2024 Game Industry Insights: Can AI "Make Games Great Again"?

2025 Global Esports Overview: Market Trends, Audience Insights, and Emerging Opportunities Driving Industry Growth.

Esports has evolved from a niche hobby into a billion-dollar global industry in 2025, connecting players, fans, and brands across every region.

From packed arenas in Seoul and Riyadh to mobile tournaments watched by millions in Southeast Asia, esports is reshaping global sports culture.

This report highlights market size, audience demographics, regional trends, and emerging opportunities, showing that esports is not just entertainment, but a growing digital economy driven by community and innovation.

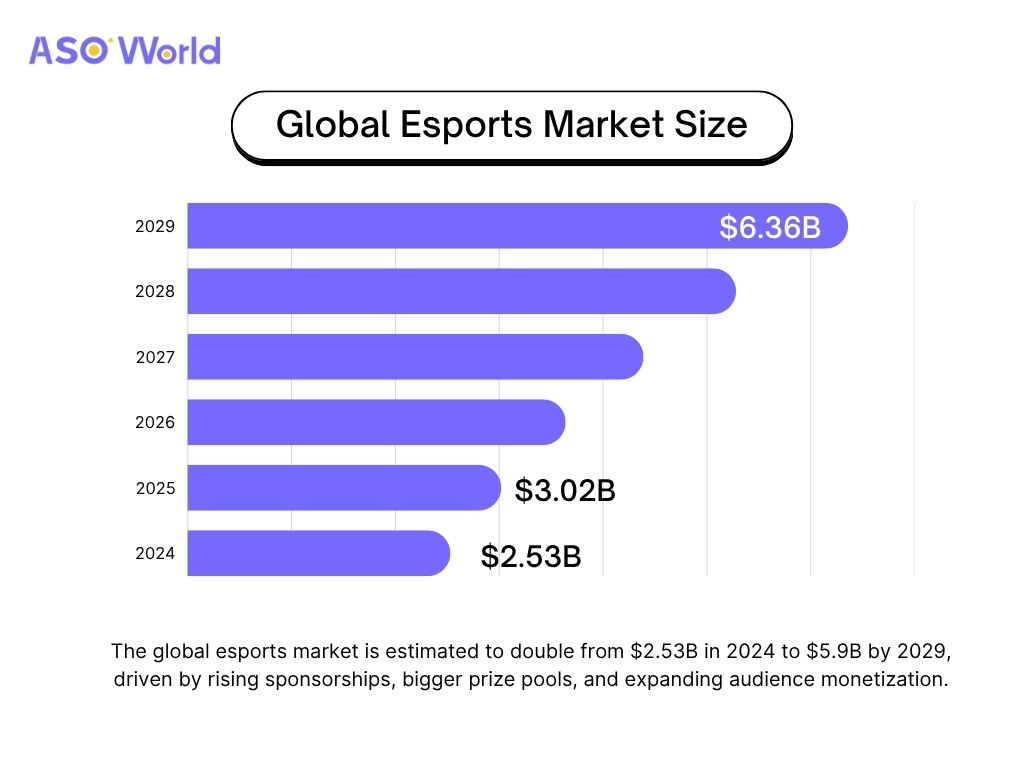

The global esports market continues to expand at an impressive pace. As of 2025, it is estimated to be worth around $3.0 billion, up from $2.53 billion in 2024 — reflecting a robust compound annual growth rate (CAGR) of nearly 19%.

(Global Esports Market Size 2024-2029 | Source: The Business Research Company)

This acceleration highlights the industry's transition from niche competition to mainstream entertainment, fueled by broader public awareness, the surge in live streaming engagement, and the steady rise of international tournament prize pools.

(Global Esports Market Revenue Segmentation 2025 | Source: Esport Stats)

Sponsorship and media rights remain the dominant revenue sources, accounting for roughly 40% of total income.

