Peak shopping windows — from the pre-Thanksgiving deal-hunt through Black Friday, Cyber Monday and the Christmas run-up — compress massive user intent into a few high-value weeks. Top shopping apps win not because they're lucky, but because they map creative assets, store experiences, paid windows and in-app events to clear seasonal intent.

This article distills key lessons from Q4 seasonal analysis into a concise growth blueprint for apps aiming to dominate holiday moments.

Search volume for terms like "Black Friday" and "gift ideas" ramps in October and builds through November; the strongest organic and paid returns come from starting ASO + ad campaigns weeks ahead and extending them into the days after the event. ASOWorld recommends metadata updates ~2 months before peak and launching ad windows 1–2 months prior.

IAEs boost visibility with time-sensitive placements directly targeting seasonal shoppers — yet adoption among top shopping apps was low in 2024 (only ~16% used IAEs at Thanksgiving, 14% at Christmas, 7% at New Year's). That gap creates a clear opportunity for apps that set up events tied to sale windows.

Top apps extended CPP runs beyond single-day deals (e.g., Best Buy's CPPs ran across Nov 17–Dec 1) and paired them with updated screenshots and localized messaging. Combining CPPs with supporting creative produced measurable lifts in downloads and ranks.

Preinstallation, bundling and carrier/device promotions can produce outsized install volumes (a pattern ASO World documents for other verticals — e.g., bundled Galaxy Store apps). Marketers should factor device activations and partner promos into forecast and campaign timing.

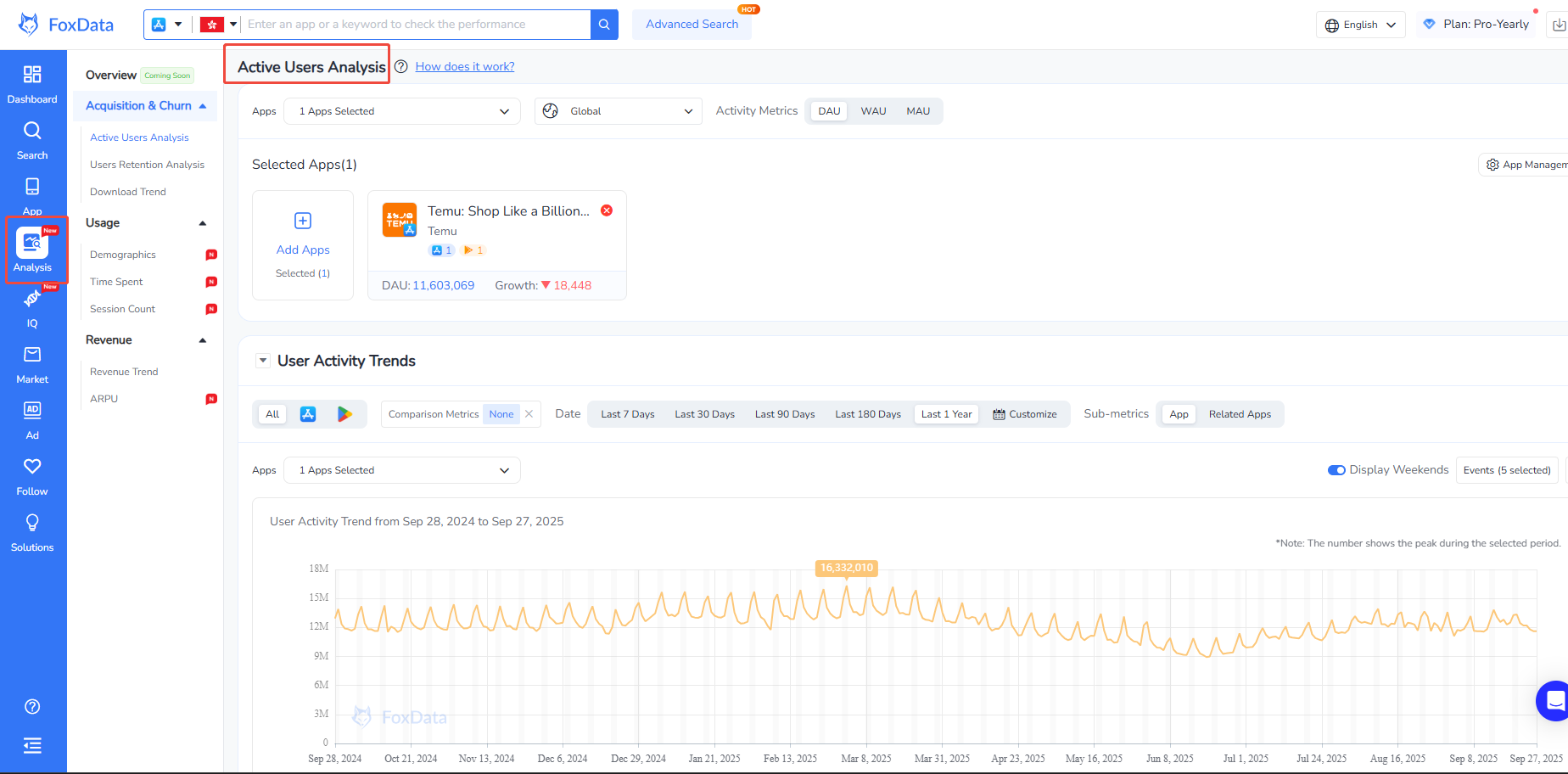

Use historical seasonality (your subcategory's spikes, not generic "shopping" averages) to pick launch dates. FoxData's Analysis helps identify exactly when your niche peaks.

