The Future of Sports Apps Marketing in 2026: What to Expect Next

The global travel app market grew 4.4% in 2024, with downloads reaching 2.15 billion and revenue expected to exceed $180 million, driven by seasonal peaks and regional market leaders.

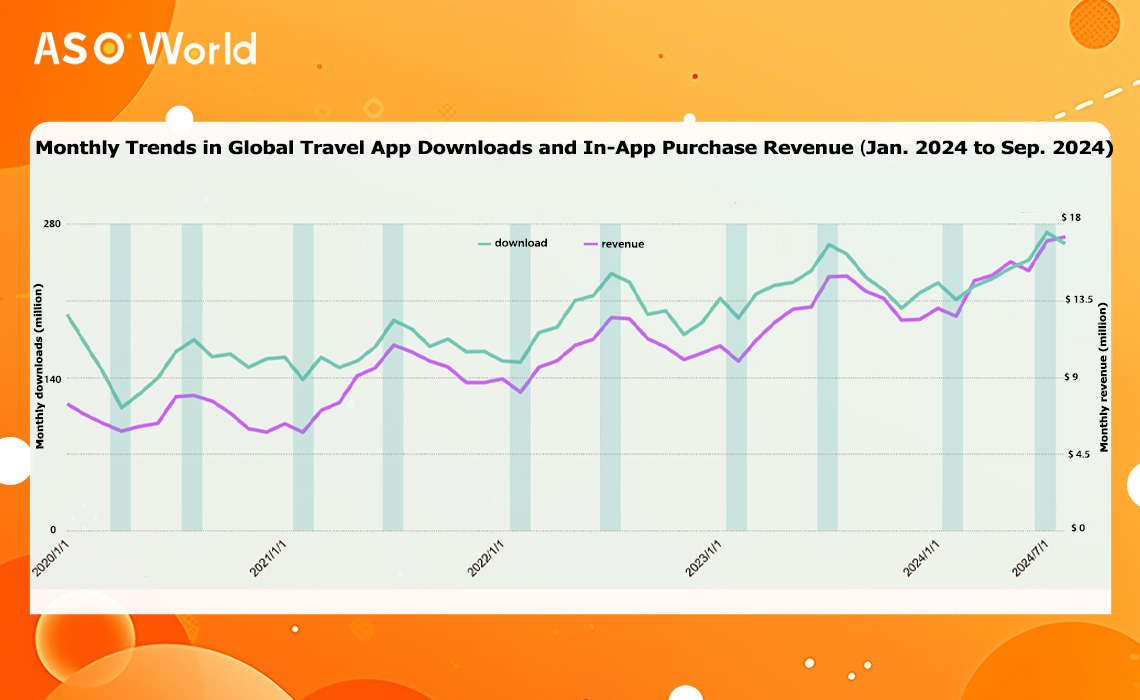

In recent years, the global travel app market has seen consistent growth in both downloads and revenue. From January to September 2024, downloads and revenue increased by 4.4% and 19.5%, respectively. It is projected that by the end of 2024, downloads will reach 2.8 billion, and revenue will surpass $180 million.

This report aims to analyze the trends in global travel app downloads and revenue, the distribution of downloads and revenue across different countries, and the leading travel apps in terms of downloads and active users in various markets.

From 2020 to 2024, global travel app downloads have steadily increased. In the first nine months of 2024, downloads grew by 4.4% year-over-year, reaching 2.15 billion. It is anticipated that total downloads for the year will exceed 2.8 billion. Concurrently, in-app purchase revenue for travel apps has also been on the rise. From January to September 2024, revenue increased by 19.5% to 140 million, with expectations to surpass 180 million by year-end.

The COVID-19 pandemic had a significant impact, with global travel app downloads plummeting to a historic low in April 2020.

Since then, downloads and revenue have shown a cyclical upward trend, peaking annually around July after a low point in February.

