The Future of Sports Apps Marketing in 2026: What to Expect Next

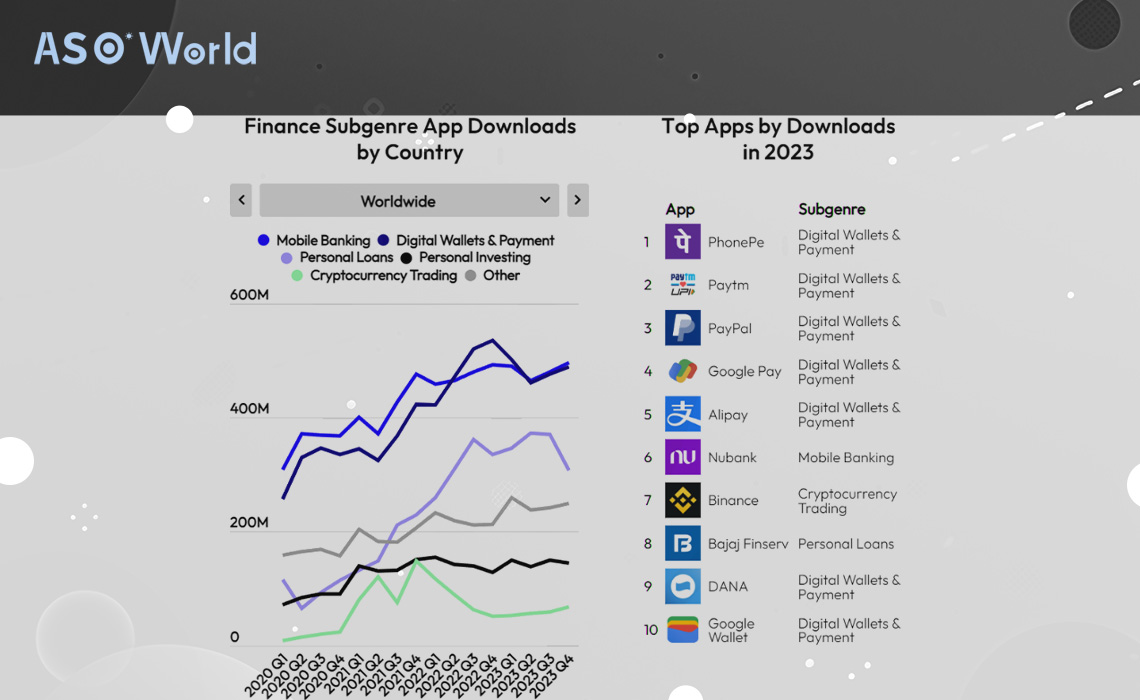

The 2023 mobile app industry sees personal loan apps thriving amidst economic challenges, while super apps lead by integrating diverse financial services.

As the year 2023 unfolds, the mobile app industry continues to navigate through economic turbulence, evolving consumer behaviors, and technological advancements.

This report delves into the current state of the mobile application market, focusing on the financial services category, to provide a comprehensive overview and valuable insights for app developers and marketers aiming to optimize their presence in the app stores.

