November 2025 saw continued momentum in the global app market, with overall downloads rising steadily, particularly for social networking and AI-driven productivity apps. In the U.S., however, the dynamics show some striking differences. Social apps like TikTok, Instagram, and ChatGPT captured the majority of user attention, while games and subscription services drove revenue.

By examining downloads, revenue, keyword trends, and user engagement, we aim to highlight where opportunities lie and which strategies can maximize ASO performance in the U.S. market.

While global downloads continued to grow, the U.S. market demonstrates a more nuanced pattern. Social and AI apps lead in adoption, showing strong iOS preference, while Android sees more distributed downloads across shopping and casual gaming apps.

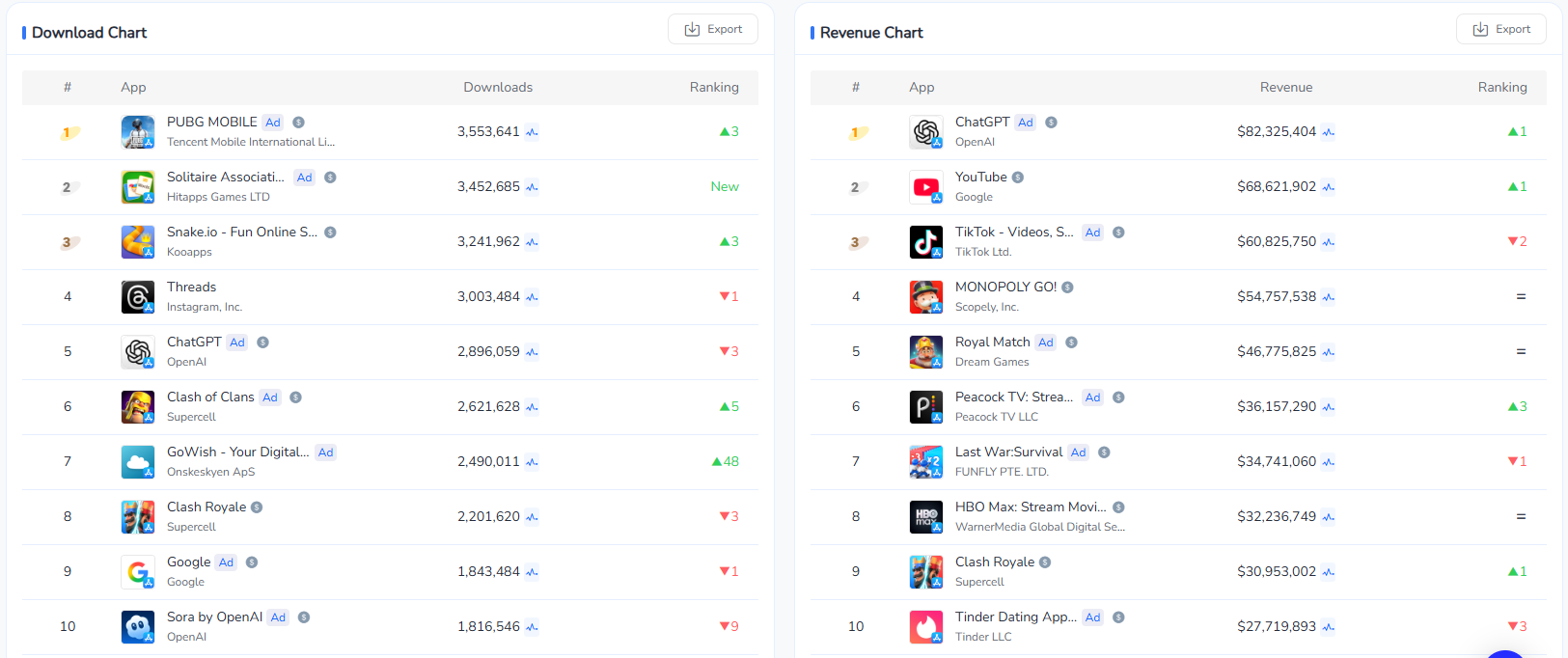

Revenue performance tells a complementary story: subscription-based services and IAP-driven games dominate monetization, with ChatGPT topping the iOS revenue chart at over $82M, far above Google Play equivalents.

