Riot Games' innovative revenue-sharing model marks a transformative moment for esports, promising a more equitable and stable financial future for teams and players.

Riot Games, the developer of League of Legends (LoL), has announced a new business model for esports that involves the creation of a Global Revenue Pool (GRP) to distribute all revenue from digital LoL esports.

This new model will apply to teams in the North America-based League Championship Series (LCS), the League of Legends European Championship (LEC), and the League of Legends Champions Korea (LCK).

The shift aims to reduce teams' reliance on sponsorship amid post-pandemic financial challenges, with Riot pledging a 50% revenue share after recouping its esports investments. They plan to collaborate with China's LPL to refine this model.

※ Expert Comment: John Needham, Head of Esports at Riot, believes this move from sponsorship to digital sales will enhance economic resilience and market growth, as digital content sales offer a broader revenue scope without the conflicts of sponsorship terms.

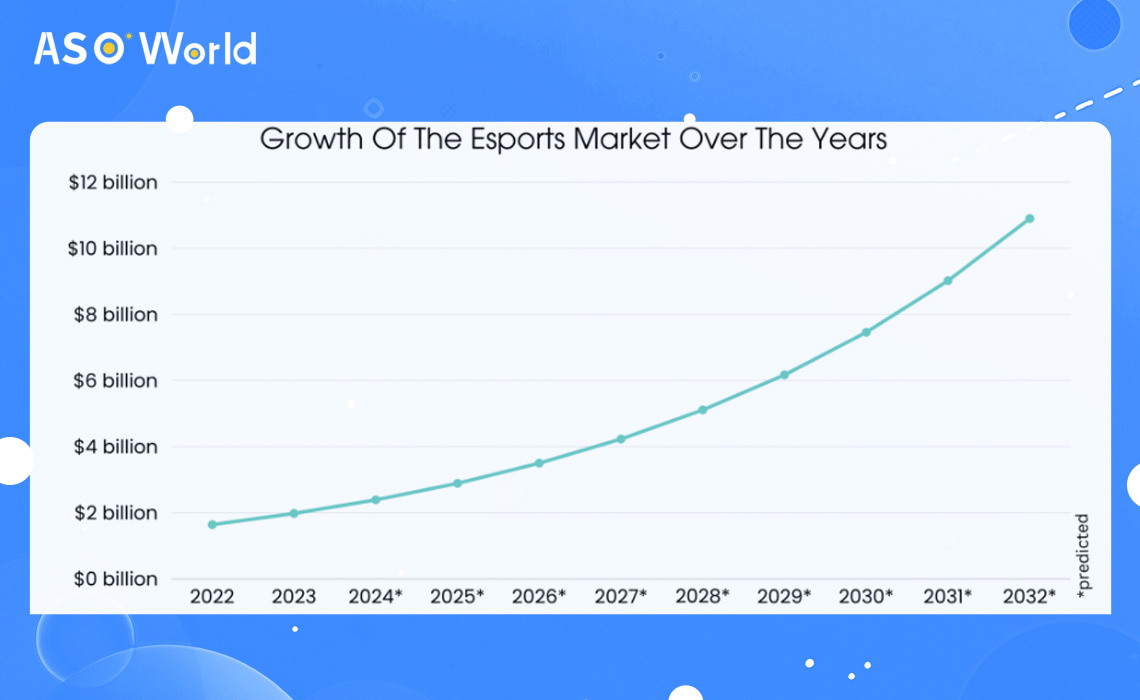

The global esports market is valued at 1.98 billionin 2023. It is expected to grow at a compound annual growth rate (CAGR) of 20.9%, 2.39 billion by the end of 2024. By 2032, the market value is anticipated to hit $10.9 billion.

The United States holds a dominant position in the esports industry in terms of revenue. The US esports market is valued at approximately 871 millionin 2023 and is expected to exceed 1.07 billion in 2024. With a projected CAGR of 18.7% from 2024 to 2028, the US esports market size is expected to reach $1.51 billion by 2028.

Sponsorships are as crucial to esports as they are to other sports. In 2022, esports sponsorship revenue exceeded 837.2 million, with a significant portion of the income derived from sponsor ships. Media rights and publisher fees generated a combined total of approximately 338.5 million.

