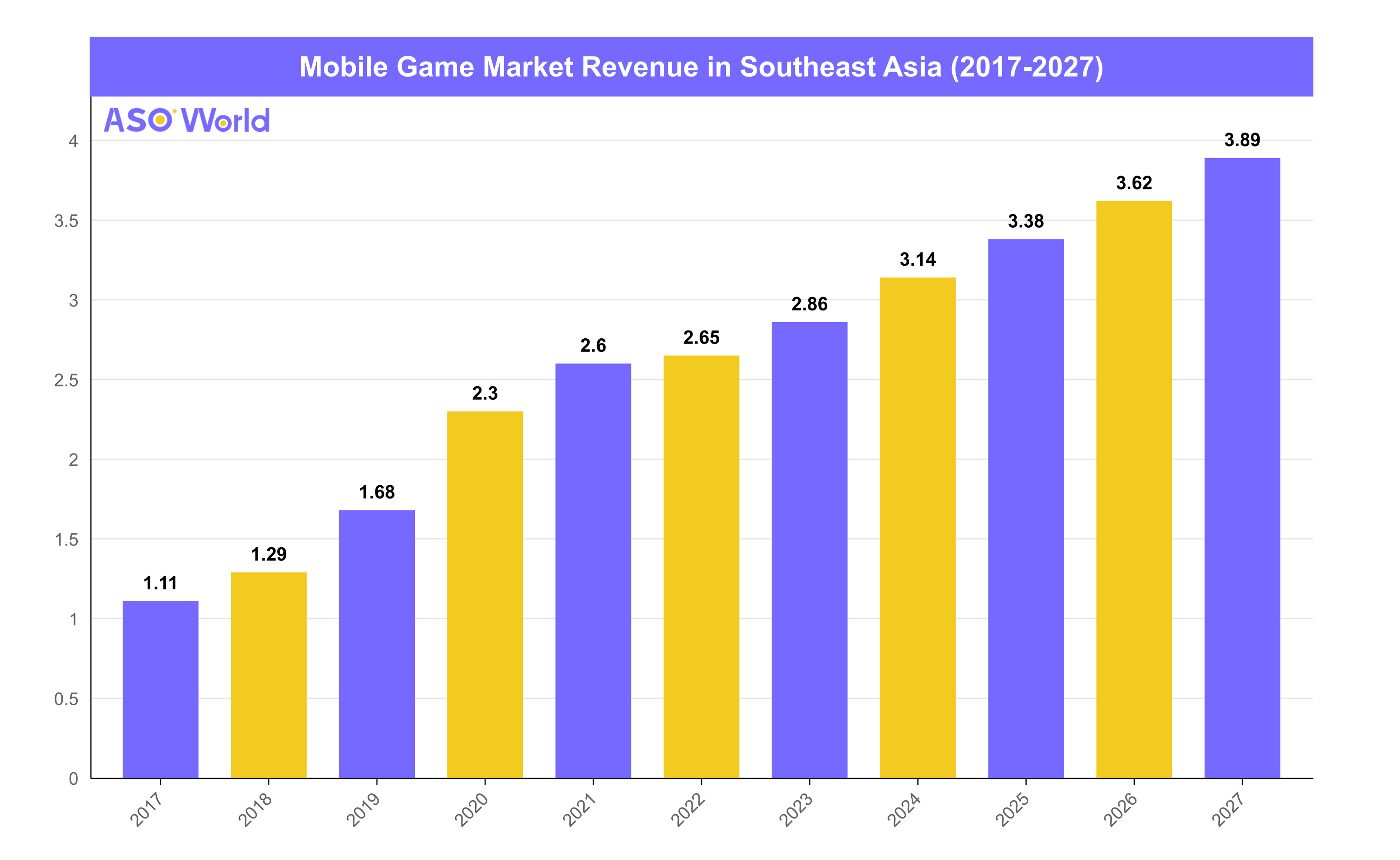

The mobile gaming sector in Southeast Asia is thriving, with projections indicating it will reach US$3.14 billion by 2024 and continue to grow at a CAGR of 7.40% through 2027.