Meanwhile, ticketing and digital merchandise have grown steadily as fans return to physical events and adopt new monetization models.

The market's rapid expansion also reflects a global convergence of gaming, content, and brand ecosystems — with publishers, broadcasters, and advertisers increasingly viewing esports as a core part of their digital strategy.

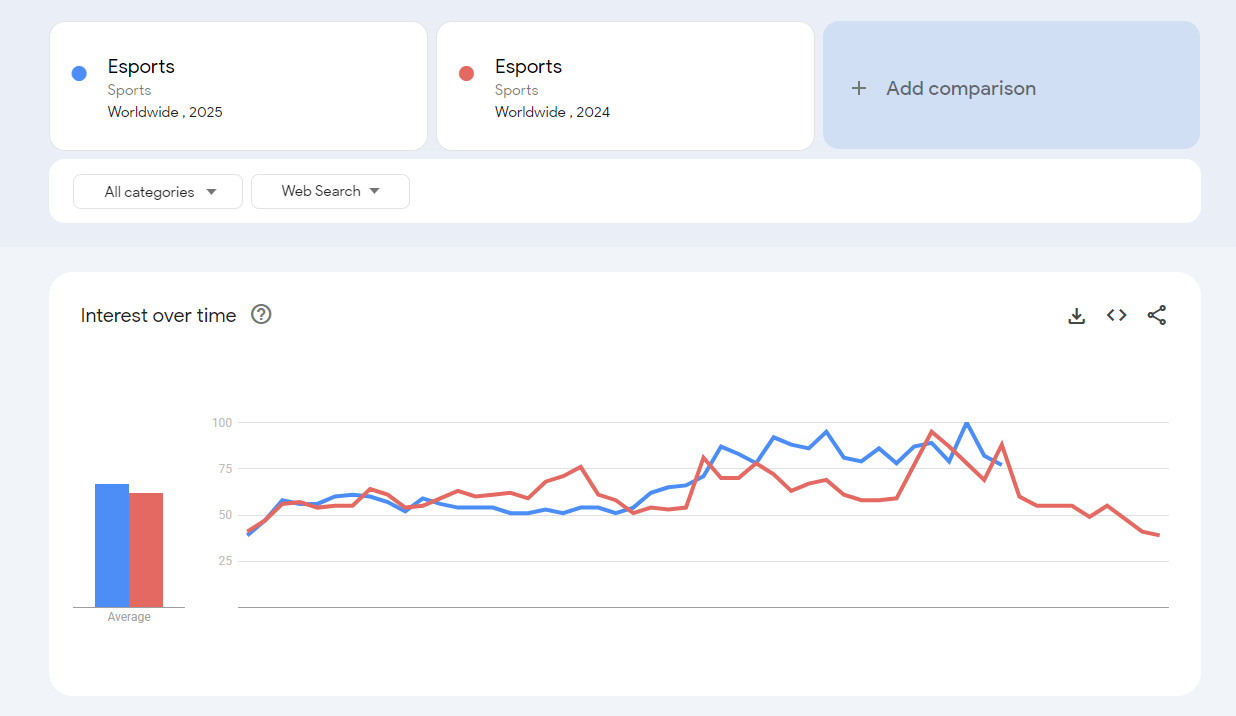

According to Google Trends, global search interest in the topic "esports" has risen notably in 2025 compared with 2024. The average global search index reached 67 in 2025 (as of October 28), up from 62 in 2024 — reflecting growing mainstream attention and sustained engagement across key markets.

(Global Search Trends of Esports Topic 2025 vs 2024 | Source: Google Trends)

Both years recorded their peak interest in October, closely aligning with the League of Legends World Championship, suggesting that major international tournaments remain the strongest driver of global online visibility for esports.

This upward trend underscores the continued expansion of esports' digital footprint, with rising search activity indicating not only larger audiences but also increased media and brand involvement in the ecosystem.

