The Future of Sports Apps Marketing in 2026: What to Expect Next

Discover how 35% of consumers embrace cashless transactions through payment apps and mobile wallets. Insights on adoption, security, and preferences.

The surge in digital transformation, catalyzed by the pandemic, has propelled mobile wallets and payment apps into the spotlight. With cashless transactions becoming the norm, one mobile payment app has emerged as a favorite among users – whether they're shopping online or in physical stores.

Let's delve into the details and uncover the driving forces behind this trend.

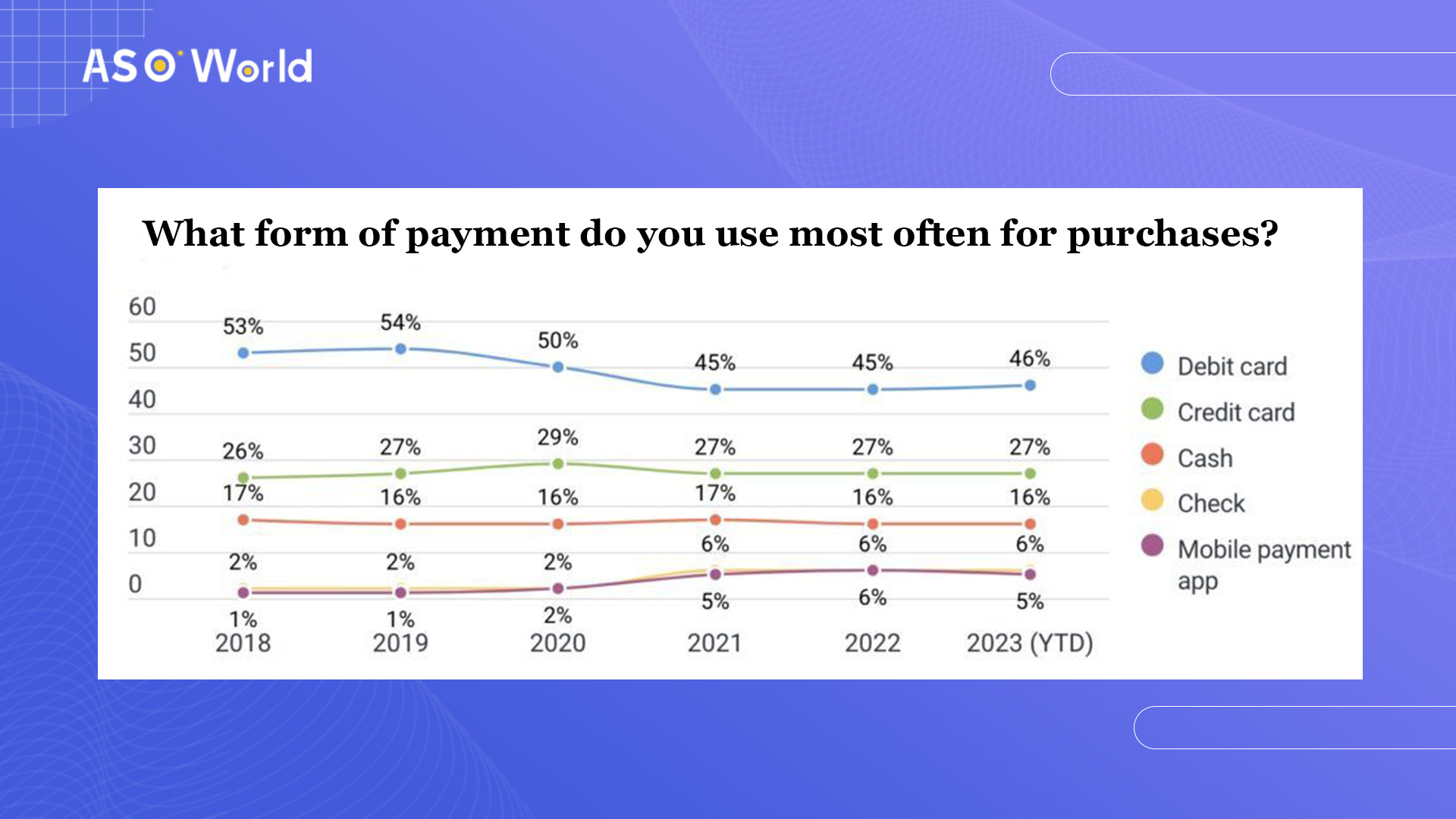

As digital payment methods gain traction, a rising number of Americans are embracing mobile wallets for their shopping transactions.

Impressively, around 35% of respondents employ at least one e-wallet or mobile payment app for in-store purchases, and this figure increases to 44% for online transactions.

But which specific app takes the lead in this dynamic landscape?