(Data Source: Statista)

With the gamer population expected to surge past 157 million users during this period, there's substantial engagement potential for developers and marketers in this dynamic market.

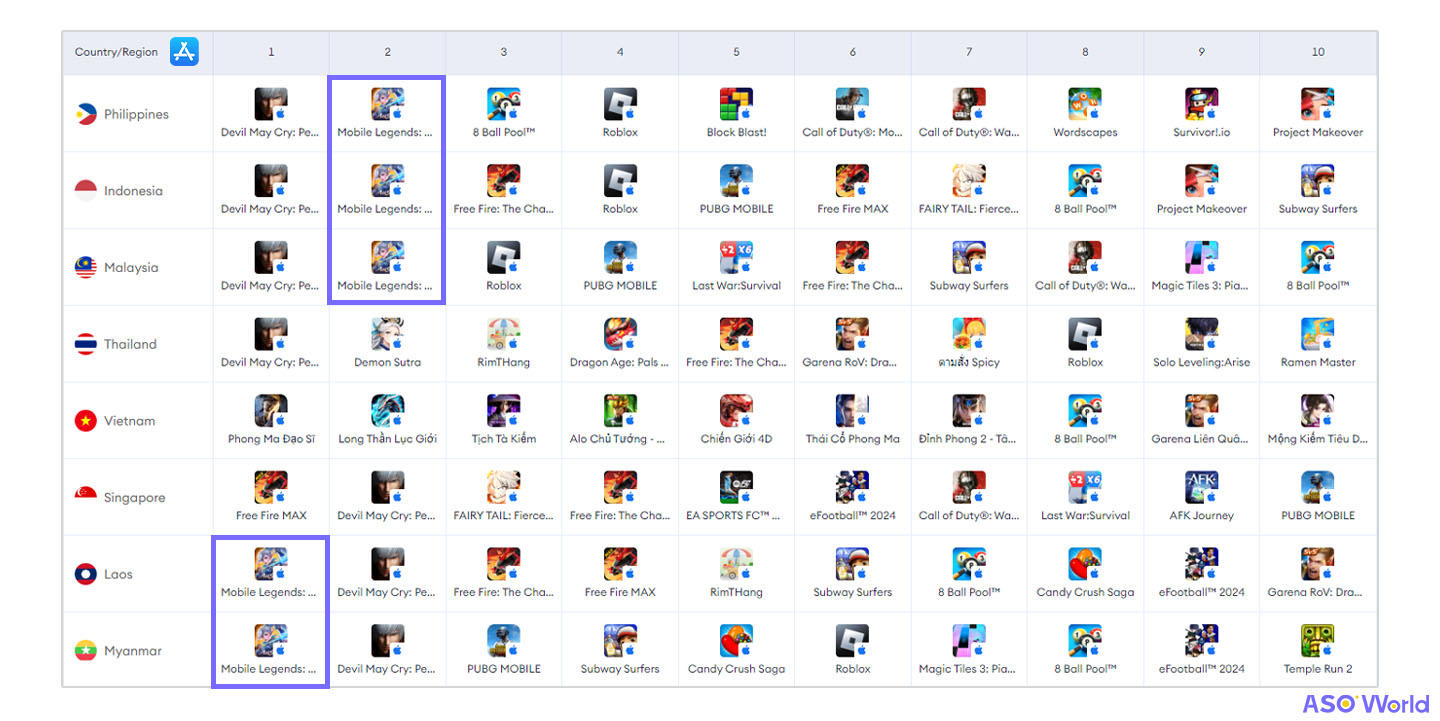

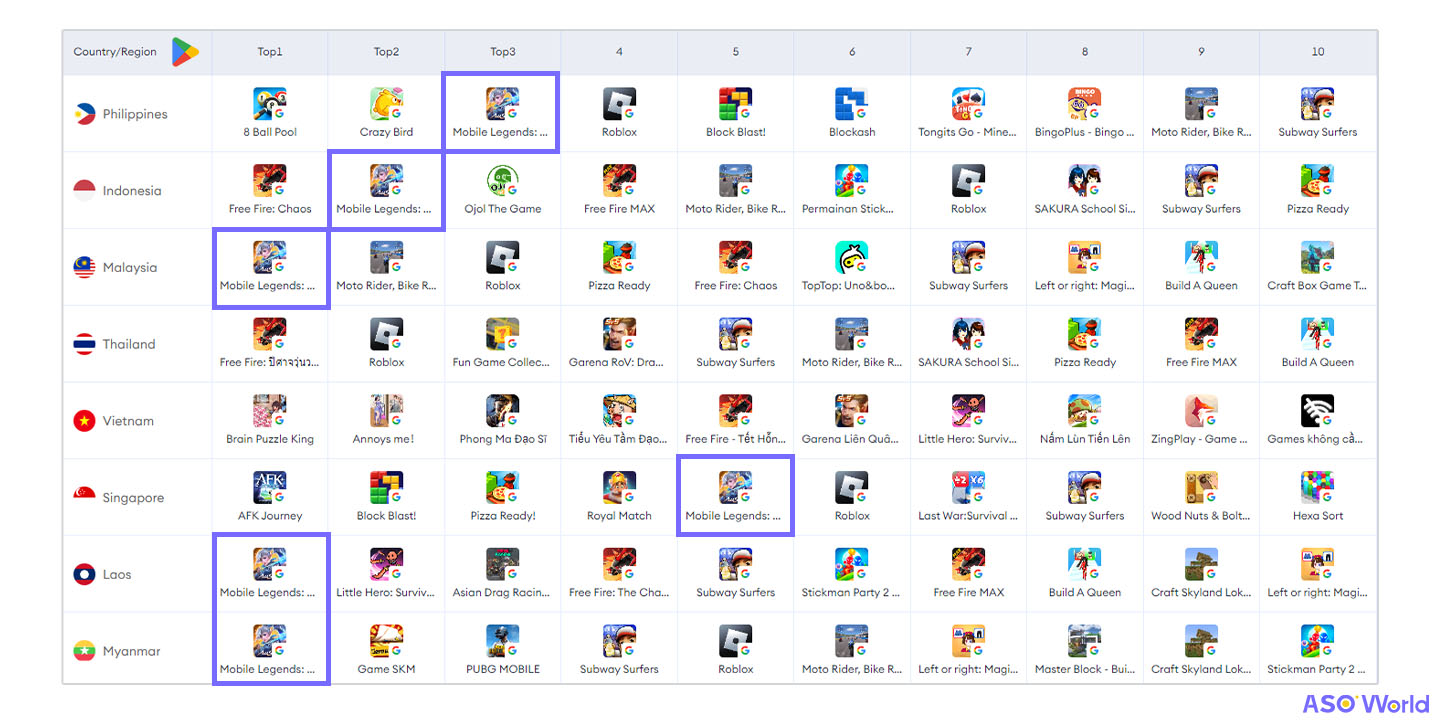

The two charts below show the TOP 10 App Store & Google Play games in Southeast Asia:

(Data Source: Foxdata)

In the competitive arena of Southeast Asia's app stores, a glance at the top ten rankings reveals an exceptional trend: Mobile Legends: Bang Bang (MLBB) consistently secures a spot within the TOP 3 positions among most countries in the region.

As a mobile MOBA game developed and published by a Chinese company (Moonton, a subsidiary of ByteDance), it surpasses its local competitors and grabs a large amount of market share in SEA.

