2025년 11월, 글로벌 앱 시장은 지속적인 성장세를 보였으며, 특히 소셜 네트워킹 및 AI 기반 생산성 앱에서 다운로드가 꾸준히 증가했습니다. 그러나 미국 시장은 다른 양상을 보입니다. TikTok, Instagram, ChatGPT와 같은 소셜 앱이 사용자 관심을 대부분 차지했고, 게임과 구독 서비스가 수익을 주도했습니다.

다운로드, 수익, 키워드 트렌드, 사용자 참여도를 분석함으로써, 미국 시장에서 기회가 있는 영역과 ASO 성과를 극대화할 수 있는 전략을 강조하고자 합니다.

글로벌 다운로드가 계속 증가하는 가운데, 미국 시장은 더 세분화된 패턴을 보입니다. 소셜 및 AI 앱이 채택을 주도하며 iOS에서 강세를 보이는 반면, Android는 쇼핑 및 캐주얼 게임 앱으로 다운로드가 분산됩니다.

수익 측면에서도 비슷한 현상이 나타납니다. 구독 기반 서비스와 인앱 구매(IAP) 중심 게임이 수익을 지배하며, ChatGPT는 iOS 수익 차트에서 8,200만 달러 이상을 기록하며 Google Play 대비 월등히 높은 수치를 보였습니다.

흥미롭게도, Solitaire와 PUBG MOBILE 같은 캐주얼 게임은 다운로드는 많지만 높은 참여도가 반드시 수익으로 연결되지는 않음을 보여줍니다. 반면 Google One과 같은 구독 앱은 예측 가능한 수익을 지속적으로 제공하며, 사용자 확보와 수익화 전략의 균형이 중요함을 강조합니다.

전문가 인사이트: 미국 사용자는 AI 및 소셜 앱에 강한 관심을 보이며, 이 카테고리가 성장 캠페인과 ASO 최적화의 핵심 목표가 됩니다.