Regionally, Asia-Pacific remains the leading force in both audience size and revenue, driven by China, South Korea, and Japan, while North America and Europe maintain strong institutional and commercial influence.

The Middle East and South Asia are emerging as new growth frontiers, powered by state investments and large-scale tournaments such as the Esports World Cup in Riyadh.

Against this global backdrop, regional markets reveal varied paths of growth—each shaped by local culture, investment priorities, and audience engagement.

The North American esports market remains one of the most commercially mature, driven by strong sponsorships, collegiate programs, and integration with traditional sports networks.

Franchised leagues such as the Call of Duty League and Valorant Champions Tour Americas continue to attract major brands like Red Bull, Mastercard, and Intel.

However, profitability remains a challenge, with teams shifting toward diversified revenue models—merchandising, content creation, and event hosting.

Europe's esports scene thrives on stability and heritage. Countries like Germany, France, and Sweden remain major hubs for events and organizations, while Eastern Europe maintains passionate communities around Dota 2 and CS2.

The region's strength lies in its infrastructure—LAN venues, event organizers, and media coverage—though rising operational costs and regulation debates continue to shape the landscape.

China continues to be the world's largest esports market by audience and revenue, with domestic platforms like Bilibili and Huya fueling both live and short-form content.

South Korea remains the symbolic heart of esports professionalism, particularly in League of Legends and StarCraft, while Japan has rapidly embraced competitive gaming post-legal reform, seeing strong growth in fighting games and console-based tournaments.

Together, these markets define the technological and cultural core of global esports.

Southeast Asia is the fastest-growing esports region in 2025. Mobile-first ecosystems dominate here, with Mobile Legends: Bang Bang and PUBG Mobile leading massive national leagues in Indonesia, the Philippines, and Malaysia.

Affordable smartphones, localized tournaments, and high social media engagement make SEA a proving ground for mobile esports monetization and fan community innovation.

India has emerged as one of the most dynamic markets following the return of BGMI and increased government recognition of esports as a legitimate sport.

The country's youthful population, expanding 5G infrastructure, and thriving content creator scene have made it a global hotbed for mobile and grassroots tournaments. Local sponsors and telecom companies are now heavily investing in event organization and streaming rights.

The Middle East has rapidly evolved into a global esports powerhouse, largely due to state-backed investment and mega-events like the Esports World Cup in Riyadh.

Saudi Arabia, the UAE, and Qatar are investing in dedicated esports arenas, training facilities, and publisher partnerships.

The region's strategic vision—positioning gaming as a key pillar of economic diversification—has turned it into one of the most ambitious esports markets worldwide.

(2025 LoL World Championship in Beijing, Shanghai and Chengdu | Source: LoL Esports)

Based on Tencent's Global Esports Industry Development Report (published June 2025), which ranked cities by tournament viewership, infrastructure, policy, and cultural impact, Shanghai, Los Angeles, and Seoul emerged as the world's top three esports cities.

They scored 90.1, 87.2, and 85.7 respectively, highlighting a growing divergence between mature and emerging esports hubs — not in passion, but in ecosystem completeness and commercial sustainability.

| Rank | City | Country | Index Score |

|---|---|---|---|

| 1 | Shanghai | China | 90.1 |

| 2 | Los Angeles | United States | 87.2 |

| 3 | Seoul | South Korea | 85.7 |

| 4 | Beijing | China | 82.4 |

| 5 | Riyadh | Saudi Arabia | 82.1 |

| 6 | São Paulo | Brazil | 78.7 |

| 7 | Singapore | Singapore | 78.0 |

| 8 | Shenzhen | China | 77.9 |

| 9 | Chengdu | China | 76.3 |

| 10 | Manila | Philippines | 76.2 |

The data shows clear regional differences in both demand and ecosystem maturity:

Asian megacities — including Shanghai, Seoul, and Beijing — lead in infrastructure, talent, and large-scale event hosting, while Western hubs such as Los Angeles excel in content production, entertainment integration, and global brand partnerships.

