Taobao’s 514% download surge in 2025 reveals strategies driving its global e-commerce success.

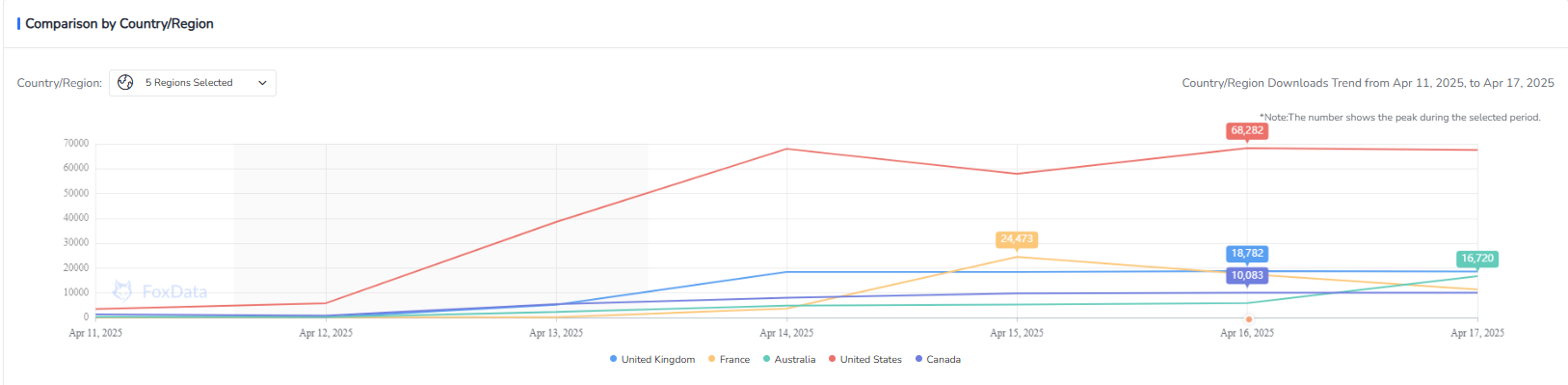

In April 2025, Taobao, China’s dominant e-commerce platform, made waves in global markets, with app downloads surging by an astonishing 514% in the U.S. alone. This leap pushed Taobao to the forefront of app store rankings across countries like the U.S., France, Canada, and the U.K., marking a pivotal moment in its international journey.

This article explores the forces behind Taobao’s remarkable growth, analyzes its strategies, and considers the broader implications for the e-commerce landscape.

TaoBao, founded in 2003 by the Alibaba Group, is a leading e-commerce platform in China that offers both consumer-to-consumer (C2C) and business-to-consumer (B2C) retail services. As of 2024, the platform boasts over 930 million monthly active users, reflecting its immense popularity and reach across the country. TaoBao provides a user-friendly interface and a wide range of competitively priced products, from fashion and beauty to electronics and home goods.

Recognized as one of the largest e-commerce platforms globally, TaoBao plays a vital role in China’s digital economy. It continues to expand its influence worldwide through localized services such as Taobao Global, enabling international users to access Chinese products more easily and efficiently.

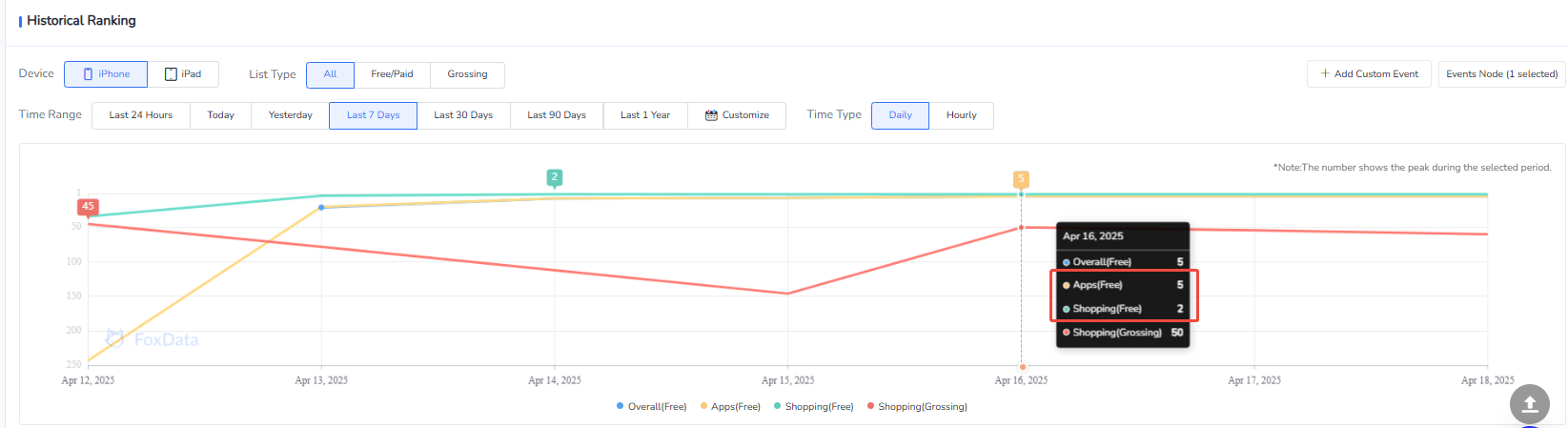

Taobao’s ascent in April 2025 was nothing short of extraordinary. In the U.S., it climbed to 5th overall on iOS and 2nd in the shopping category, outpacing established players like Amazon and Walmart.

