An in-depth analysis of Japan's top utility apps, revealing user preferences and optimization strategies for developers and marketers.

The utility app market in Japan is a dynamic and evolving space, where user convenience and efficiency are paramount. This report analyzes the top 10 utility apps in Japan's App Store and Play Store, providing developers and marketers with strategic insights into app trends and optimization directions.

Utility apps have transformed the way users interact with their devices, streamlining tasks and enhancing productivity. In Japan, a market known for its tech-savvy consumers, understanding the top utility apps provides a window into user preferences and market trends. This analysis is crucial for app developers aiming to optimize their offerings and for decision-makers seeking to navigate the Japanese app ecosystem.

A detailed examination of Japan's leading utility apps reveals a preference for apps that offer device optimization, security solutions, and convenient access to services. These apps have been selected for their high ratings, relevance, and user engagement.

In the App Store's utility category, Myna and Myna Point dominate the top spots. Myna, a Japanese app, simplifies access to personal ID and government services by linking with the personal number card system. Myna Point complements this by allowing users to earn and redeem rewards associated with the same system.

Google and Chrome's presence in the utilities underscores the strategic advantage of proper category and sub-category selection in enhancing app visibility.

For paid utilities, 280 Adblocker leads the pack, priced at ¥800. It not only blocks ads for a smoother browsing experience but also includes extra features for an ad-free digital environment.

The category's other top paid apps offer a variety of digital support and productivity tools, addressing diverse consumer requirements.

Over on the Play Store, Myna remains a free app favorite, joined by Bing AI Chat, a newcomer with advanced chatbot functions.

⚡ Related reading: Utility App Marketing Solutions

* Grow with our app growth solutions - choose a guaranteed app ranking service for the TOP 5 app ranking acquirement, and maximize your app traffic. Or click the picture above (to increase app installs service for app visibility).

* What Is the Keyword Guaranteed Ranking Service? What Is the Advantage of It?

The top 10 free apps are mainly system optimizers and security tools, focusing on device performance and cybersecurity.

Leading the paid apps is Mute My Camera, costing ¥400. Its appeal lies in its ability to automatically mute the camera, a significant feature in Japan where privacy laws are strict.

Other top-ranking paid apps specialize in phone optimization and personalization, with prices spanning from a few hundred to several thousand yen.