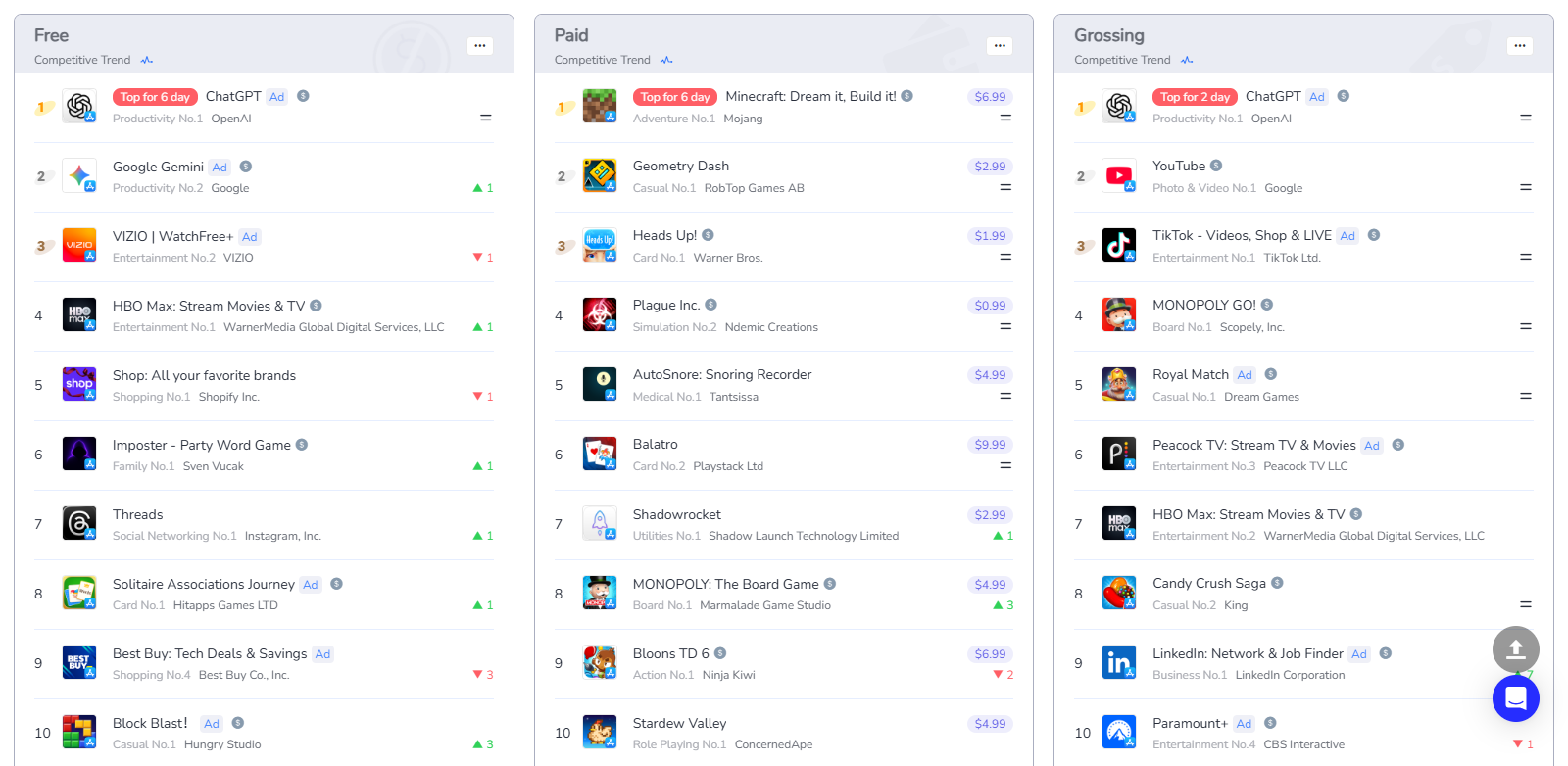

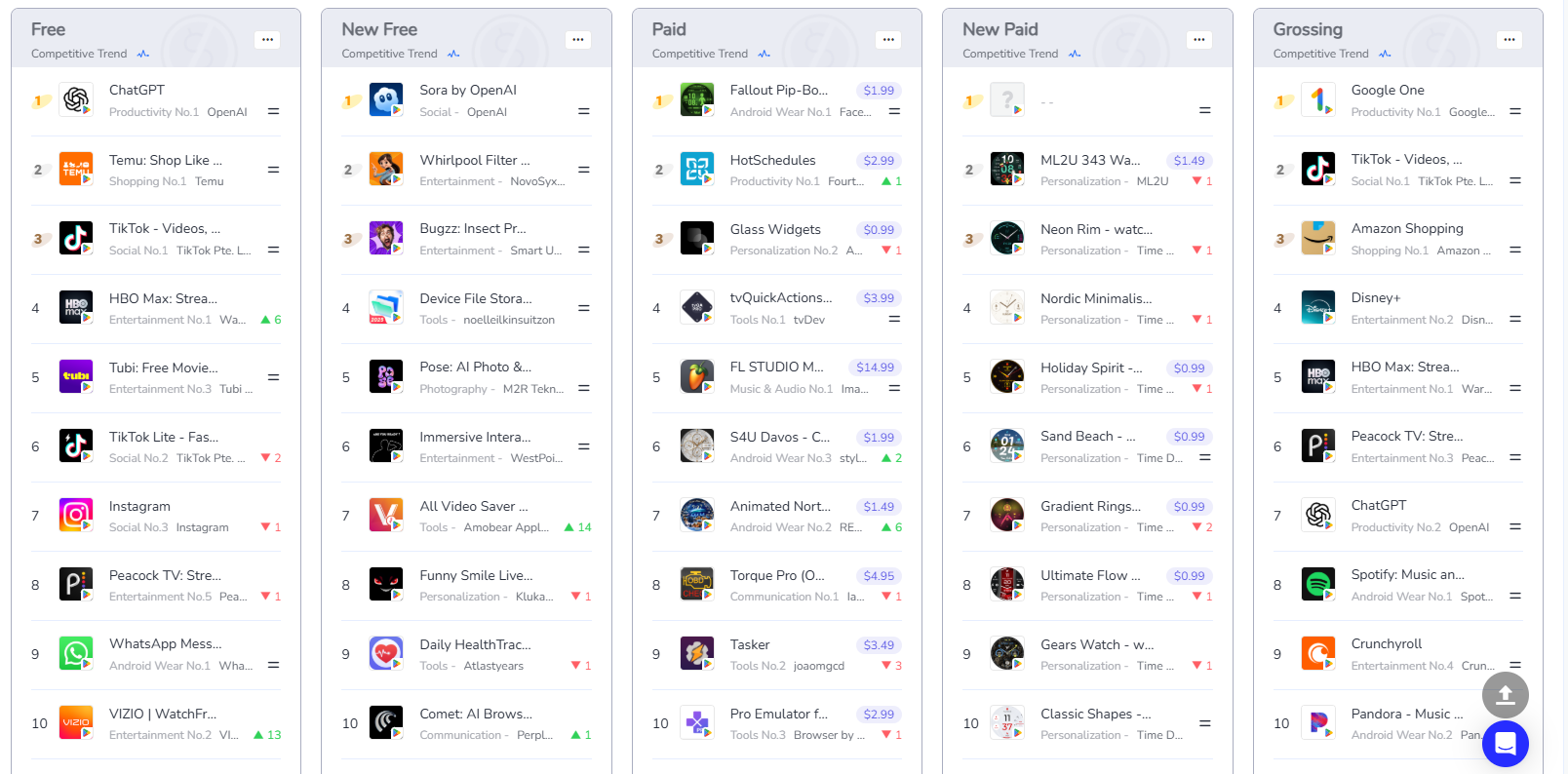

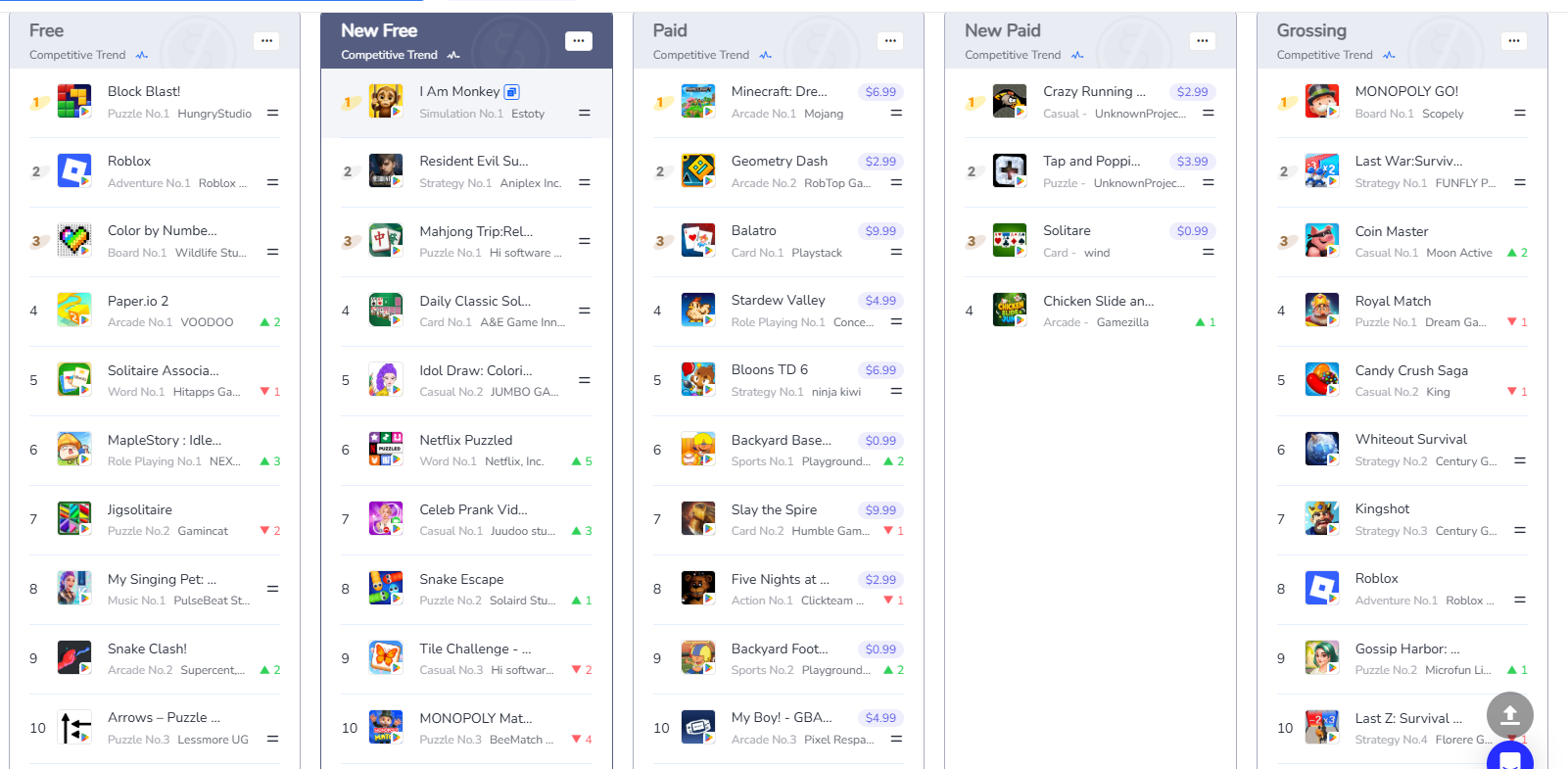

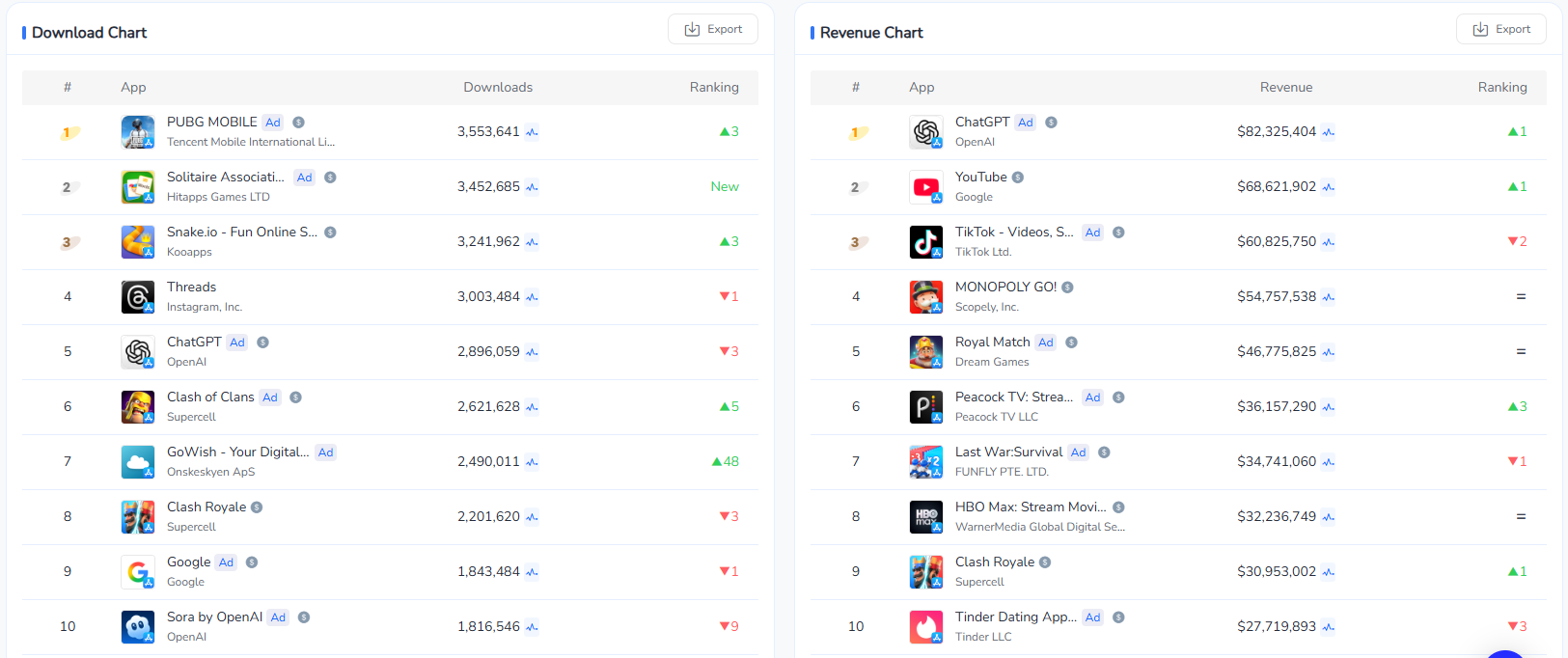

App Store와 Google Play 상위 차트를 분석하면 명확한 승자와 변화하는 트렌드를 확인할 수 있습니다:

무료 다운로드는 ChatGPT, Google Gemini, Threads, Instagram 등 소셜 앱이 지배했습니다. 유료 차트에서는 Minecraft, Geometry Dash 같은 대표 게임이 선두를 차지했고, 수익 차트에서는 ChatGPT, YouTube, TikTok이 상위권을 차지하며 구독 및 IAP 중심 모델에서 높은 수익을 보였습니다.

(FoxData 출처)