It's also notable that emerging centers like Riyadh, Singapore, and Manila are rapidly gaining ground through policy support, investment, and youthful demographics.

This shifting landscape suggests that the future of esports leadership will be shaped not only by legacy powerhouses, but also by rising cities that combine strategic policy, digital innovation, and cultural momentum.

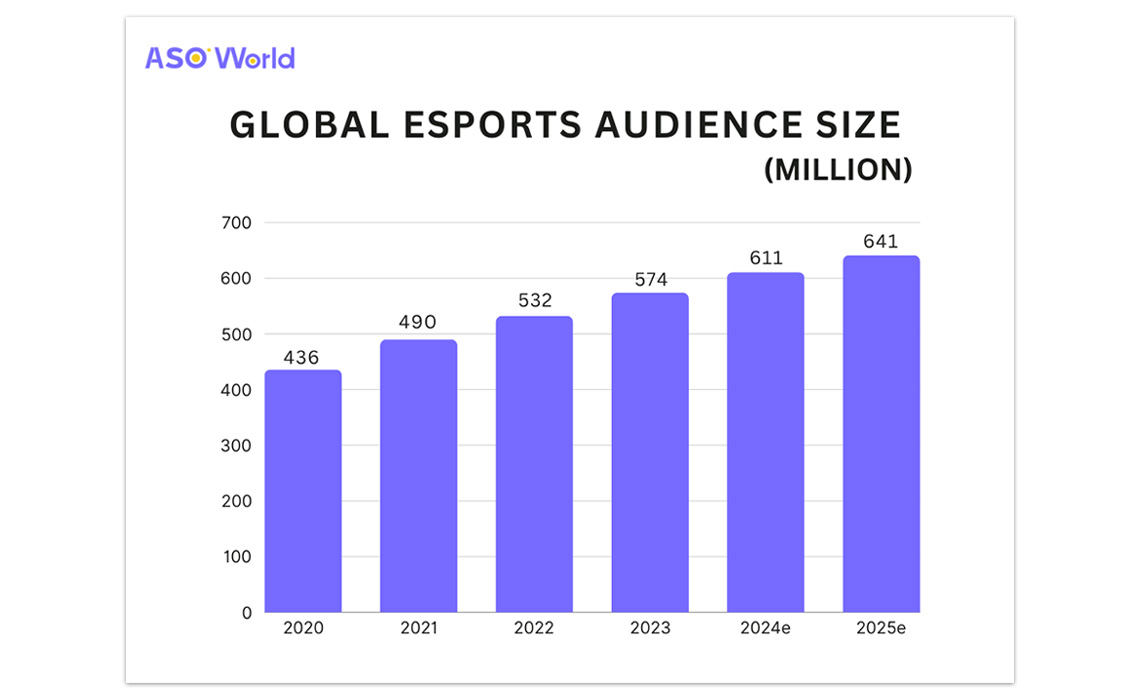

(Global Esports Audience Size 2020-2025 | Source: ASO World)

The global esports audience is expected to reach around 641 million viewers in 2025, including approximately 320 million core fans who follow tournaments regularly.

This represents a steady annual growth rate of about 7–8%, driven largely by mobile accessibility, streaming platforms, and expanding local leagues in emerging markets.

As global internet infrastructure improves and 5G networks expand, audience growth in Africa, Latin America, and South Asia will likely accelerate, adding tens of millions of new fans by 2026.

Asia-Pacific remains the epicentre of esports viewership, accounting for more than 55% of global fans.

China and South Korea continue to lead in live broadcast reach, while Southeast Asia and India show the fastest year-on-year audience growth—especially in mobile titles such as Mobile Legends: Bang Bang and BGMI.

In contrast, North America and Europe maintain high engagement levels per viewer, with strong crossover between esports and traditional sports audiences.