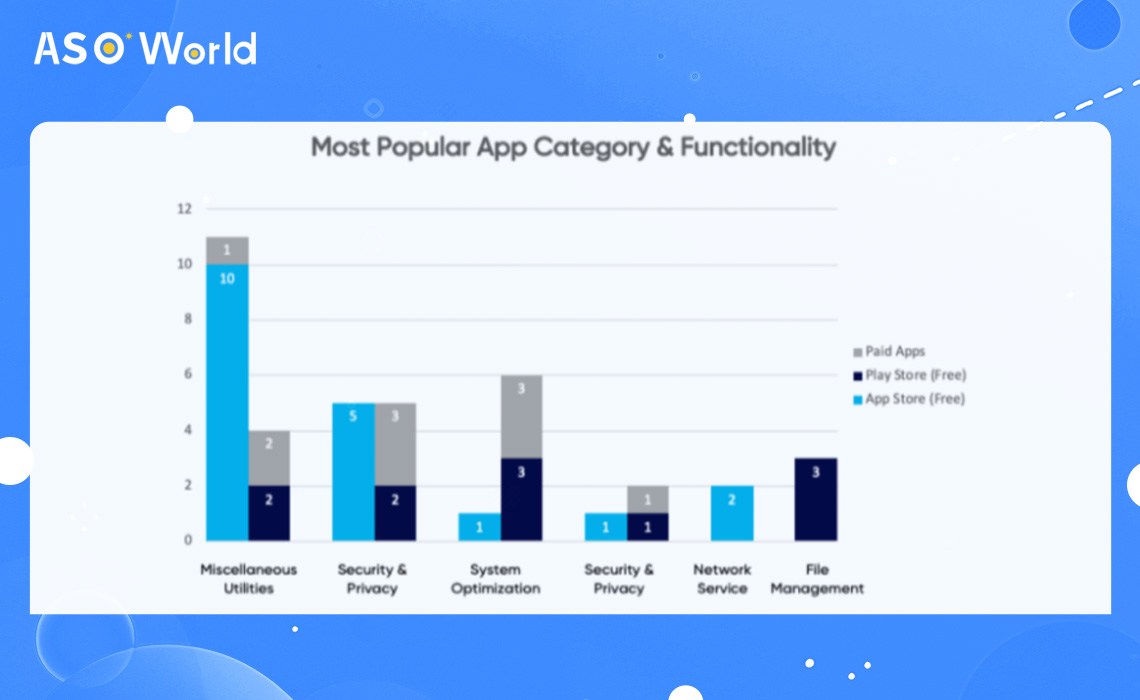

The utility category is broad, encompassing a diverse range of apps. The top apps in Japan include those that facilitate personal identification management, rewards programs, ad-blocking, system optimization, and device customization. These functions cater to a wide array of user needs from convenience to privacy.

Within the Utility category's flexible framework, app developers are empowered to introduce a broad spectrum of applications. This openness fosters a rich variety of utility apps, enabling developers to craft inventive solutions, cater to diverse user requirements, and delve into a multitude of utility functions.

In both the App Store and Play Store, certain sub-categories have gained prominence among the top 10 Utility apps, indicating user preferences and market trends.

Strategic use of metadata and keywords is essential for app visibility. Analysis of the top apps shows a careful selection of keywords related to the app's functionality, which aids in discoverability within the app stores.

Metadata optimization is a pivotal element for improving an app's visibility and discoverability. Our analysis has pinpointed key terms that are prevalent in the metadata of leading Japanese utility apps.

⚡ Related reading: How to Conduct Keyword Research & Increase App Visibility at ASOWorld?

In examining the utility app sector, which commands a substantial share of the rankings, we've identified vital keywords within their descriptions. For instance, in the case of Myna Point, a top contender in the App Store's Utility category, we've isolated several impactful keywords.

Myna Point Keywords:

Transitioning to the Network Services niche, we encounter Shadowrocket, priced at ¥400. This app stands out for its secure and efficient browsing features and incorporates a distinct set of keywords.

Shadowrocket Keywords:

These cases underscore the importance of carefully curating meta keywords and crafting compelling, localized descriptions to connect with the target audience effectively.