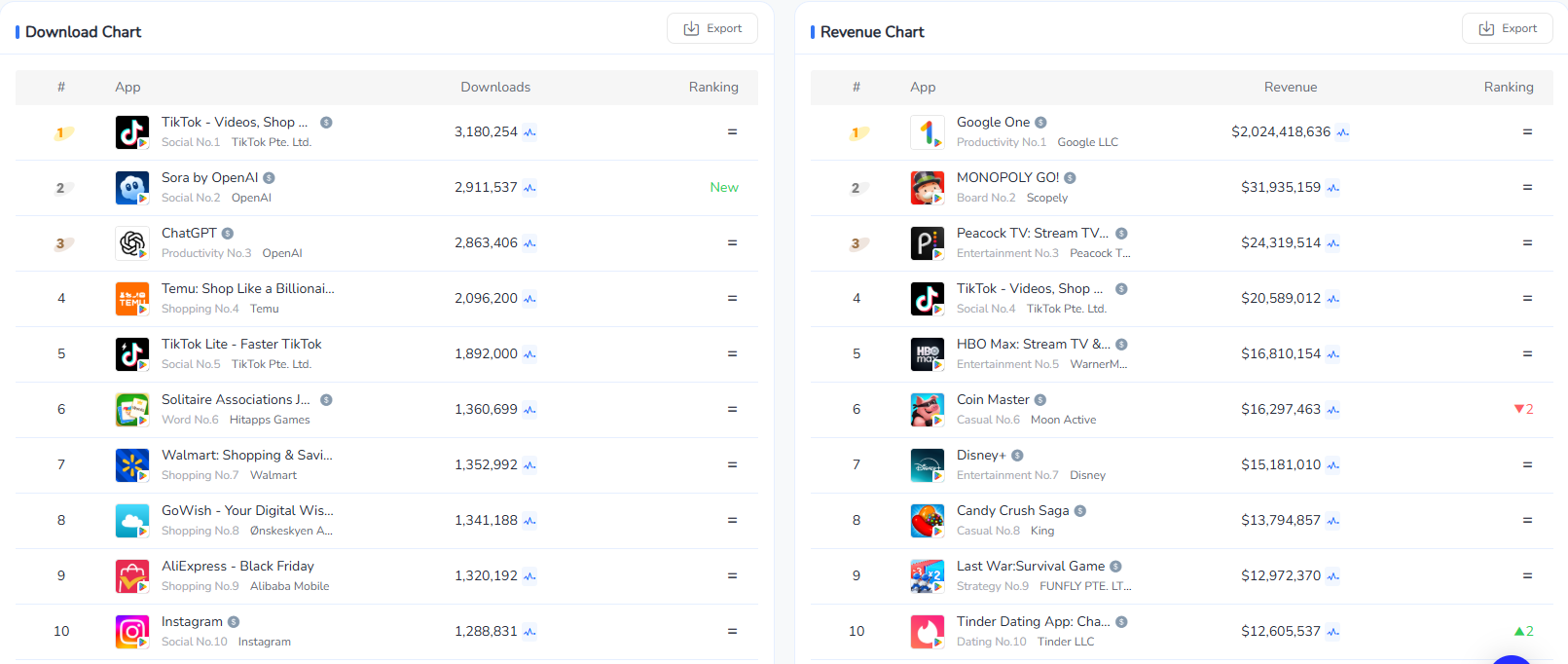

ChatGPT, Temu, TikTok, TikTok Lite가 무료 다운로드를 선도했으며, Free/Paid 차트의 신규 앱은 단기 변동성이 컸습니다. 수익 차트는 Google One과 MONOPOLY GO!와 같은 IAP 중심 게임이 안정적으로 차트를 이끌며, 반복 수익 모델의 중요성을 보여줍니다.

게임은 수익 차트에서 강한 존재감을 유지하지만, 소셜 및 AI 앱도 다운로드와 수익에서 꾸준히 상승하며 사용자들이 혁신적 경험에 참여하고 지불할 의향이 있음을 보여줍니다. 유틸리티 및 도구 앱은 가시성이 빠르게 변동하지만 단기 ASO 캠페인과 기능 포지셔닝을 통해 혜택을 볼 수 있습니다.

핵심 요약: 개발자는 상위 앱의 유지 중심 차트 전략을 중간 수준 앱에 대한 ASO 캠페인과 결합해 중간 계층 기회를 포착함으로써 의미 있는 다운로드 및 수익화로 연결할 수 있습니다.

