Google Play's April 2025 policy update expands rules for news apps, loan services, and data usage. Discover the key changes and ASO compliance strategies.

Google Play's policy updates, announced on 10th April 2025, introduce significant changes for developers, particularly for news, magazine, and personal loan apps, with key deadlines extending to 27th August 2025 for some policies.

These updates, alongside clarifications on user data, permissions, and content, aim to enhance transparency and user safety.

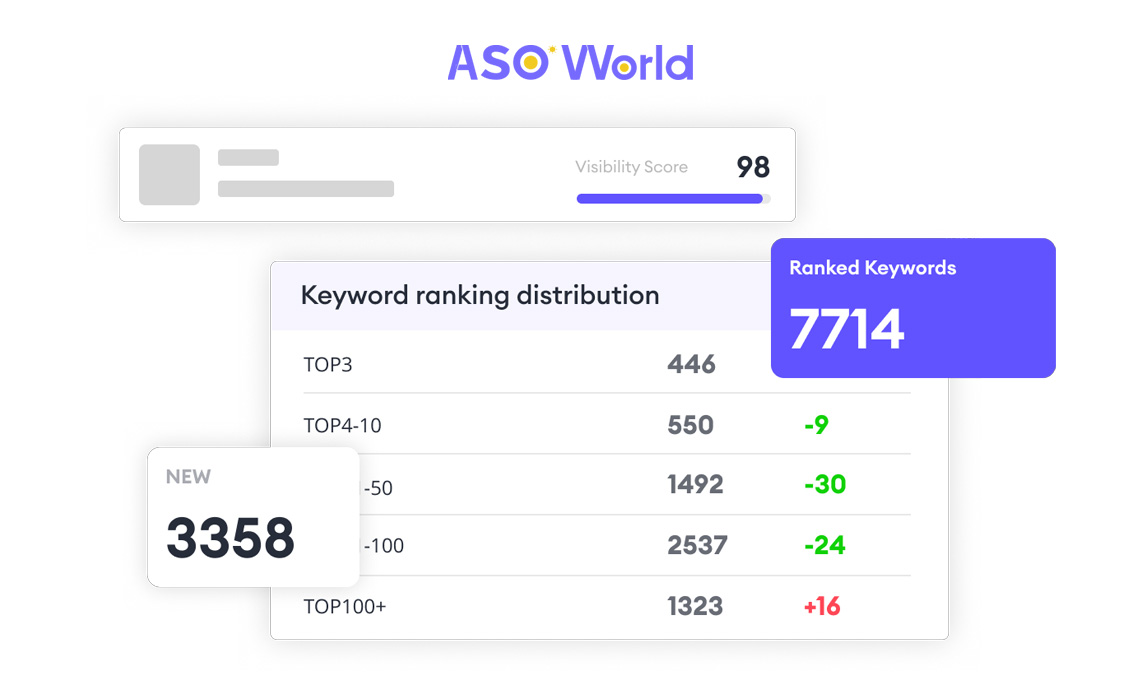

This article analyses the updates from an ASO (App Store Optimisation) perspective, offering developers and publishers actionable strategies to maintain visibility, ensure compliance, and strengthen user trust in a competitive Android ecosystem.

The News policy now encompasses both news and magazine apps, requiring all to complete an expanded self-declaration in the Play Console by 27th August 2025.

This declaration includes new questions to verify content accuracy and transparency, aligning with Google's push for trustworthy information.

💡 ASO Insights:

To maintain compliance and avoid potential delisting or reduced visibility, you must first ensure your app is accurately categorised as a News or Magazine product in the Play Console.

Failure to comply could negatively impact your app's organic discoverability, making it essential to proactively address these requirements during your ASO and compliance review process.

👉 How to Promote a News & Magazine App?