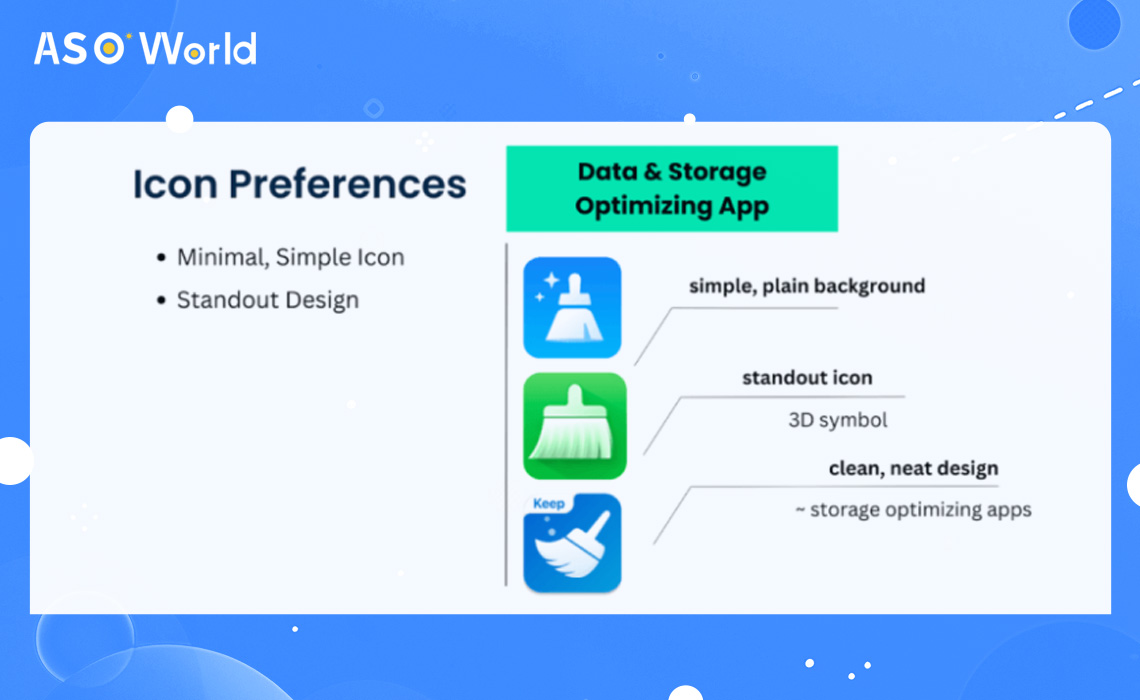

Japanese users show a preference for apps with clean, professional icon designs and in-app visuals that provide essential information efficiently. The design often reflects cultural aesthetics, favoring minimalism and clarity.

Visual design is a critical component of user experience, particularly in the Japanese utility app market. Popular design patterns observed in this market emphasize functionality and user engagement.

App Icon:

User feedback is a goldmine of insights. Reviews of the top utility apps indicate that Japanese users value intuitive design, reliability, and features that enhance device performance. Developers can leverage this feedback to refine their apps, ensuring they meet the high expectations of the market.