👉 App Store & Google Play 앱 순위 요소 해킹 방법

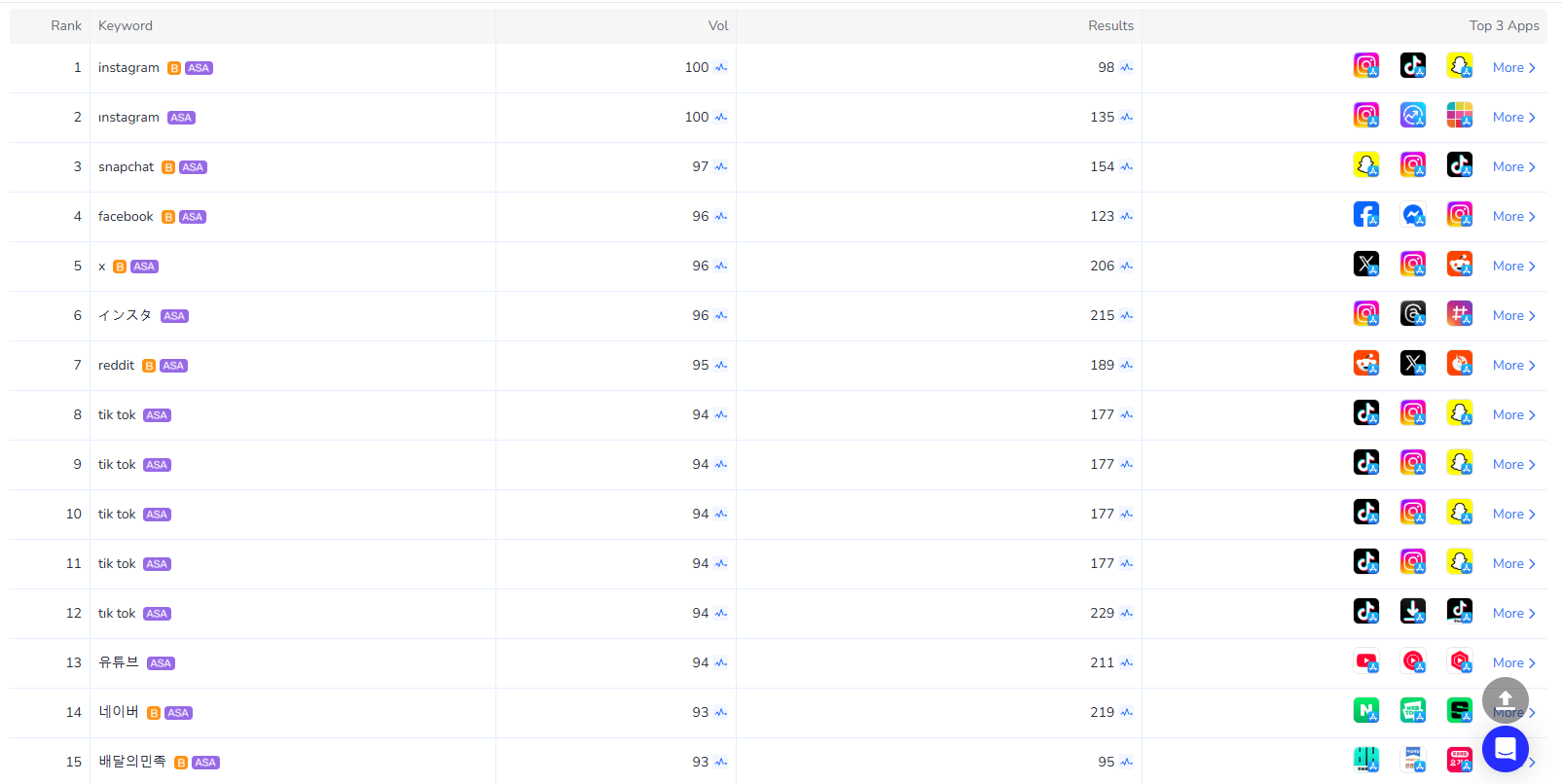

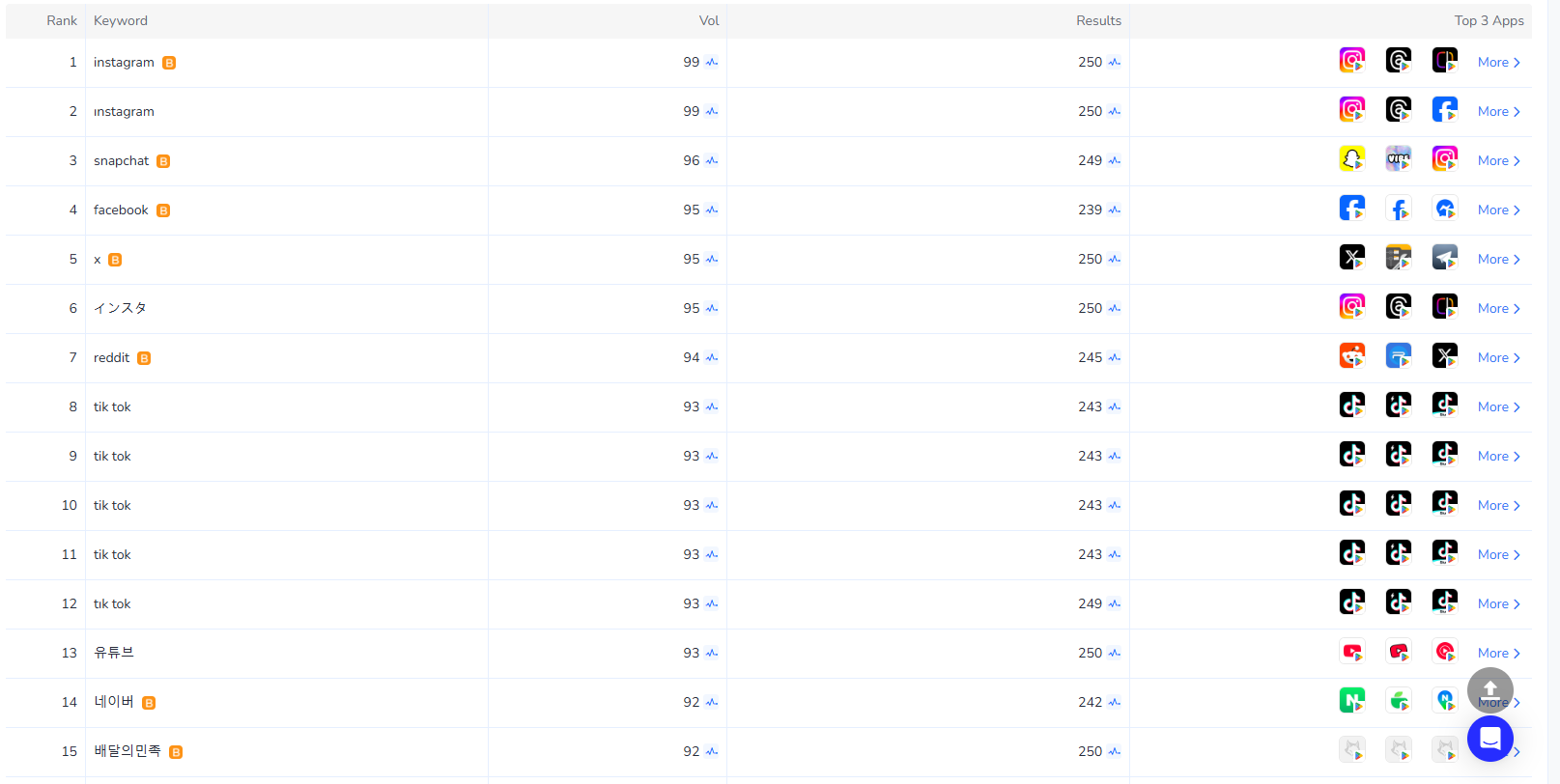

높은 검색량 키워드는 사용자의 관심이 집중되는 영역을 보여줍니다:

가시성을 넘어, 키워드는 사용자 행동을 이해하는 렌즈 역할을 합니다. 예를 들어, 소셜 앱의 높은 검색량과 무료 앱 차트의 빠른 변동은 사용자가 탐색적이지만 선택적임을 보여주며, 검색에서 전환 최적화가 중요함을 시사합니다.