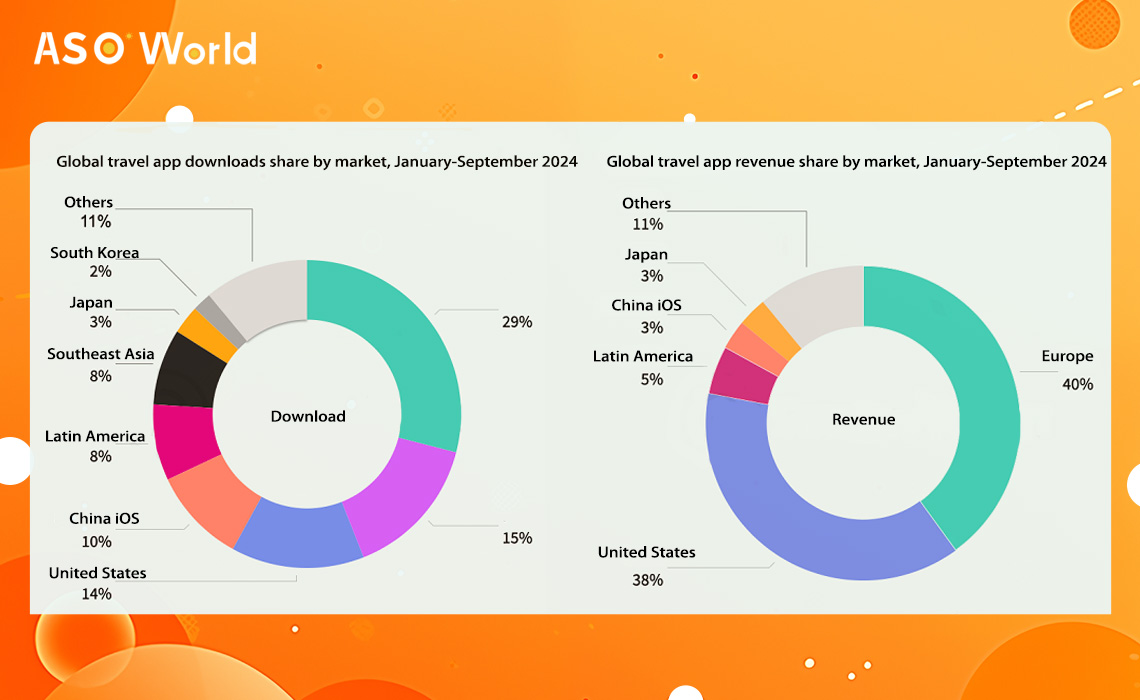

India stands as the largest single market for travel app downloads, contributing 15% of total downloads from January to September 2024.

The iOS markets in the United States and China follow closely, contributing 14% and 10% of total downloads, respectively. In terms of revenue, the European and U.S. markets dominate, accounting for 40% and 38% of global travel app revenue from January to September 2024.

Following the easing of pandemic restrictions, China's iOS market saw a resurgence in travel app downloads, reaching a peak in Q3 2023 with nearly 80 million downloads. The national railway booking system app, "Railway 12306," experienced a 260% increase in downloads in 2023, reaching approximately 43 million.

From January to September 2024, it topped the download charts. "Meituan," due to its comprehensive service offerings, maintained its position as the leader in monthly active users with nearly 65 million, while ranking third in downloads.

Japan's travel app market returned to growth in Q1 2022, with a 13% year-over-year increase in Q3 2024, surpassing 20 million downloads. "Google Maps" remained stable, leading the download chart and ranking second in active users.

The local app "Suica" saw a 10% and 14% increase in downloads and active users, respectively, securing the third position in downloads and fourth in active users.