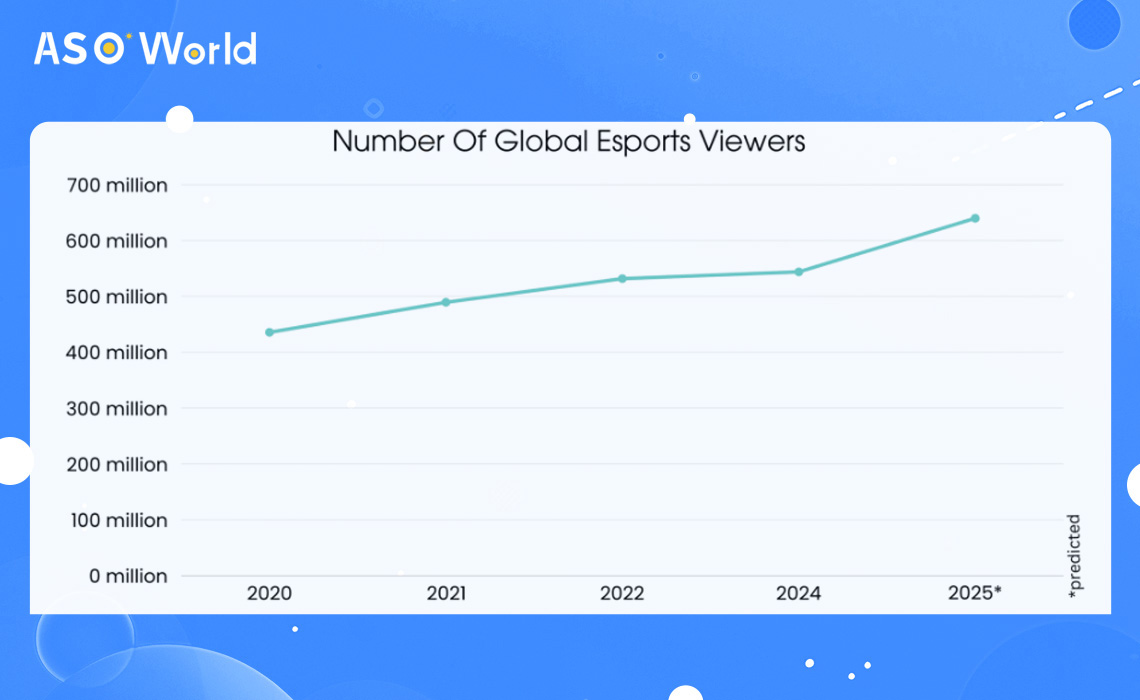

With the globalization of gaming and broadcasting innovations, there will be more players and viewers exploring the esports domain in 2024. The number of esports viewers has significantly increased from about 435 million in 2020 to over 540 million in 2024. The global esports audience is expected to surpass 640 million by 2025 as esports continues to grow and become more widespread.

As many mature gamers enter the esports scene, fan communities are also growing, following and supporting their favorite influencers. By 2024, esports will be fully recognized as a mainstream sport. In 2022, there were approximately 261.2 million esports enthusiasts and 270.9 million occasional viewers.

With the audience numbers gradually increasing over the years, it is projected that by 2025, there will be over 322.5 million occasional viewers and 318.1 million esports enthusiasts watching esports.