Schedule IAEs to coincide with rising search trends; only a minority of competitors use IAEs, so early adoption can win visibility.

Create multiple CPPs targeted to buyer intents (e.g., "last-minute gifts," "electronics deals") and A/B test messaging.

Swap screenshots and feature copy to emphasize seasonal assets (gift guides, limited-time deals, fast shipping). Visuals showing gifts, holiday outfits, or "Black Friday" captions convert better than off-season imagery.

Start Apple Ads (or platform equivalents) 2–8 weeks before the peak and link campaigns to dedicated CPPs. Extend campaigns through the immediate post-event days when search interest remains elevated.

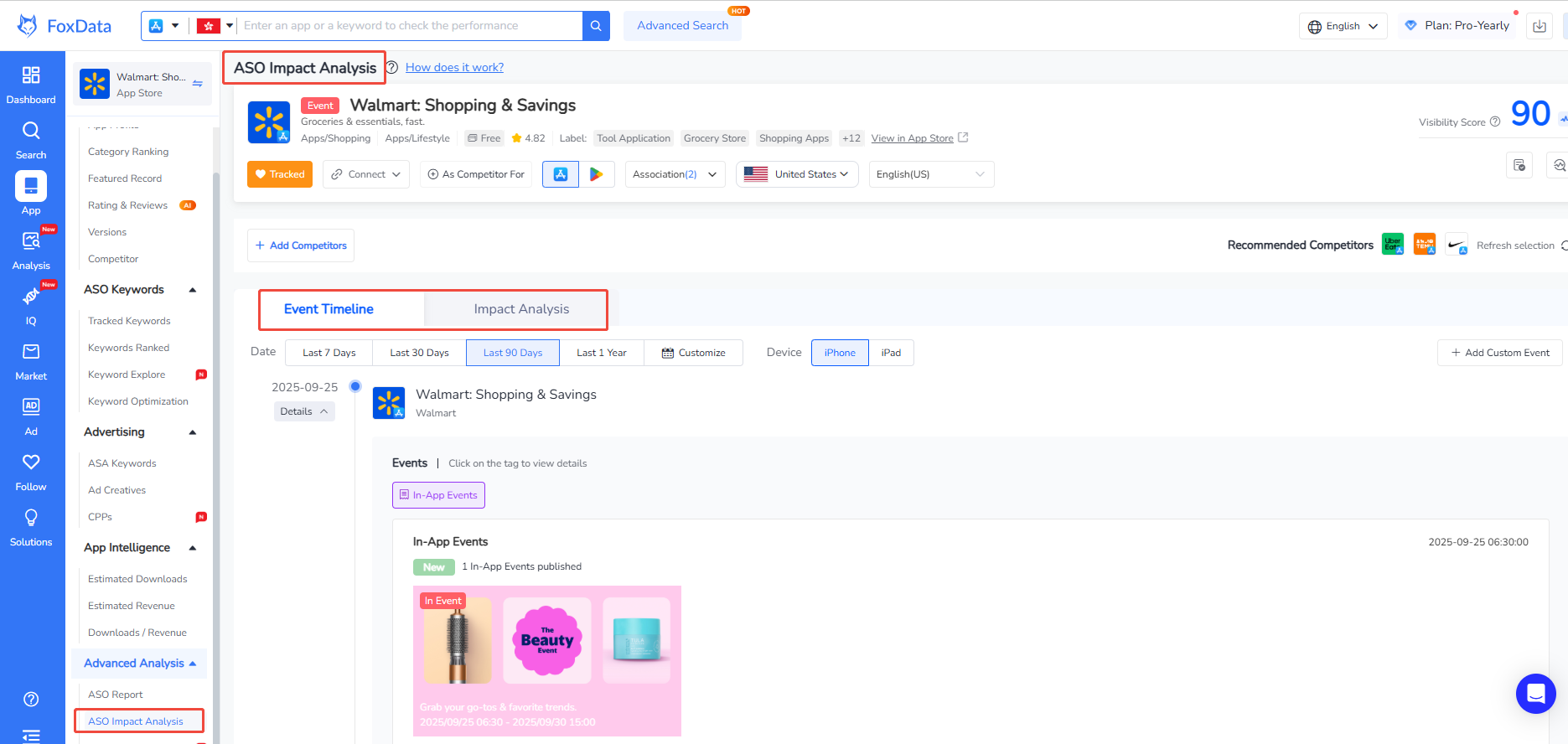

Pull competitor timelines, IAEs, CPP variants and winning creatives to shortcut your roadmap. FoxData's ASO Impact Analysis can reveal which variants actually won.

Apply for featuring early (festive seasons are slower for review & featuring).

Align in-app banners, emails, and external ads with CPP messaging for consistent conversion funnels.

Monitor reviews and crash/performance metrics closely — technical problems erode trust at the worst possible time.

Peak shopping weeks are not a sprint of guesswork; they reward advance planning, precise seasonal messaging, and tactical use of store features (IAEs, CPPs, creative refreshes). The most successful apps treated Q4 as a coordinated product + marketing moment: early metadata updates, extended ad windows, tailored CPPs, and synchronized in-app event calendars.

Follow this playbook, learn fast from competitor experiments, and you’ll convert the seasonal wave into sustained growth.

Get a good start for your app optimization with practical ASO guideline!

Want to get the latest Guides & Insights from ASOWorld?

Related posts