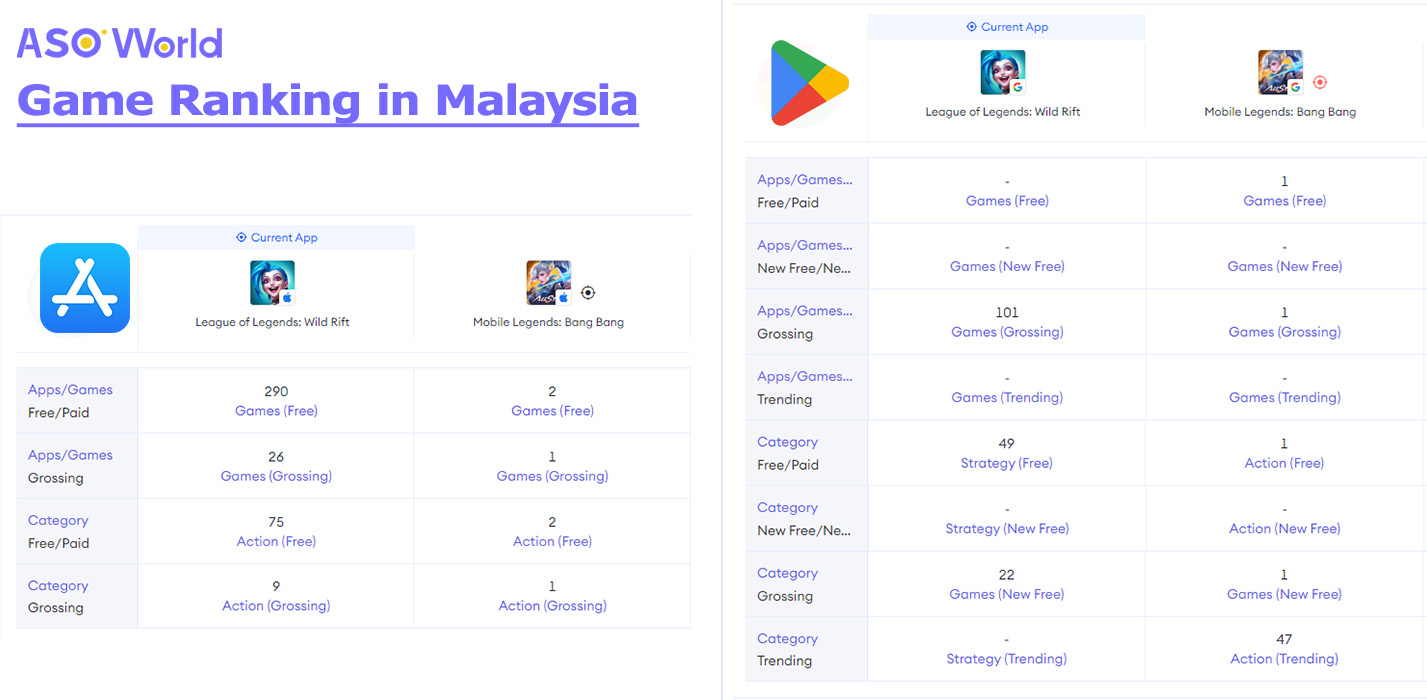

However, when compared to MLBB, another famous mobile MOBA game—League of Legends: Wild Rift—presents a stark contrast in market performance here.

(Example: Ranking Comparison between Wild Rift and MLBB in Malaysia)

You must be curious about:

"Why MLBB, but not Wild Rift, can succeed in the Southeast Asian market?"

From the perspective of App Marketing, the answer lies hidden beneath layers of its strategic localization, clever marketing approaches, and active community engagement, which can bring game developers and publishers comprehensive insights into the determinations of success in the region.

In the ever-competitive mobile gaming landscape, keyword performance is a critical metric for success.

As of April 11, 2024, "Mobile Legends: Bang Bang" (MLBB) dominates the Philippines Google Play Store with approximately 23.8K keywords, whereas "League of Legends: Wild Rift" has around 17.5K keywords.

This significant gap highlights MLBB's stronger app store discoverability, commanding about one-fourth more keywords than its competitor in one of Southeast Asia's key markets.

(Data Source: FoxData)

This data not only reflects each game's visibility in app stores but also highlights the effectiveness of their respective keyword strategies.

Diving deeper into game-related keywords provides further insight into this disparity. For instance, for a broad-reaching term like "mobile games," MLBB secures the top spot whereas Wild Rift appears much lower at twelfth place.

Similarly, under category-specific terms such as "moba" or "moba games," MLBB maintains its prime position in first place with Wild Rift trailing behind at second.

Recognizing and utilizing keywords is crucial for success—impacting organic reach and enhancing Conversion Rate (CVR) significantly.

👉 ASO Guide: How to Conduct Keyword Research & Increase App Visibility?