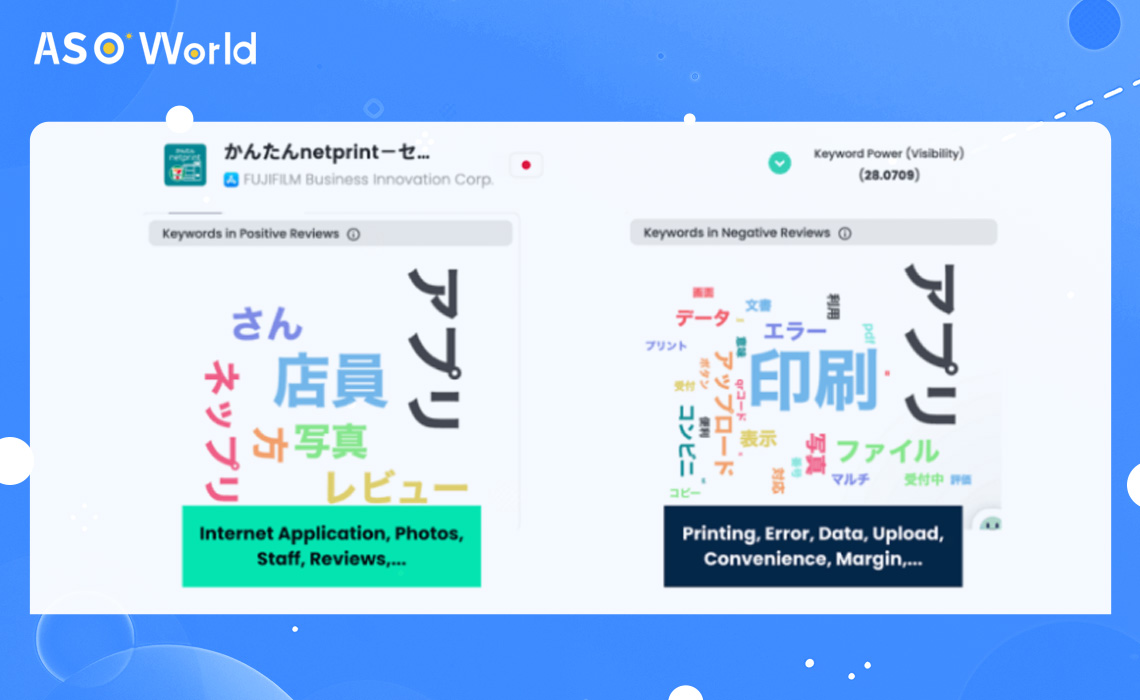

User reviews are a goldmine of information, offering direct feedback on an app's performance and user contentment. In our examination of user reviews for leading utility apps, we've distilled prevalent sentiments, issues, and recommendations shared by users. For instance, Netprint by 7/11, a highly downloaded Utility app on the App Store, has an average rating of 2.94 out of 5 from 1929 ratings. Key terms frequently mentioned in user reviews include:

User Review Keywords:

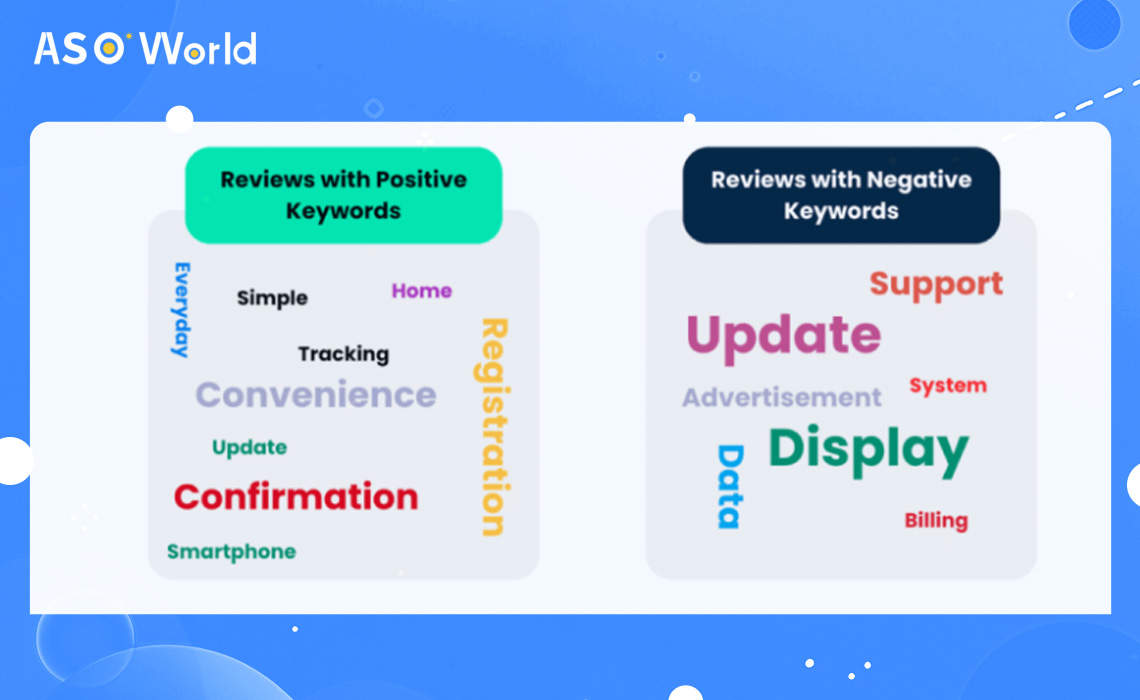

Additionally, across the miscellaneous utility category, we've identified a series of recurring keywords that encapsulate user feedback:

More Keywords to Consider:

This in-depth analysis enables app developers to continuously track and scrutinize user reviews. By doing so, they can gauge user satisfaction, pinpoint areas needing enhancement, and respond to any user concerns or advice, which is essential for app refinement and user retention.

The analysis of Japan's top utility apps demonstrates a market driven by efficiency, security, and user-centric design. Developers and marketers can capitalize on these insights to create apps that resonate with Japanese users and stand out in a competitive landscape.

Click "ASOWorld" to drive your apps & games business with the ASOWorld app promotion service now.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.