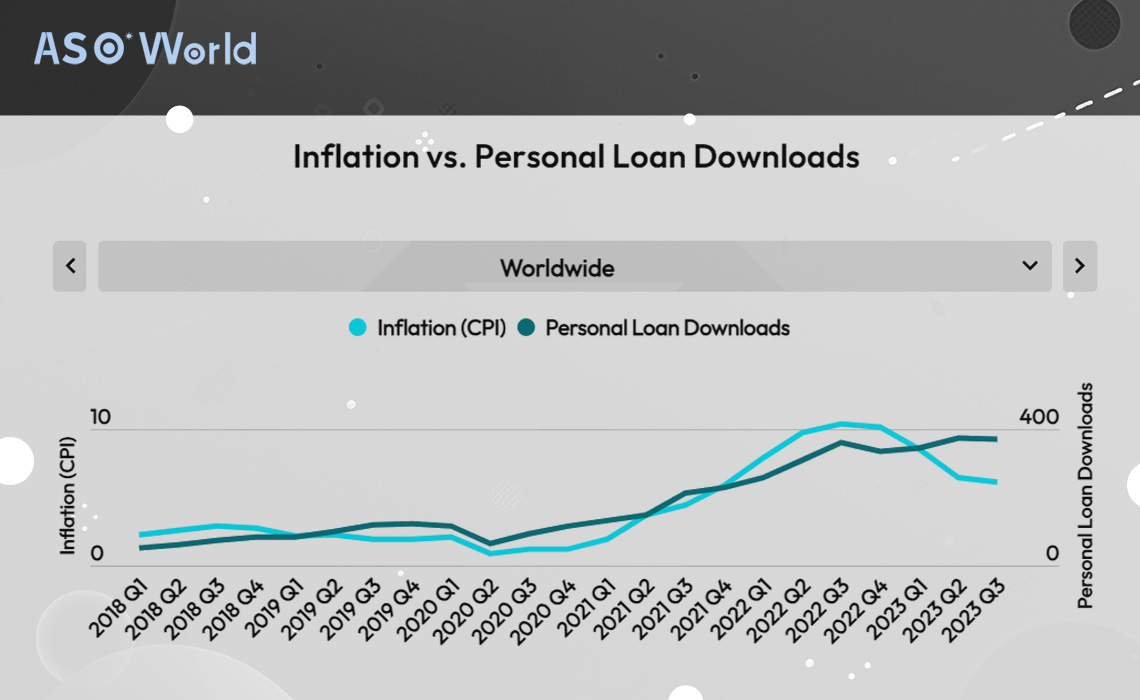

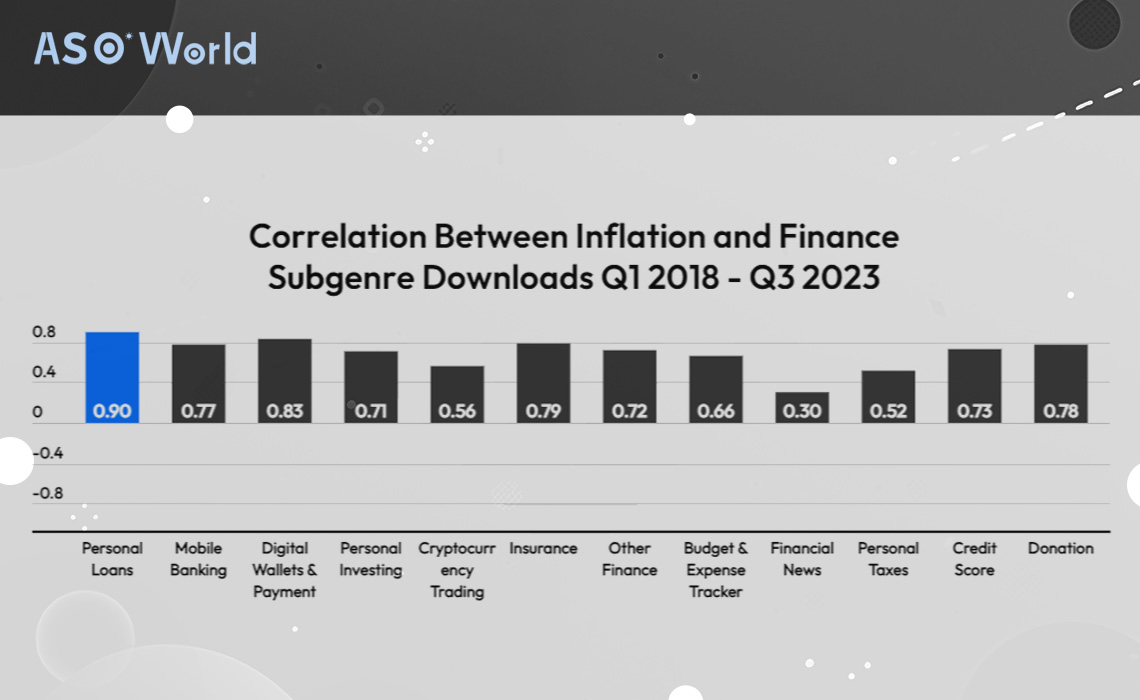

With consumers feeling the financial pinch, there has been a significant uptick in the adoption of personal loan applications. As crypto trading and investment growth stalls, individuals are increasingly seeking alternative financial solutions, leading to a surge in personal loan apps, particularly in regions like India, Indonesia, and Mexico.