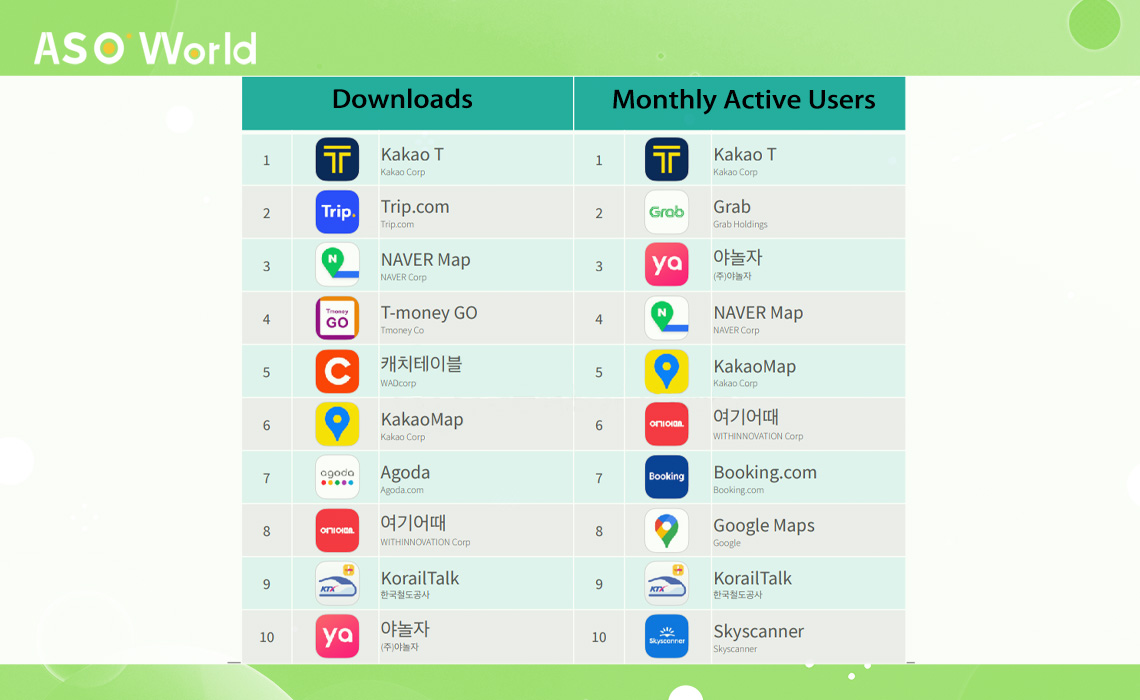

Since 2020, South Korea's travel app downloads have remained relatively stable, reaching 14.5 million in Q3 2024. The local ride-hailing app "Kakao T" dominated both the download and active user charts, with nearly 58 million cumulative downloads and 14 million monthly active users by September 2024.

"Trip.com" saw an 18% increase in downloads, climbing to the second position, with South Korea being its largest single market.

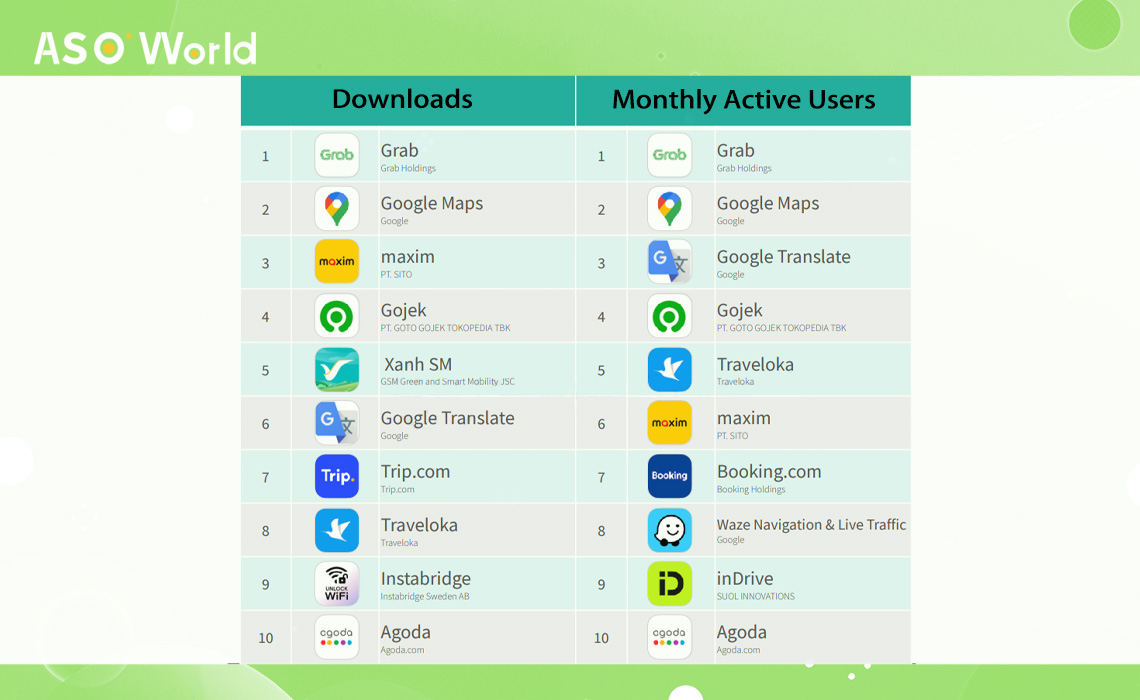

In Q2 2024, Southeast Asia's travel app downloads hit a record high of nearly 61 million, with Indonesia contributing 44% of the total. "Grab" maintained its leadership in both downloads and active users, with a 12% growth from January to September 2024.