👉 키워드 리서치 및 최적화로 App Store 검색 트래픽 확대 방법

💡 전문가 팁: ASOWorld은 모든 키워드 정보를 제공하는 무료 키워드 리서치 도구를 제공하여 키워드 연구에 큰 도움을 줍니다.

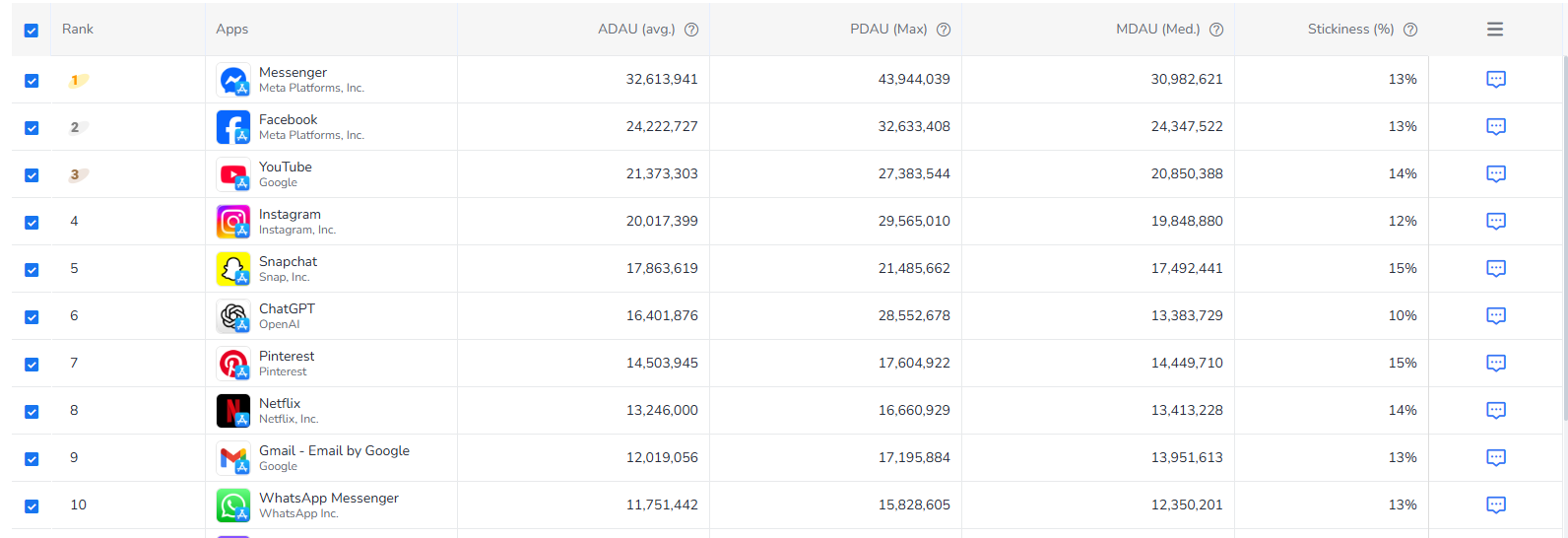

11월 데이터는 다운로드, 수익, 활성 사용자 트렌드가 항상 일치하지 않음을 보여줍니다:

TikTok, Temu, ChatGPT, Solitaire 앱이 가장 많은 다운로드를 기록했습니다. AI 및 소셜 앱의 iOS 채택률이 특히 강하고, Android는 쇼핑 및 캐주얼 게임으로 다운로드가 분산됩니다.