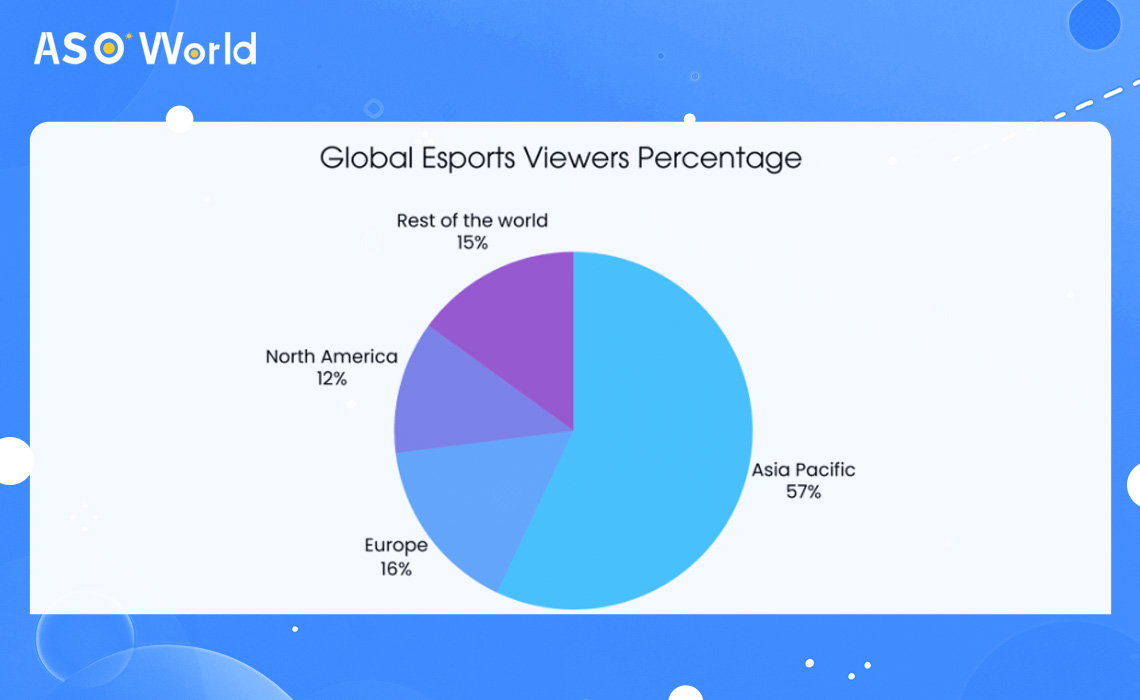

With over 1.5 billion gamers, Asia inevitably contributes the majority of esports fans. The region, including major gaming countries like Indonesia and China, boasts a high esports viewership rate (57%), claiming the largest share of the global esports audience.

As of 2023, the United States has an esports audience of approximately 45 million. Europe follows closely behind, accounting for about 16% of the global esports audience share.

The advertising segment holds a substantial share of the healthy esports market. In-game advertising allows companies to reach different audiences, leading to higher revenues. Furthermore, advertisements during esports games can result in greater brand recall due to its unique advertising technique, further driving the growth of this segment.

According to market analysis, the sponsorship segment is likely to see steady growth during the forecast period, as it is an effective way to win the trust of loyal fans who are likely to spend money on sponsored brands. In addition, the increasing digital assets of major gaming companies offer lucrative opportunities in the sponsorship domain.

MOBAs hold a significant share of the esports market, attributed to the emergence of high-quality and high-resolution video games such as "PUBG," "League of Legends," and "Call of Duty." MOBA games are team-based and require greater coordination, multiple player involvement, and intense competition, attracting a larger audience.

From a market perspective, due to the growing popularity of high-end arcade games, the fighting game sector is also expected to experience stable growth in the coming years.

⚡ MOBA Game Case Study: Expand Global Markets Through App Localization

The North American esports market is experiencing significant growth due to high internet penetration in the region. Esports as a form of entertainment is increasingly favored by tech-savvy youths, and various organizations in the region are attempting to promote the creation of esports clubs in educational institutions such as schools, universities, and colleges.

Meanwhile, the Asia-Pacific region is expected to emerge as a leading esports hub due to the expansion of the gaming community. In countries like South Korea, Japan, China, and India, the number of esports players and enthusiasts has significantly increased due to the growing popularity of mobile gaming. Additionally, the increasingly widespread 5G network in countries like Vietnam, Thailand, and the Philippines may drive market expansion in the coming years.

Founded in 1979 and headquartered in California, USA, Activision Publishing, Inc. is a leading video game publisher and a subsidiary of Activision Blizzard. The company has a solid foothold in the entertainment field and has developed pioneering innovative games such as "Call of Duty," "Skylanders," and "Crash Bandicoot."

Electronic Arts Inc. is a leading video game production company that has developed well-known games such as "Dead Space," "NFS Unbound," "The Sims 4," "FIFA 23," and "Madden 23." Headquartered in California, USA, and established in 1982, Electronic Arts provides high-quality games and content for networked game consoles and various networked devices.

Gameloft SE is a renowned video game company that has developed award-winning PC and console games, with over 70 million monthly active users across all platforms. The company offers games for businesses and individuals, aiming to make gaming enjoyable and help build connections. Founded in 1999, Gameloft is currently headquartered in Paris, France.

Other participants in the esports market include Tencent Holdings Limited, Skillz Inc., Motorsport Games Inc., Gfinity PLC, HTC Corporation, FACE IT LIMITED, Riot Games, Inc., and CAPCOM Co., Ltd., among others.

>>> The data for 2023 is also worth referencing 👉 Global eSports Market Report (2023)

The increasing availability of high-speed internet in emerging economies and developed countries is one of the primary factors supporting the growth of the esports market. Additionally, the rising trend of cloud gaming allows gamers to join from a variety of devices, thereby enhancing accessibility for players and meeting market demand.

High-speed internet is essential for streaming esports content. Faster internet speeds enable high-definition, uninterrupted live broadcasts of esports events, providing a more enjoyable viewing experience for fans worldwide. This improved accessibility and quality have facilitated the growing popularity of esports as a spectator sport.

With better internet connections, more individuals can participate in online gaming, which is fundamental to esports. In emerging economies, improved internet access has opened up opportunities for more people to engage in gaming, potentially leading to a greater pool of esports talent and a broader audience.