In France, it claimed the top spot both overall and in shopping, while in Canada and the U.K., it secured 2nd place in the shopping category.

The numbers tell a compelling story: U.S. downloads soared from 30,000 to 185,000 in a single month—a 514% jump.

This rapid expansion signals Taobao’s ability to penetrate competitive markets and hints at shifting consumer preferences worldwide.

The platform’s success wasn’t limited to one region. Its rankings and download metrics reflect a coordinated global push, leveraging both market opportunities and operational strengths. Understanding this surge requires a closer look at the underlying drivers that fueled Taobao’s rise.

Several key elements converged to propel Taobao’s global expansion, blending external market conditions with sharp strategic execution.

One major factor was the U.S.-China tariff landscape. Policies in 2025 had driven up the cost of imported goods on platforms like Amazon, where prices for items like handbags or apparel were often 4-5 times higher than on Taobao. This gap caught the attention of price-sensitive shoppers, who turned to Taobao for savings of 60%-80% on comparable products.

A similar trend lifted platforms like DHgate, which also saw download spikes tied to tariff-related price edges. For Taobao, this translated into a 5.7x increase in weekly U.S. downloads, as consumers flocked to affordable alternatives amid rising costs elsewhere.

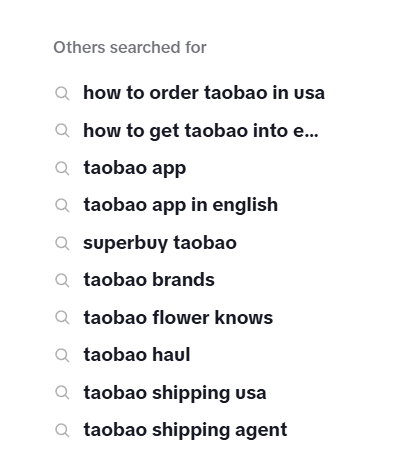

Social media, particularly TikTok, acted as a turbocharger for Taobao’s growth. User-generated content—think videos flaunting $20 dupes of luxury items like Goyard bags—created a seamless path from discovery to purchase. The hashtag #taobaotutorial racked up over 330,000 videos, amplifying visibility.

Popular searches on TikTok

In Malaysia, influencer Maryam Razak’s live stream drew 250,000 viewers, spiking local registrations by 80%. This organic, content-driven momentum turned TikTok into a vital artery for traffic, proving social media’s role as more than just a marketing tool—it’s a sales engine.

>>> Live Stream to Market Your Brand: From Mobile Games to Live Shopping

Taobao didn’t just rely on price or buzz; it doubled down on localization. Its logistics arm, Cainiao Network, slashed delivery times in Malaysia from 15 to 6 days via a smart hub in Kuala Lumpur.

In Europe, overseas warehouses enabled 5-10 day shipping with local returns, easing buyer concerns. Payment options expanded to include local favorites like Malaysia’s Touch 'n Go and Europe’s Klarna, covering 81% of e-wallet users in those regions.

Add multilingual interfaces across 14 countries, and Taobao erased language and logistical barriers, making it feel local wherever it landed.

👉 Ecommerce App Marketing Solutions

The competitive field also tilted in Taobao’s favor. Temu’s U.S. ranking slid to 69th as tariff costs forced it to cut ad spending, while Shopee’s parent, Sea Group, retreated in Southeast Asia. Taobao filled the gap with a “mid-price, wide-range” approach—distinct from Temu’s bargain focus or Shein’s fast-fashion lane.

Meanwhile, its globalized “Double 11” campaign in Hong Kong, with subway ads and free shipping on $99+ orders, lifted regional downloads by 40%. In Malaysia, Eid al-Fitr tie-ins with influencers further cemented its cultural relevance.

Taobao’s triumph offers a roadmap for e-commerce platforms eyeing global growth. Agility is key: seizing tariff windows with subsidies or bonded warehouse shipping can lock in price advantages, as DHgate showed with its “tariff transparency” feature.

Social media integration—think live streaming paired with shopping carts—can shrink the gap between browsing and buying, especially with local influencers bridging trust gaps.

Localization must go beyond translation, weaving in regional payment systems (e.g., GrabPay in Southeast Asia) and logistics partnerships (e.g., France’s Chronopost).

Technology also matters. AI-driven translation and personalized recommendations—like eco-friendly picks for France—enhance user experience. Looking ahead, AR try-ons or 3D showrooms could set new benchmarks.

Finally, building an ecosystem—via supply chain investments or open APIs for local vendors—creates a moat that price wars alone can’t match.

To dominate competitive app markets in 2025, leveraging expert App Store Optimization (ASO) strategies is no longer optional—it’s essential. ASOWorld, a trusted leader in app growth solutions, offers tailored services to skyrocket your visibility and rankings.

👉 Case Studies: How We Increase The Conversion Rate of User's Shopping App With ASO?

Taobao’s rise isn’t without hurdles. Profitability remains a tightrope: Q1 2025 saw a 12% GMV increase but a 1% EBITA dip, as subsidies and logistics ate into margins. Geopolitical risks loom, too—tighter U.S. rules on “tariff evasion” could force compliance shifts, like local entities or tax alignment. Local giants like Amazon, with its supply chain revamp, or Walmart, pushing social commerce, could claw back ground.

Looking forward, Taobao’s edge hinges on balancing expansion with profit, navigating regulations, and innovating for users. Its success stems from policy savvy, social media mastery, and localization depth—a formula others can adapt. Yet, sustaining this momentum will demand relentless focus on compliance, efficiency, and experience in an ever-shifting global market.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.