Q3 2023 marks a resurgence in the mobile gaming market with increased advertisers and innovative marketing. Simulation games and untapped regional markets present new growth opportunities.

As the third quarter of 2023 unfolds, the mobile gaming industry is showcasing a promising trajectory of resurgence. Building upon the momentum of the previous year, the sector has observed a significant uptick in downloads, surpassing the 100 million mark and registering a year-over-year growth of 6% alongside a quarter-over-quarter increase of 2%.

This steady climb reflects a robust recovery and a positive trend in the global mobile game market, signaling a revitalized engagement from gamers and a successful adaptation by developers to the dynamic demands of the digital entertainment landscape.

This mobile game market report will provide a deep dive into these trends, focusing on media buying strategies, blue ocean market opportunities, and gameplay innovations within niche genres.

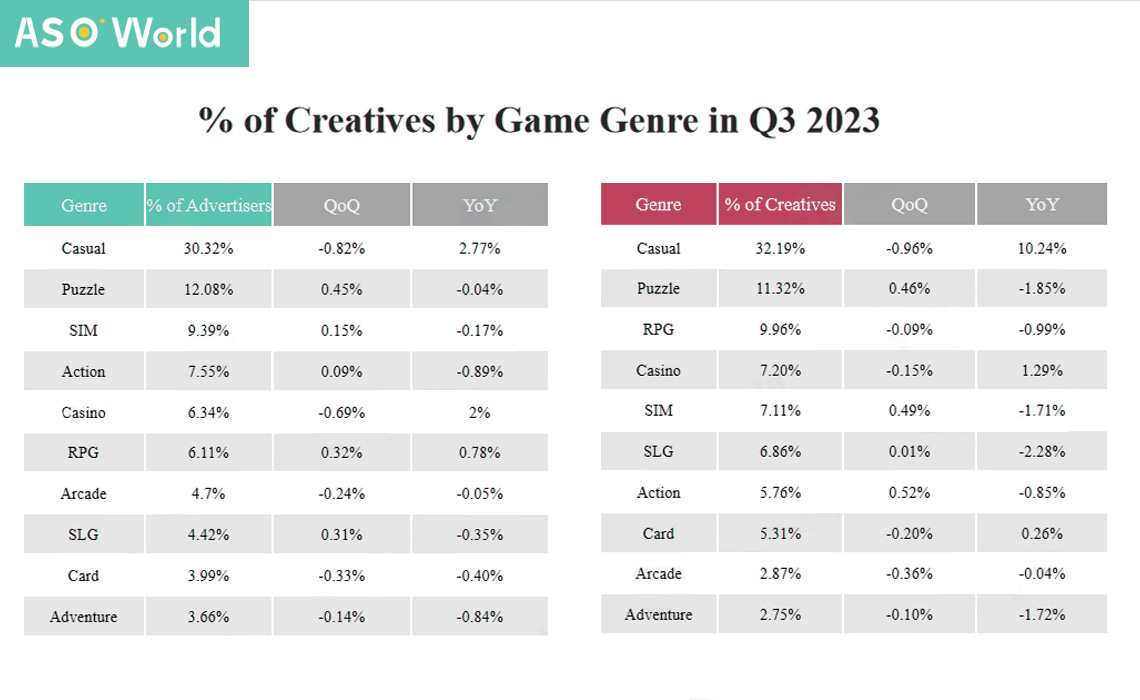

The global gaming market has seen a substantial increase in mobile game advertisers, growing 72.3% year-over-year (YoY), with over 110K advertisers in 2023. Despite a 38% YoY decrease in average monthly creatives per advertiser, the cost per install ad continues to rise, necessitating continuous creative optimization.

North America stands as the industry's vanguard, boasting an average of 28,000 advertisers each month. This number not only underscores the market's vast scale but also its sophistication and competitiveness.

The region's affluent and eclectic user base continues to attract high-budget campaigns, with advertisers employing innovative strategies to differentiate themselves in a crowded marketplace.

Contrasting with North America's established market, the Middle East shines as an emerging arena for mobile game advertising, characterized by its lower saturation and significant potential for growth.

With approximately 13,000 monthly advertisers, the region is ripe for exploration. A youthful, tech-literate demographic coupled with rising purchasing power makes the Middle East an attractive prospect for developers willing to tailor their approach to resonate with local tastes and cultural sensibilities.

Southeast Asia maintains its reputation for vigorous advertising activity, with advertisers pushing an average of 142 creatives monthly. This intensity reflects a battleground where constant innovation is key to capturing the attention of an eager gaming populace.

The region's mobile-centric approach and diverse cultural tapestry demand that advertisers not only localize content but also forge authentic connections with a varied audience to succeed.

Simulation games are highlighted as a potential growth area, with their low revenue volatility and consistent player engagement. These games account for 36% of App Store revenue among Chinese developers, second only to Strategy and Role Playing genres.

The simulation genre's advertising intensity is high, with a nearly 80% video creative share.

The Q3 2023 data indicates that the Middle East represents a significant untapped market for mobile game advertisers. With only 13K average monthly advertisers, compared to the 28K in North America, the region exhibits less market saturation.

Despite the lower number of advertisers, the Middle East showcases a high engagement rate, with an average of 122 creatives per advertiser, which aligns with some of the most competitive markets like Europe and Japan/Korea.

This presents an attractive opportunity for mobile game companies looking to expand their reach. The relatively open market landscape in the Middle East offers a strategic advantage for early entrants who can establish a strong foothold before the competition intensifies.

The cultural nuances and gaming preferences in the region may differ from other markets, hence, a tailored approach in game development and marketing strategies will be essential for success.

The mobile gaming sector is embracing short video content for pre-registration campaigns, capitalizing on the format's alignment with users' brief attention spans. These videos serve as an engaging tool to drive pre-launch interest and downloads, with interactive elements like mini-games enhancing user conversion.

Platforms hosting short videos provide fertile ground for game marketers to emulate KOLs, creating organic-feeling content that boosts user engagement. This trend represents a strategic shift in marketing, where compelling short narratives and exclusive rewards are key to securing a strong player base from the outset.

The Q3 2023 period has demonstrated a dynamic and evolving mobile gaming market. With the industry accelerating across all fronts, understanding and leveraging the latest trends in media buying, market opportunities, and gameplay innovations are crucial for sustained growth and success.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.