Mobile esports is becoming increasingly popular due to its convenience and accessibility. Moreover, the continuous rise in smartphone prices, coupled with the rollout of esports compatible with smartphones, further drives demand in the esports market.

Mobile esports offers unmatched convenience and accessibility. Unlike traditional PC or console gaming setups, mobile games can be played anytime and anywhere, attracting a wider and more diverse audience. Modern smartphones come with increasingly powerful processors, high-quality graphics, and responsive large screens, making them suitable for high-end gaming experiences.

Game developers are not just adapting existing PC or console games for mobile devices; they are also creating esports games specifically designed for mobile platforms. These games are designed with the mobile user experience in mind, optimizing gameplay, controls, and graphics for smaller screens and touch interfaces.

※ Expert insights on Mobile Esports Game Marketing:

Mobile esports marketing capitalizes on smartphone ubiquity, leveraging targeted ads, social media, and personalized notifications to engage users. A freemium model with in-app purchases drives monetization, while partnerships with device manufacturers and telecoms enhance visibility and incentivize play.

Hosting mobile esports tournaments creates community, brand loyalty, and attracts sponsors, with promotion through live streams and influencers. These strategies are essential for tapping into the growing mobile gaming market.

The entry of more professional sports clubs into the esports arena has intensified competition, heightened betting interest, and added to the market value of esports.Many professional sports clubs from traditional sports like football, basketball, and racing have started to create or sponsor their own esports teams or players. This involvement brings a certain level of legitimacy, professionalism, and mainstream appeal to the market.

The participation of these clubs intensifies the competition within the esports sector, as they often bring substantial resources, fan bases, and marketing expertise. The heightened competition and increased visibility have sparked interest in esports among a broader audience, including traditional sports fans.

Government initiatives aimed at legalizing esports betting are expected to further drive market growth in the coming years. Legalization subjects esports betting to government regulation, which helps to standardize practices and ensure fairness and transparency.

Such regulations can enhance consumer confidence in betting platforms, thereby attracting more audience participation.The legal recognition of esports betting enhances the market's legitimacy. This can attract more investors and sponsors, as the legal framework provides a more stable and predictable environment for investment.

South Korea has become a leading esports market due to its advanced gaming infrastructure and high penetration of internet and smartphones. Government initiatives supporting the development of dedicated esports venues and the increasing number of esports championships and leagues hosted in the country further propel the growth of its esports market.

Additionally, the country possesses a deeply ingrained social gaming culture. PC Bangs (gaming cafes) are widespread and popular, where individuals can pay by the hour to play computer games. These spaces have played a crucial role in popularizing gaming and esports, creating a strong community around gaming.

※ Experts Insights: South Korea's dominance in esports presents a unique marketing opportunity for mobile game developers. Marketing strategies should focus on integrating with the existing gaming culture, such as collaborating with PC Bangs to offer exclusive mobile gaming events or promotions.

Additionally, leveraging South Korea's social gaming norms can help in creating viral marketing campaigns that encourage community-driven engagement. By tapping into the local esports ecosystem, marketers can effectively promote mobile esports titles and drive user acquisition and retention in this key market.

ASOWorld will also output industry insights and strategies for specific countries in the future, so stay tuned!

Click "Learn More" to drive your apps & games business with the ASO World app promotion service now.

Technological advancements and innovations are key trends in the esports market, expected to drive market demand in the coming years. Technologies like Artificial Intelligence (AI) and blockchain are anticipated to analyze game data, enhance viewer experiences, improve player behaviors, and achieve higher-resolution video streams. Artificial Intelligence can also improve the viewer experience by providing real-time statistics, predictive analytics, and personalized content.

AI-driven algorithms can enhance live broadcasts with automatic highlights, player performance metrics, and more immersive interactive viewing experiences. AI technology can help monitor player behavior and ensure fair competition, including detecting cheating or unethical conduct, thereby upholding the integrity of the matches.

Furthermore, blockchain can be utilized to create unique digital collectibles and fan tokens, enhancing fan engagement. These tokens can offer fans voting rights on minor team-related decisions or access to exclusive content, thus creating a more engaged and loyal fan base.

⚡ 2024 Game Industry Insights: Generative AI in Game Development

The esports market is experiencing exponential growth, with increasing audiences, significant revenue from sponsorships and media rights, and a strong presence in key regions around the world. The market is set to become even more mainstream by 2024, solidifying its status as a prominent sport in the digital age.

Stay at the forefront of Esports industry and continue to fuel your passion by following ASOWorld.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.