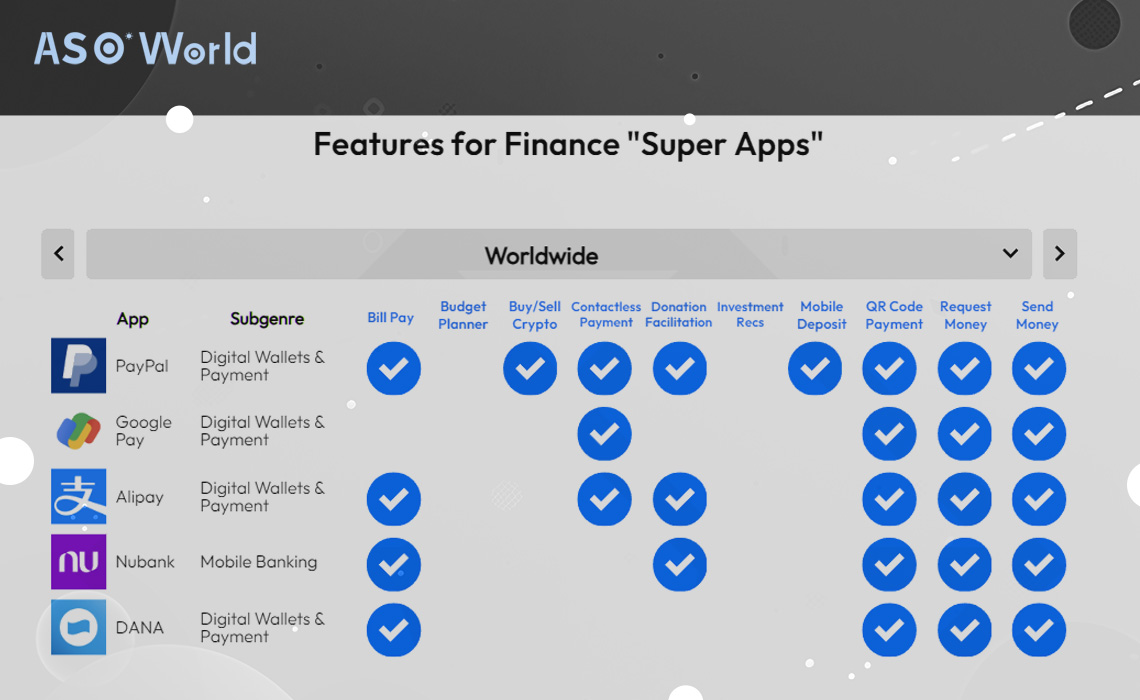

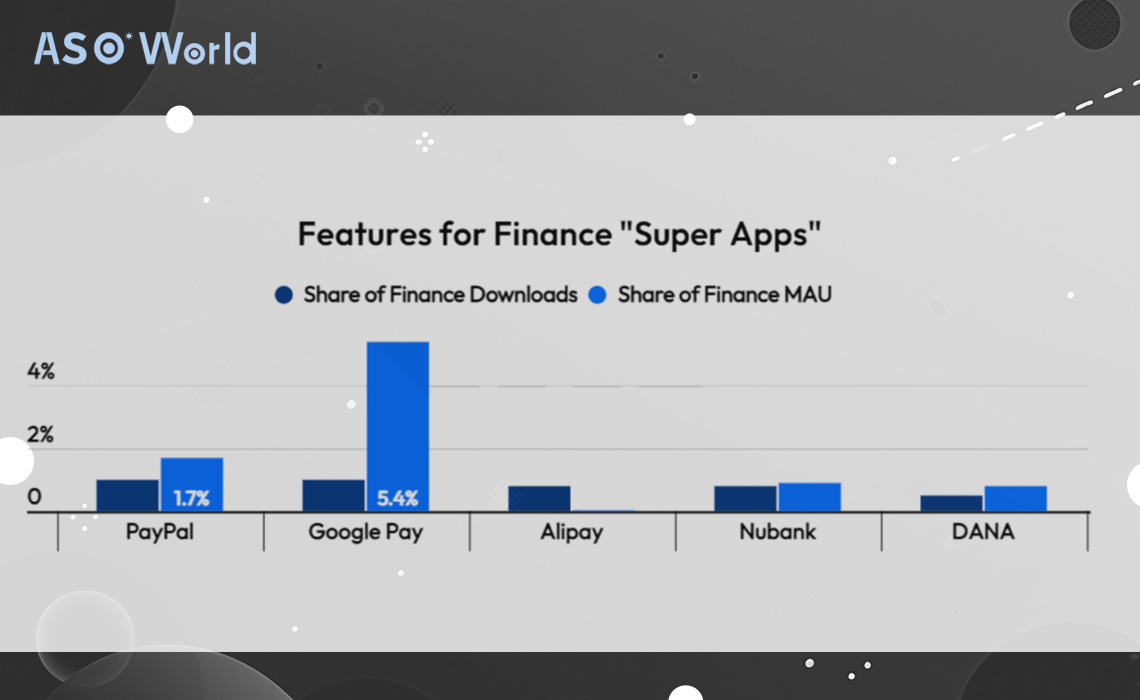

The concept of "super apps" is gaining traction as these platforms continue to integrate a variety of features, from banking to payments and crypto trading. This trend is redefining market expectations and pushing app developers to innovate beyond traditional app boundaries.