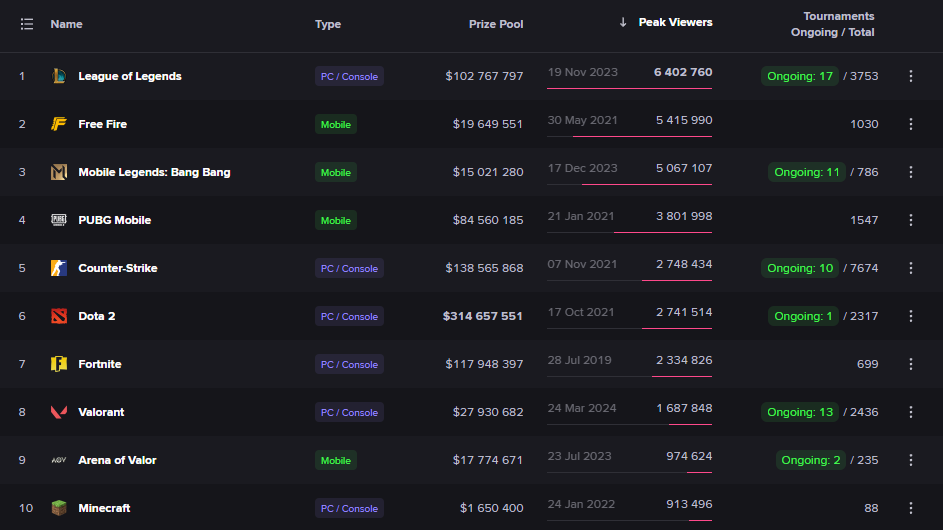

In the esports arena of Southeast Asia, "Mobile Legends: Bang Bang" (MLBB) is a dominant force with unmatched viewership and engagement levels.

It outperforms lots of established titles, including PC giants such as Dota 2 and Fortnite.

(Data Source: Esports Charts)

The MLBB Southeast Asia Cup 2023 not only set a new record for regional tournaments but also became the third most-watched event in MLBB's history, attracting around 3.7 million peak viewers and trailing behind its global championships M5 and M4, which attracted 5 million and 4.3 million peak viewers respectively.

In Indonesia's presidential election, candidates including President Joko Widodo engaged young voters by embracing the popular game "Mobile Legends: Bang Bang" (MLBB), with Widodo even meeting top player 'Jess No Limit.'

In the Philippines, local governments celebrate their esports athletes' international participation by publicly showcasing recognition through banners and other forms of promotion.

In Myanmar, the game's reach extends even to monastic circles, with monks gathering to watch the MLBB finals.

Tailor Content for Cultural Relevance: Adapt the game's content to meet linguistic and cultural preferences through localization—beyond mere translation—to align with local norms and values, akin to MLBB creating region-specific events or features tailored to local tastes.