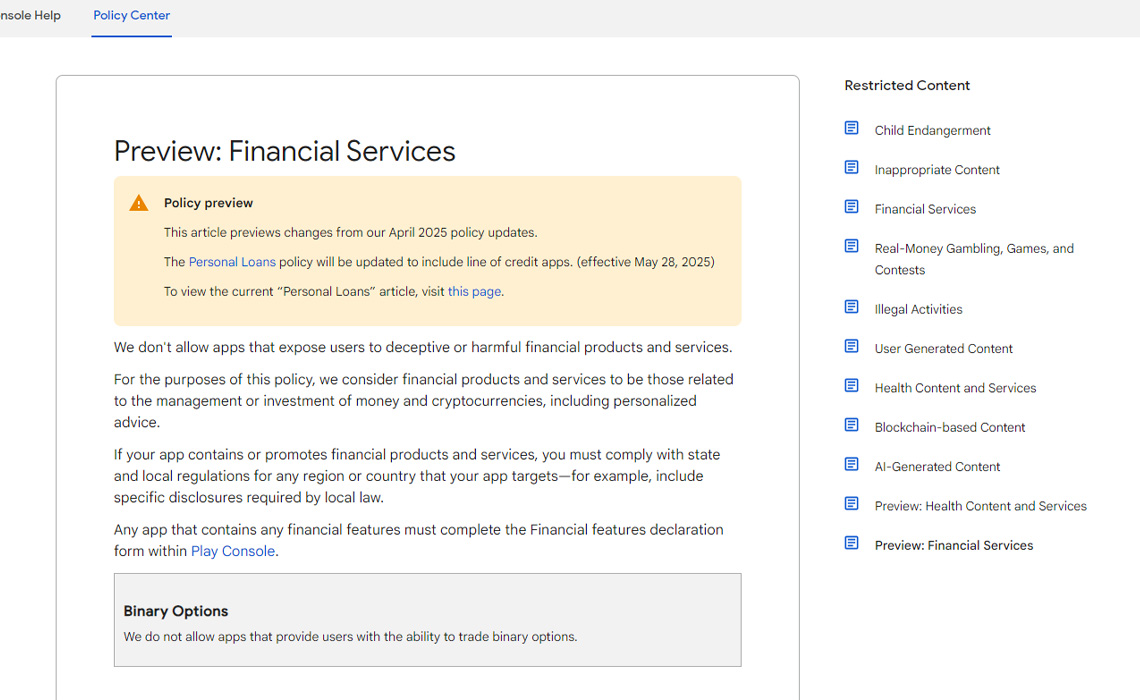

The Personal Loans policy has been expanded to include line of credit apps, effective 28th May 2025, aligning them with existing requirements for personal loans and Earned Wage Access (EWA) apps.

These apps must now adhere to strict disclosure rules, including repayment terms, maximum Annual Percentage Rate (APR), a representative cost example, and a comprehensive privacy policy.

Additionally, they are prohibited from accessing sensitive data, such as photos, contacts, or location, to protect users from predatory practices.

🔗 Financial App Policy Updates April 2025

💡 ASO Insights:

The inclusion of line of credit apps signals Google's intent to close regulatory gaps, potentially impacting their visibility if not properly optimised.

Developers should prioritise the following:

Highlight Compliance in Listings: Update app descriptions to emphasise transparency, using phrases like "secure credit solutions" or "privacy-first loans." This builds trust and aligns with Google's algorithm favouring compliant apps, potentially boosting conversion rates.

Optimise for New Keywords: Incorporate terms like "line of credit" or "flexible borrowing" into titles and descriptions to capture searches from users seeking credit-focused apps. Avoid high-risk phrases like "instant loans" to prevent policy flags.

Audit Permissions Early: Remove restricted permissions (e.g., Read_contacts, Access_fine_location) before the 28th May deadline. Highlighting "no sensitive data access" in screenshots can attract privacy-conscious users, enhancing click-through rates.

Monitor Competitor Strategies: Analyse how rival financial apps adjust their metadata post-policy update. A/B testing descriptions with compliance-focused messaging can help identify high-performing terms, maintaining a competitive edge.

Failure to comply risks delisting or reduced discoverability, particularly for apps targeting competitive financial categories.

Proactively updating metadata and permissions ensures sustained visibility in search and recommendation algorithms.

👉 How Often Should You Update Your App Store Metadata?

Google clarified the exceptions and examples of violations under its Manipulated Media policy, reinforcing its stance against misleading or deceptive content.

Clarification also confirms that system-level default contacts role handlers are eligible for default handler exemptions in contact prioritisation and management.

A direct link to the definition of "sharing" has been added in the Play Data Safety section, helping developers better understand what constitutes data sharing.

Clarifies the distinction between Personal Loans and Earned Wage Access (EWA) products.

Starting 10th April 2025, Android ID will no longer be considered a persistent device identifier, aligning with broader OS-level privacy enhancements.

Google has expanded guidance on complying with data protection laws, including the EU-U.S., UK, and Swiss Data Privacy Frameworks, and provided best practice examples.

Clarified restrictions for financial apps accessing SMS history, especially regarding potential misuse in spyware-like behaviour.

Clarified enforcement around the closure of inactive developer accounts.

👉 More Google Play Policy & Algorithm

The April 2025 policy update from Google Play has sounded the alarm for developers and publishers.

Teams behind financial apps need to act fast—by 28th May 2025, they must update permissions and metadata to comply with the new personal loan policy, or risk having their apps removed from the store.

News and magazine apps have a bit more breathing room. They have until 27th August 2025 to complete their self-declaration. If handled well, this could actually boost user trust and visibility.

That said, there's an upside to moving early: developers who stay ahead of these changes can use ASO (App Store Optimisation) to highlight badges like "Verified" or "Privacy-First," making their apps stand out in a trust-driven market.

Miss these deadlines, though, and your app's revenue and market position could be in serious jeopardy.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.