Demographically, esports remains a young and digitally native community. Nearly 65% of viewers are aged between 18 and 34, with Gen Z fans showing the highest level of brand loyalty and social media engagement.

Gender diversity is also improving: women now represent about 25–30% of the global audience, with higher participation rates in mobile and casual competition formats.

Platform-wise, Twitch and YouTube Gaming still dominate Western markets, while Bilibili, Huya, and DouYu lead in China.

Short-form video apps such as TikTok and Instagram Reels are becoming crucial for discovering highlights, team content, and player stories—indicating that esports consumption is shifting from long-form broadcast to a continuous, social-first media cycle.

In 2025, the competitive gaming landscape remains dominated by a mix of long-standing PC giants and rapidly growing mobile titles.

While legacy games continue to draw massive audiences, the industry's centre of gravity is clearly shifting toward accessibility, cross-platform play, and regional diversity.

(Top Esports Games in 2025 by Viewership | Source: Esports Charts)

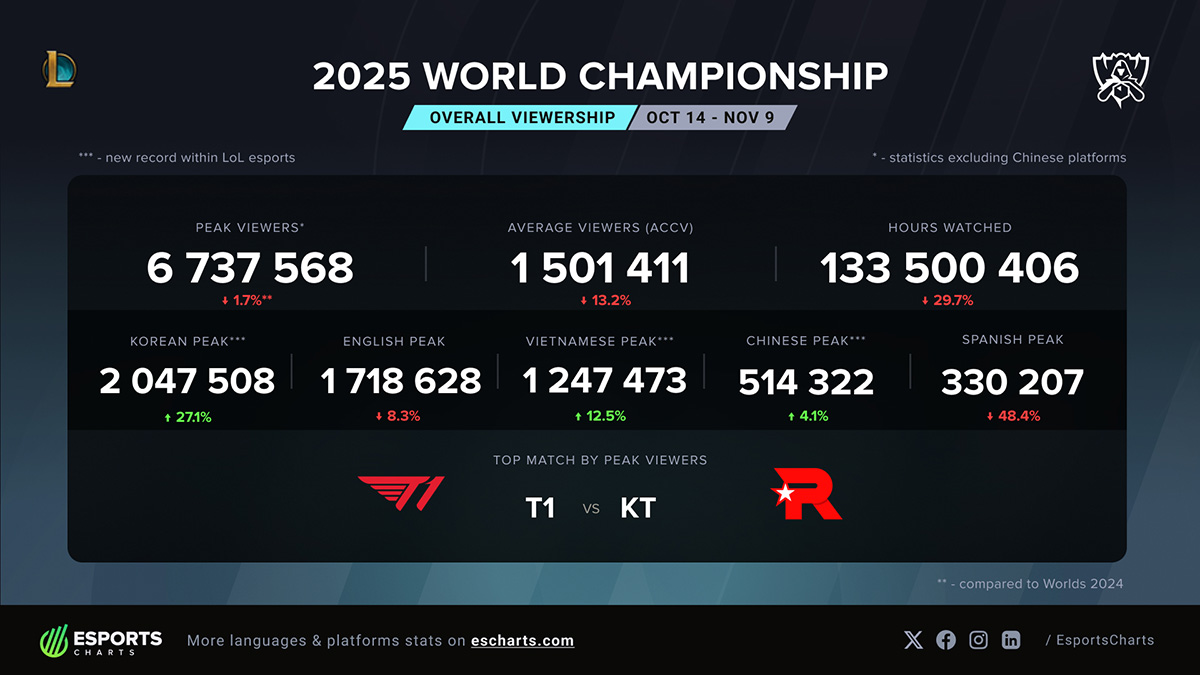

Since the 2025 Worlds is still underway, the peak viewer data only covers matches up to the semifinals.

However, according to Esports Charts, the viewership this year shows a 25% decline in the Swiss Stage. This drop may be attributed to format fatigue and fewer high-profile regional rivalries early in the tournament.