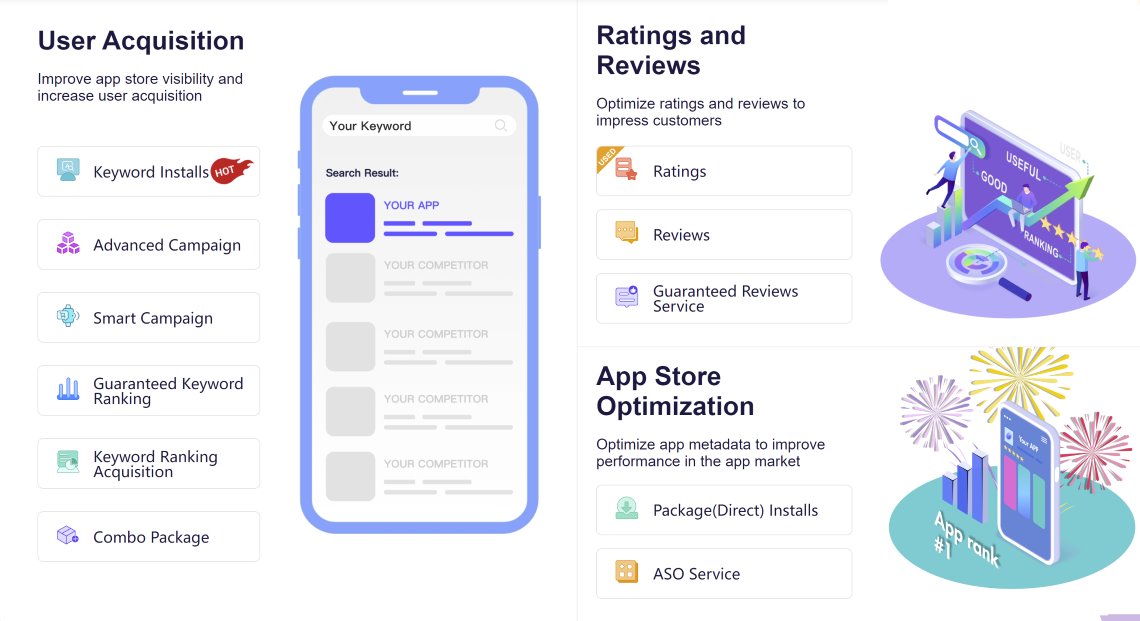

Quantity of Keywords

A robust list of keywords associated with your game increases the chances of being discovered by a diverse audience because more keywords mean more entry points in an app store's search results.

Regularly update and expand your keyword list to cover all relevant terms, including synonyms and related phrases that potential players might use.

For MLBB's case, its extensive keyword volume gives it a broad reach across various search queries, which can be emulated by regularly analyzing market trends and player behavior to identify new keyword opportunities.

* Grow with our app growth solutions - choose a guaranteed app ranking service for the TOP 5 app ranking acquirement, and maximize your app traffic. Cick the image above (to increase app installs service for app visibility).

Relevance and Ranking of Keywords

Achieving high rankings for pertinent keywords is essential, as it significantly boosts visibility and increases download rates.

For game developers and publishers, securing top positions for search terms with strong user intent is key to driving organic growth, necessitating a strategic focus on the quality and relevance of keywords alongside their quantity.

* Use Keyword Tracking Tools to monitor performance and optimize keywords that align closely with your game's core features and user expectations.

By emphasizing both the quantity and strategic ranking of keywords—as demonstrated through MLBB's success—developers and marketers can improve their game's presence in app stores, leading to increased downloads and engagement within target markets like Southeast Asia.

When a game reaches a certain user base, it stands at a critical crossroads where decisions must be made regarding its future growth trajectory.

At this juncture, the choice often lies between horizontal expansion—broadening the game's scope—or vertical deepening of existing content.

Horizontal development involves expanding the breadth of the game by transforming mature titles into broader intellectual properties (IPs).

This can lead to an ecosystem of games that cater to diverse player preferences while still capitalizing on core brand recognition. For instance, "League of Legends" has successfully branched out with derivatives like "Wild Rift," Teamfight Tactics (TFT), and Legends of Runeterra, with more such as Project L (the upcoming fighting game) in the pipeline.

These expansions not only attract new players but also offer current fans varied experiences within the same universe.

👉 2023 Mobile Gaming Report: An In-Depth Analysis of Global IP Gaming Trends

👉 Customized Game Promotion Solutions

On the other hand, vertical development focuses on intensively cultivating a single title and its related industries—one prominent avenue being esportsification.

As PvP games scale up, organizing leagues can significantly enhance their dissemination and bolster player retention by fostering community engagement around competitive play.

However, venturing into esports requires substantial investment in resources such as funding and personnel; without sufficient interest and viewership levels, companies may face considerable financial losses.

Hence, although esports present lucrative opportunities for visibility and monetization, they demand careful deliberation from developers before fully committing to this path.

For example, MLBB's approach towards vertical deepening through esports has paid off handsomely in Southeast Asia due to its culturally resonant localization strategy paired with strong tournament infrastructure that caters to both casual audiences and hardcore fans alike.

In contrast, Wild Rift's limited success in this domain suggests that despite having robust backing and heritage from League of Legends'IP portfolio, insufficient regional outreach in terms of esports could hamper potential market penetration.

In summary, whether opting for horizontal or vertical strategies—or indeed a combination thereof—game developers should weigh these paths against resource availability and market readiness.

Building upon an established user base requires strategic planning where enhancing esports engagement might just be one pivotal aspect among many others shaping the long-term prosperity of gaming franchises.

Click "Learn More" to drive your apps & games business with ASO World app promotion service now.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.