The "Maxim" E-hailing App ranked third in downloads, while Vietnam's ride-hailing app "Xanh SM" increased its downloads by 120%, reaching the fifth position.

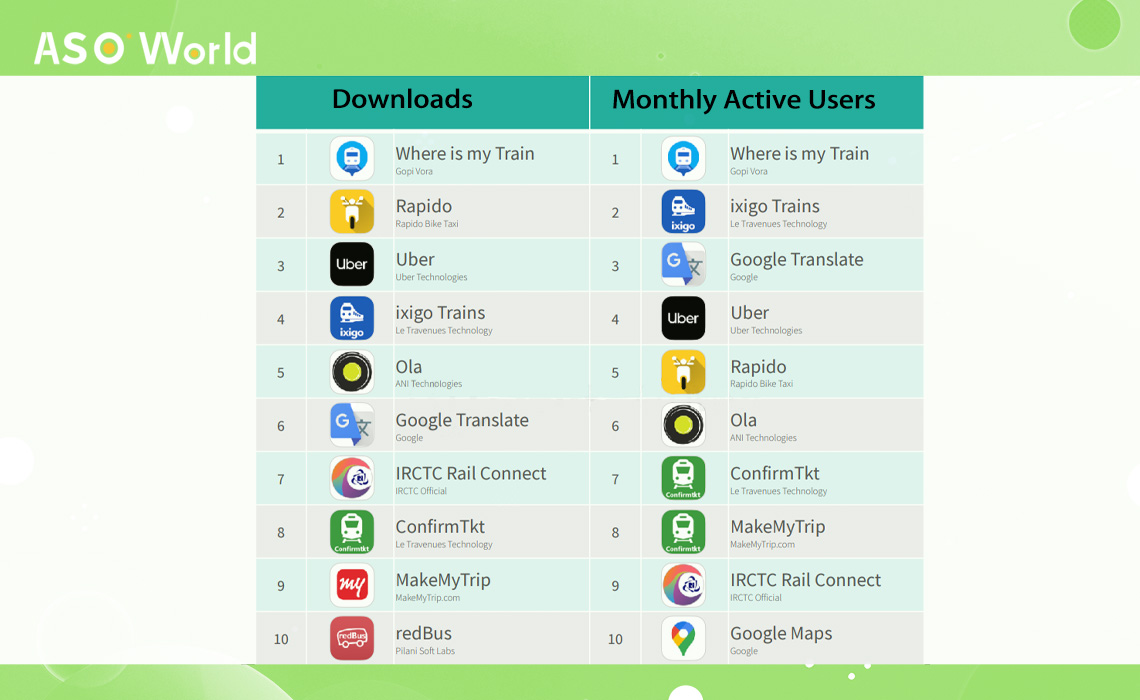

In Q2 2024, India saw a historic peak in travel app downloads, exceeding 110 million. The train travel app "Where is my Train" led both the download and active user charts, with nearly 400 million active users by September 2024.

The local ride-sharing app "Rapido" increased its downloads by 35%, surpassing "Uber" to lead the Indian ride service market.

In Q3 2024, Australia's travel app downloads reached a record high of over 10 million. New Zealand's market remained stable, with nearly 1.4 million downloads in Q3 2024. "Google Maps" and "Uber" maintained the top two positions in both downloads and active users in the Australia-New Zealand market.

"Booking.com" also performed well, ranking fourth in downloads and third in active users. The navigation app "Waze" saw a 28% increase in downloads, climbing to the third position in downloads.

As the year-end holidays approach, travel is once again becoming a major trend. To capitalize on this surge, it's crucial to strategically plan your app promotion efforts. Choose ASOWorld for professional and effective travel app marketing solutions.

Our expertise ensures that your app will stand out in a competitive market, reaching more users and maximizing your success during this peak travel season.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.