Despite the initial slowdown, engagement surged again in the knockout rounds, driven by marquee matchups and storyline-rich rematches.

With the conclusion of the Finals, KT vs. T1, League of Legends reached a peak viewership of 6.7 million, keeping its most-watched esports game title of the year.

(LoL 2025 World Championship Grand Final Overall Viewership | Source: Esports Charts)

The flagship of mobile esports continues to dominate Southeast Asia. The MLBB M5 World Championship attracted record-breaking audiences across Indonesia, the Philippines, and Malaysia, proving the mainstream potential of mobile-first competition.

👉 Mobile Game Insights: Why MLBB But Not Wild Rift Can Win in Southeast Asia?

Valve's next-gen update of the classic franchise brought new life to competitive FPS.

The 2025 Major tournaments continued to set records across Twitch and YouTube, highlighting a revival of Western esports infrastructure and sponsorship interest.

Although The International prize pool has stabilised compared to its earlier highs, Dota 2 still commands deep loyalty among fans and teams. Its ecosystem remains a key pillar of the PC esports scene, especially in Eastern Europe and Southeast Asia.

Riot's tactical shooter has firmly established itself as the fastest-growing FPS esport. The Valorant Champions 2025 saw peak audiences surpass million concurrent viewers, driven by strong regional leagues in the Americas and EMEA.

Mobile battle royales remain powerhouse titles in South Asia, the Middle East, and Latin America. The re-launch of BGMI in India and government-backed tournaments in the Gulf region have reinvigorated engagement and sponsorship revenue.

Epic's creative push through Fortnite Festival and in-game event modes has kept the ecosystem vibrant. While competitive viewership has plateaued, its integration of music and social content continues to redefine esports entertainment.

👉 Mobile Game Insights: Can Fortnite's iOS Comeback Reclaim the Battle Royale Crown?

Tencent's international counterpart to Honor of Kings continues to anchor mobile esports across Southeast Asia and Latin America.

The Arena of Valor International Championship (AIC) 2025 delivered strong cross-region engagement, underscoring the title's staying power and appeal beyond China. Its blend of mobile accessibility and team-based strategy keeps it among the top-viewed mobile MOBA events globally.

The PC version of PUBG remains a foundational title for battle royale esports, sustained by consistent regional leagues and community-driven tournaments.

Although its mainstream visibility has declined compared to its mobile counterpart, PUBG retains a dedicated competitive scene, particularly in Korea and Eastern Europe, with the 2025 Global Series reaffirming its enduring esports legacy.

China's most popular mobile MOBA continues to generate massive domestic revenue and growing international exposure through the Honor of Kings Invitational Series. Its expansion into global markets, including the Middle East and South America, is accelerating in 2025.

Overall, these top titles highlight how the esports ecosystem has become more diversified than ever — spanning genres, platforms, and geographies.

The balance between PC, console, and mobile competition suggests that the next phase of growth will depend on cross-platform engagement and the blending of gaming, entertainment, and live events.

The 2026 esports calendar is shaping up to be one of the most eventful yet, marked by global tournaments that blend competition, entertainment, and culture.

Returning to Riyadh from July 6 to August 23, the Esports World Cup will again unite leading teams across LoL, Dota 2, VALORANT, and CS2. Backed by Saudi Arabia's Vision 2030, it is set to feature record prize pools and expanded entertainment showcases.

Esports will once again feature as an official medal discipline at the 2026 Asian Games in Aichi–Nagoya, Japan, marking a continued milestone for its recognition in mainstream sports.

The lineup includes 11 titles, such as League of Legends, Honor of Kings, Mobile Legends: Bang Bang, Pokémon UNITE, and Gran Turismo 7, reflecting a balanced mix of PC, console, and mobile competitions.

Hosted in South Korea, the League of Legends MSI will spotlight top regional champions, with Riot Games introducing new broadcast formats and AR-enhanced production.