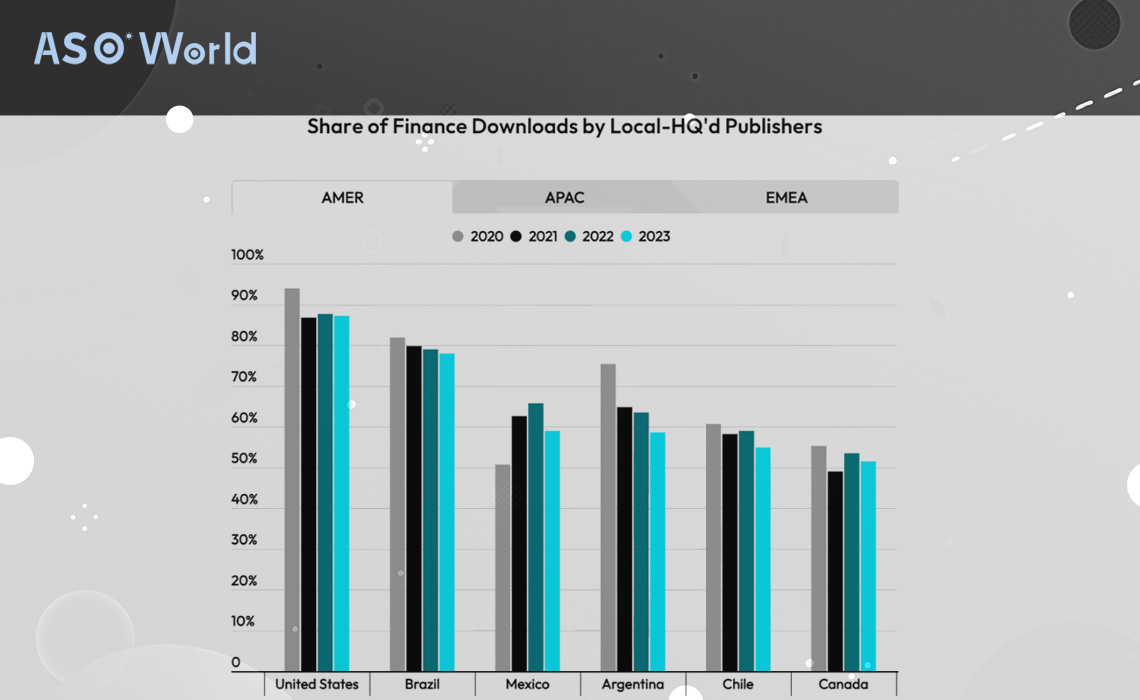

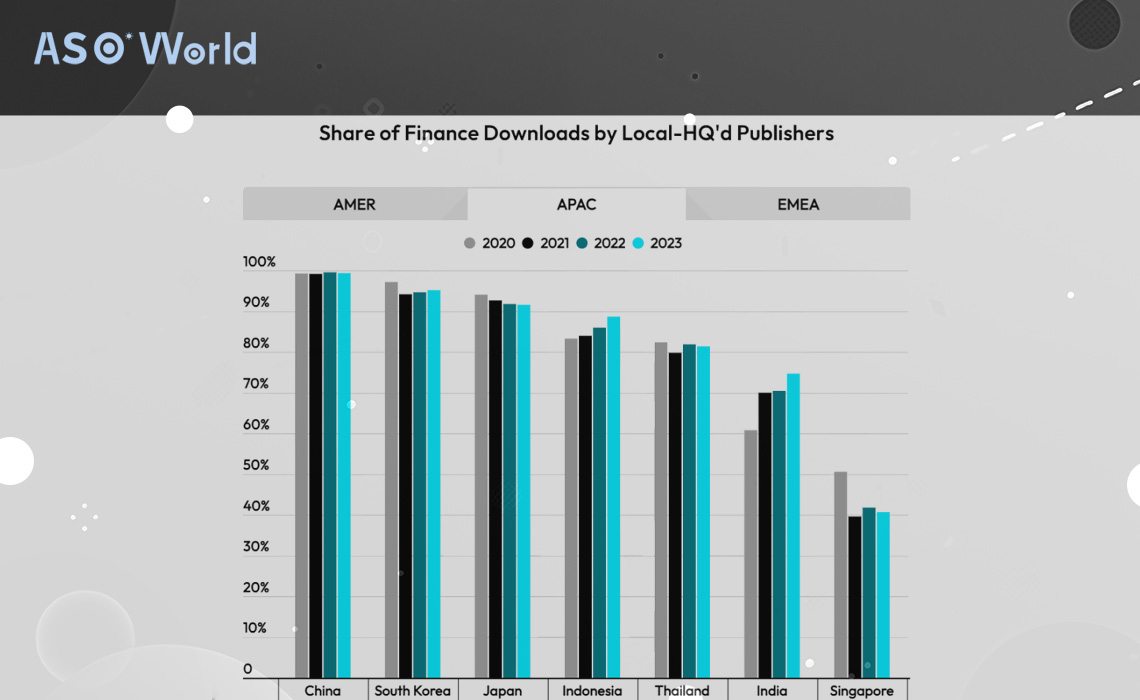

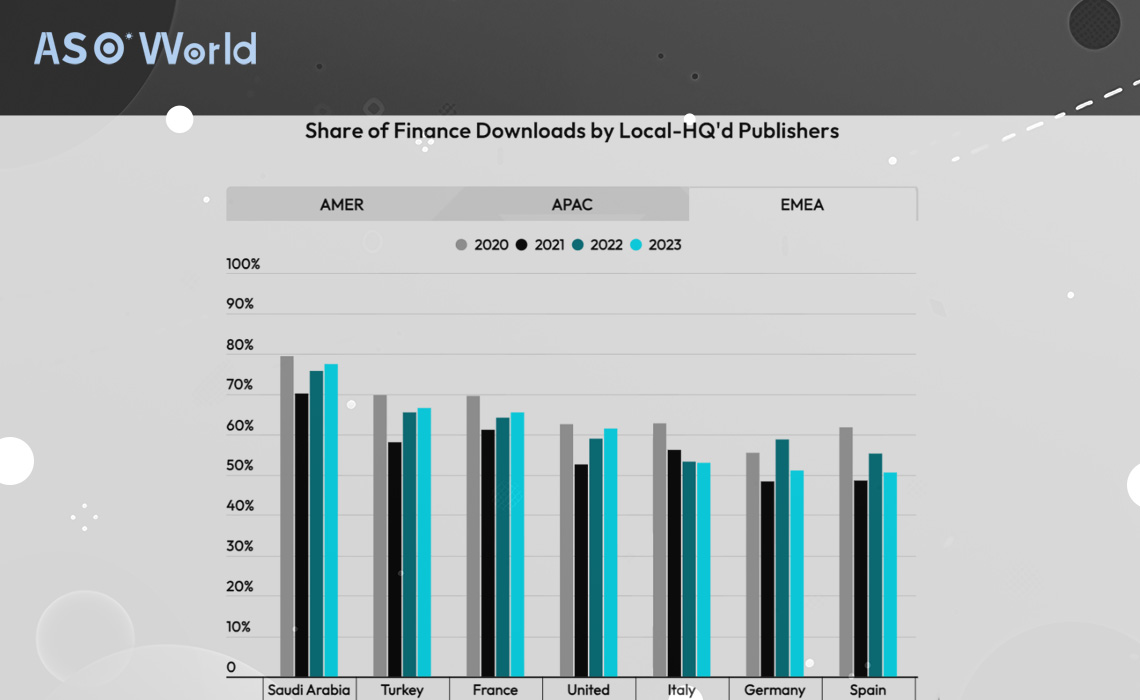

Local publishers are dominating the mobile finance market by tailoring their offerings to align with country-specific financial regulations and consumer needs. This local advantage is especially pronounced in China, Japan, South Korea, and the United States, although international publishers are gradually increasing their market share.

Economic headwinds have not slowed down app adoption; instead, they have fueled the rise of personal loan apps. The correlation between high inflation and the growth of personal loan apps underscores the opportunity for developers to meet this demand, with global downloads for these apps soaring by over 250% from 2020 to 2023.

⚡ Fintech App Marketing Solutions

Finance super apps are solidifying their market positions by offering multiple useful features, thus attracting a significant portion of the monthly active user base in top markets. These multifunctional platforms are not only retaining customers but also setting the pace for market competition.

The mobile app industry, particularly within financial services, is experiencing dynamic growth and transformation. Personal loan apps are fast becoming a necessity for consumers worldwide, while super apps are redefining user expectations by offering a one-stop solution for all financial transactions. Understanding local market nuances and consumer needs is crucial for app developers and marketers to succeed in this competitive landscape.

Click "Learn More" to drive your apps business with ASO World App Promotion service.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.