ChatGPT의 iOS 수익은 9,300만 달러를 초과하며, AI 기반 구독 앱의 수익화 잠재력을 보여줍니다. MONOPOLY GO!와 Royal Match 같은 게임이 양대 플랫폼에서 수익 차트를 지배합니다. Google One과 같은 구독 앱은 Android에서 예측 가능하고 고마진 수익을 계속 제공합니다.

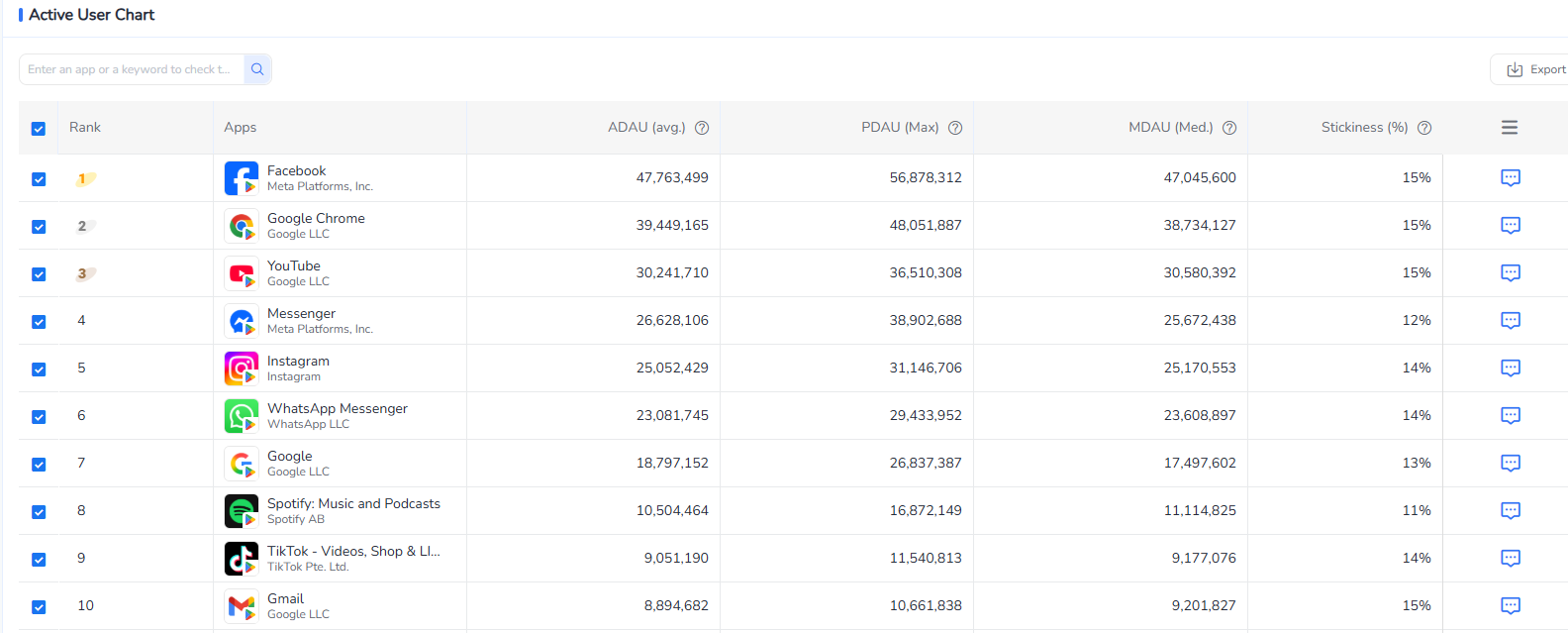

Facebook, Messenger, Instagram, ChatGPT가 일일 활성 사용자(DAU)에서 선두를 차지하며, 고정률은 10~15%입니다. 참여도는 높지만, 중간 수준 앱에서는 유지율과 장기 충성도를 개선할 기회가 있음을 보여줍니다.

전문가 인사이트: 다운로드만으로는 수익을 창출하기 어렵습니다. 개발자는 관심 있는 사용자를 구독자나 인앱 구매자로 전환하고, 정기적인 기능 업데이트와 콘텐츠 개인화를 통해 참여도를 유지해야 합니다.

동일한 결과를 달성할 수 있습니다 👉 To-Do List 앱 사례 연구: 사용자 경험 개선으로 앱 고정률 +50%

2025년 11월은 미국에서 두 가지 기회 계층을 보여줍니다:

앱 마케터와 개발자를 위한 주요 전략은 다음과 같습니다:

다운로드, 키워드 전략, 사용자 참여 인사이트를 통합함으로써, 미국 개발자는 경쟁 환경을 보다 효과적으로 탐색할 수 있습니다. 소셜 및 AI 앱은 여전히 다운로드를 지배하며, 구독과 IAP 수익화는 재정적 성공을 위한 핵심 요소로 남아 있습니다.

Get a good start for your app optimization with practical ASO guideline!

Want to get the latest Guides & Insights from ASOWorld?

관련 마케팅 가이드라인