The LoL Worlds 2026 is expected to return to North America, featuring a revised regional format and enhanced cross-league seeding. With Riot’s ongoing investment in live production, it remains one of the most-watched annual esports events globally.

The MLBB M6 will take place in Manila, marking the game's continued dominance in Southeast Asia. Following record-breaking audiences in 2025, Moonton is expanding fan zones, influencer collaborations, and regional qualifiers to strengthen international engagement.

Valve's Dota 2 circuit continues under the new open-qualifier format. The 2026 The International will be hosted in Singapore, while Major stops in Europe, South America, and China will serve as key lead-ups to the season finale.

With new franchise partnerships, VALORANT's 2026 competitive cycle will feature Masters events in Santiago, Chile and London, England, culminating in the VALORANT Champions event in Shanghai, China.

Two major championships—Spring Major in Copenhagen and Fall Major in Dallas—will anchor the CS2 calendar, backed by ESL and BLAST. Both are expected to draw top-tier attendance and global viewership.

Scheduled for November in Riyadh, this national-team competition highlights esports' growing alignment with global sports structures.

The Global Esports Federation's flagship finals will take place in Los Angeles on December 4, marking a collaboration between esports and Hollywood's entertainment ecosystem.

Major stops in Brazil (April), the U.S. (May), and China (November) will anchor the CS2 competitive circuit, reaffirming IEM's global prestige.

Collectively, these events illustrate esports' transformation into a year-round global circuit—where competition, media, and culture converge.

The global esports industry in 2025 stands at a fascinating crossroads — more commercialized, more global, and more intertwined with mainstream culture than ever before.

As new technologies, audiences, and business models continue to shape its trajectory, the next few years are set to redefine what "competitive gaming" means on a global scale.

Mobile esports have officially broken out of their regional shells. Titles like Mobile Legends, Free Fire, and Honor of Kings are driving the largest viewership growth, especially in Southeast Asia, India, and Latin America.

Publishers are increasingly adopting cross-platform tournament structures, allowing PC, console, and mobile players to coexist within the same competitive ecosystem — a move that broadens accessibility and sponsor reach.

In 2025, the line between esports and entertainment blurred even further. Events like the Fortnite World Cup and Twitch Rivals demonstrated how creator-driven tournaments can match — and sometimes surpass — traditional esports viewership.

Expect more collaborations between pro players, streamers, and media brands as esports continues to merge with pop culture and influencer ecosystems.

Artificial intelligence is becoming a major force in esports analytics — from real-time performance tracking to AI-powered coaching and automated highlight generation.

Esports organizations are leveraging data to optimize player training, scout new talent, and personalize fan experiences. By 2026, AI-assisted coaching tools are expected to become standard across top-tier teams.

With esports entering mainstream education, government partnerships, and Olympic-level recognition, standardized regulations are emerging.

Countries like South Korea and the UAE are setting benchmarks for athlete management, visa systems, and anti-doping policies. This growing structure helps legitimize esports as a sustainable career path — not just a passion project.

The future of esports may not be confined to screens. AR and VR tournaments are gaining traction, offering immersive hybrid experiences that merge physical and digital play.

Additionally, major tech firms are exploring metaverse-style esports hubs — where audiences can spectate, interact, and even influence matches in real time.

Esports has evolved from niche entertainment into a global industry shaping modern digital culture. With billion-dollar growth, expanding audiences, and recognition from events like the Asian Games, it now rivals traditional sports in scale and influence.

As mobile play, AI, and cross-media collaboration drive the next wave, esports is set to become not just a competition — but a central force in the future of global entertainment.

If you like our report, please follow our official account:

Twitter/X: @ASOWorldcom | @ASOGameNews

LinkedIn: ASOWORLD

Facebook: ASO World

Instagram: @asoworldcom

👉 Register to learn more about eSports and Gaming Marketing Analysis

Our previous Global Esport Market Report:

👉 Global Esports Market Report (2024)

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.