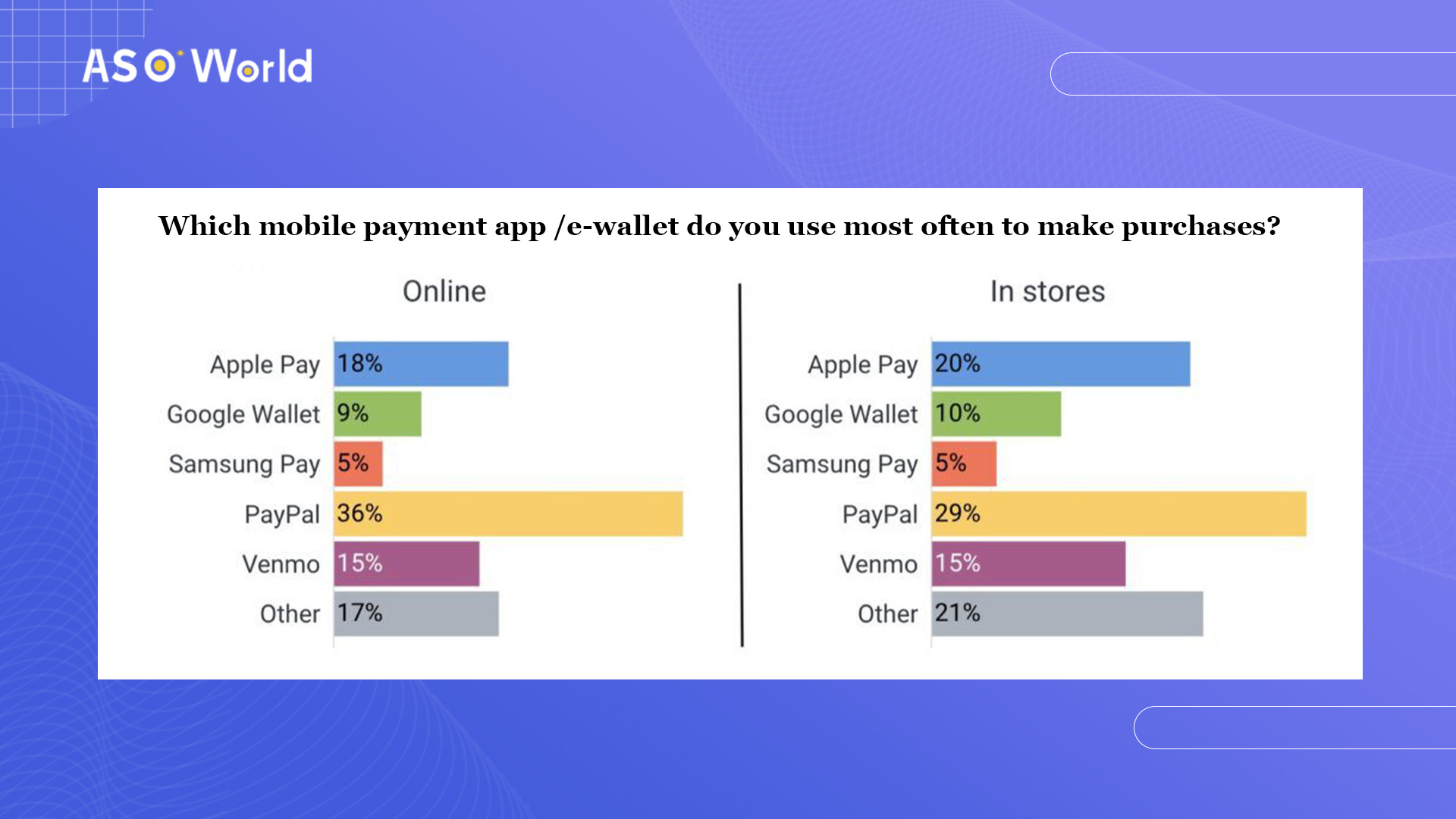

Among the plethora of payment apps available, PayPal emerges as the top preference for users. Regardless of whether transactions occur in the digital realm or in physical stores, consumers consistently choose PayPal over competitors like Apple Pay, Venmo, and Google Wallet.

While PayPal claims the lead, Apple Pay secures the second spot. Interestingly, Apple Pay performs even better for in-person transactions compared to online dealings, surpassing Google Wallet.

For in-store transactions, Apple Pay gains a two-point advantage over its online usage, whereas PayPal lags by seven percentage points.

However, PayPal's role as a recognized payment method in physical stores remains relatively limited, underlining the role of e-wallets in this arena.

Despite the surge in adoption, only 14% of consumers frequently use mobile payment solutions, while 24% exhibit a notable aversion towards them. The majority falls in between – individuals who use mobile payments infrequently or are cautiously considering them.

Security apprehensions constitute a significant barrier to widespread adoption. Users who sporadically use or are hesitant about mobile payments often express concerns about the apps' security. Notably, this worry spans generations, with those aged 55 and above registering the highest degree of concern at 48%.

Convenience emerges as the second major hurdle. Many users believe that mobile wallets and payment apps don't offer more convenience than traditional methods. To sway non-users, demonstrating how these apps genuinely enhance convenience becomes pivotal - potentially expanding the pool of mobile payment adopters.

⚡ Mobile Payments App Growth Case Study: Increasing App Downloads with User Journey and Product Page Optimization

The younger demographic, particularly those under 35, are driving the broader population's adoption of mobile payment apps. An impressive 10% of Gen Z adults declare mobile payment apps as their primary choice, a stark contrast to the mere 1% among those aged 55 and above.

⚡ How to Find Your Mobile App's Target Users

Enthusiasts of mobile payment apps also exhibit a proclivity towards exploring alternative financial tools. A notable 16% express an intention to try 'buy now, pay later' apps, and an impressive 38% have already embraced this option. Moreover, those who primarily use mobile payment apps demonstrate a more optimistic outlook on their personal finances.

⚡ Addressing App User Retention: Insights into User Behavior in App Markets

Click "Learn More" to drive your apps & games business with the ASO World app promotion service now.

While mobile payment apps and e-wallets continue to reshape the financial landscape, they haven't yet established their dominance as the primary payment method.

Although Apple Pay and Venmo usage is prevalent, merely 5% consider mobile payments their foremost choice. Overcoming entrenched perceptions remains a challenge, especially among older generations, as the journey towards broader acceptance of mobile payments persists.

Key Takeaways:

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.