Interestingly, casual games such as Solitaire and PUBG MOBILE, while strong download drivers, show that high engagement does not automatically translate to revenue. Meanwhile, subscription apps like Google One continue to provide predictable revenue streams, emphasizing the importance of balancing user acquisition with monetization strategy.

Expert Insight: U.S. users display strong interest in AI and social apps, making these categories key targets for growth campaigns and ASO optimization.

👉 Social Media App Marketing Solutions

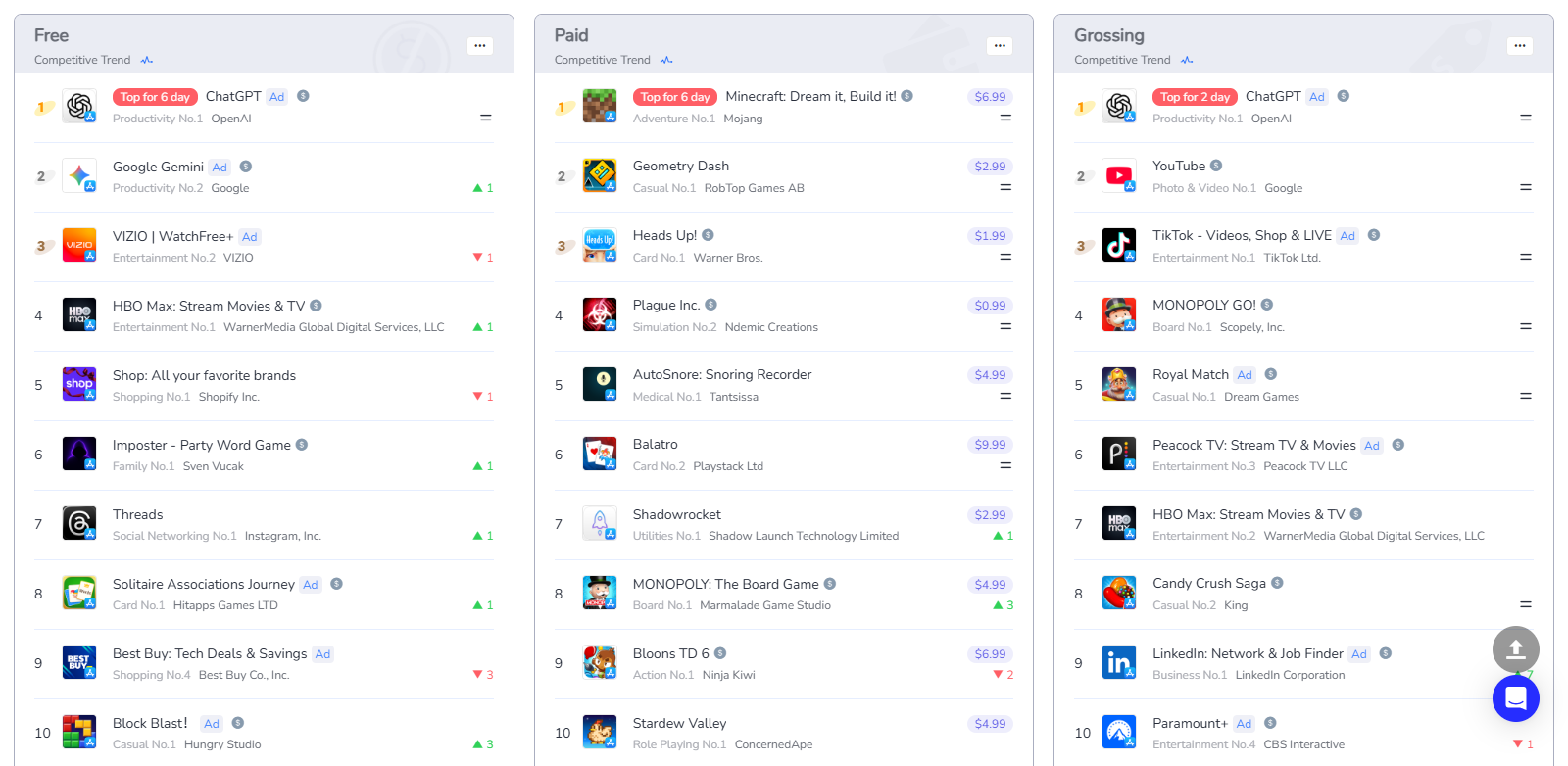

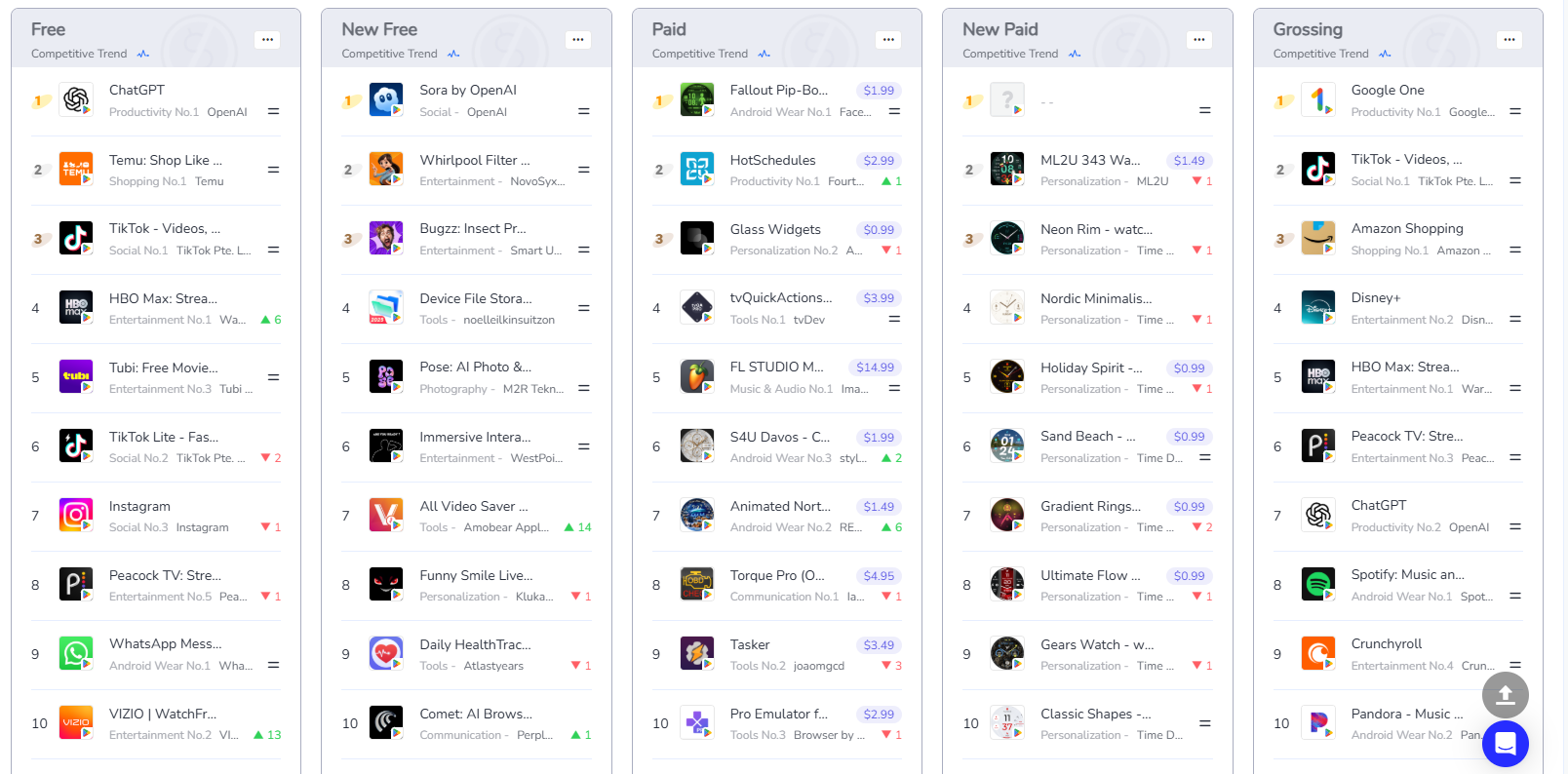

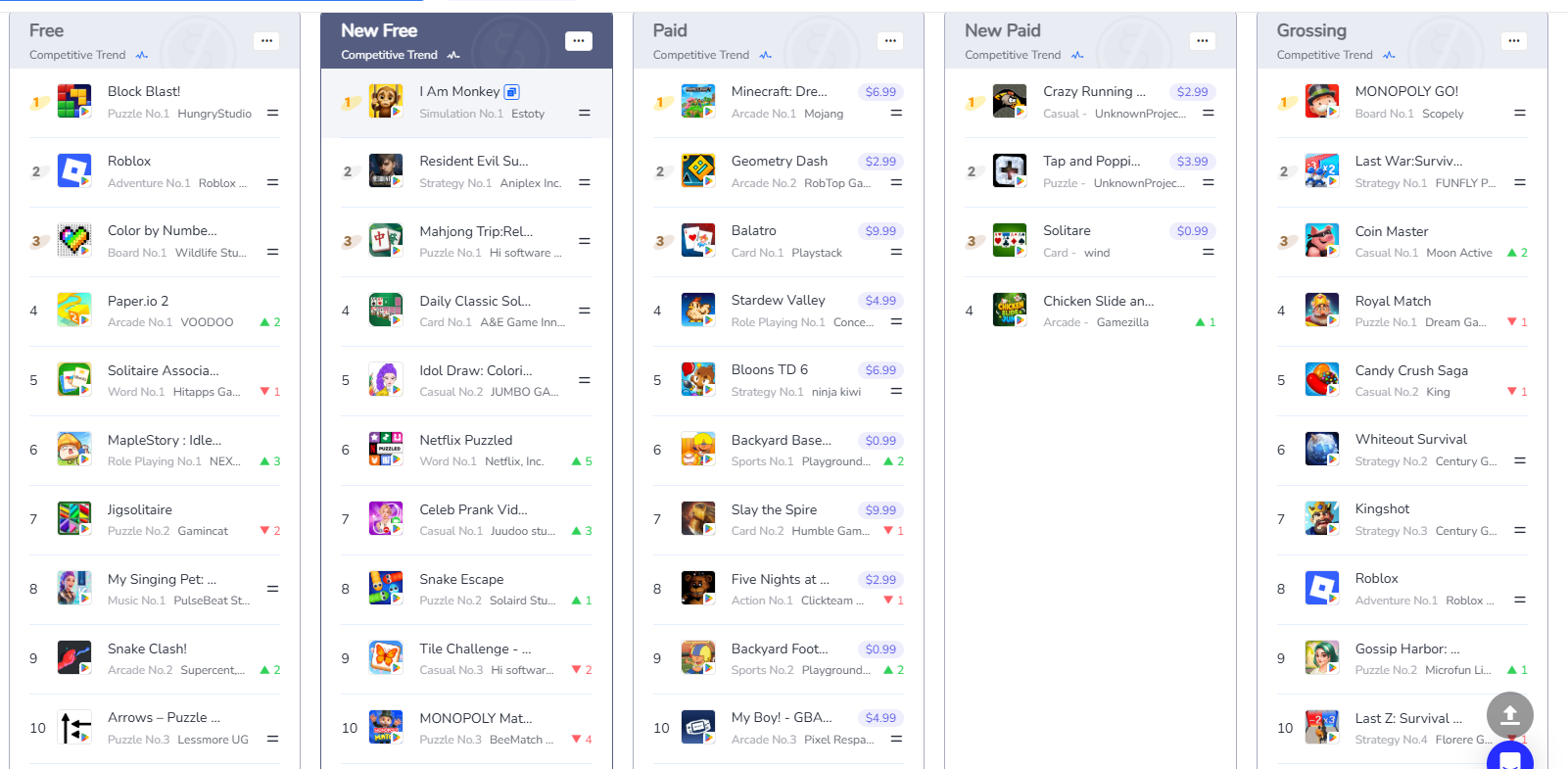

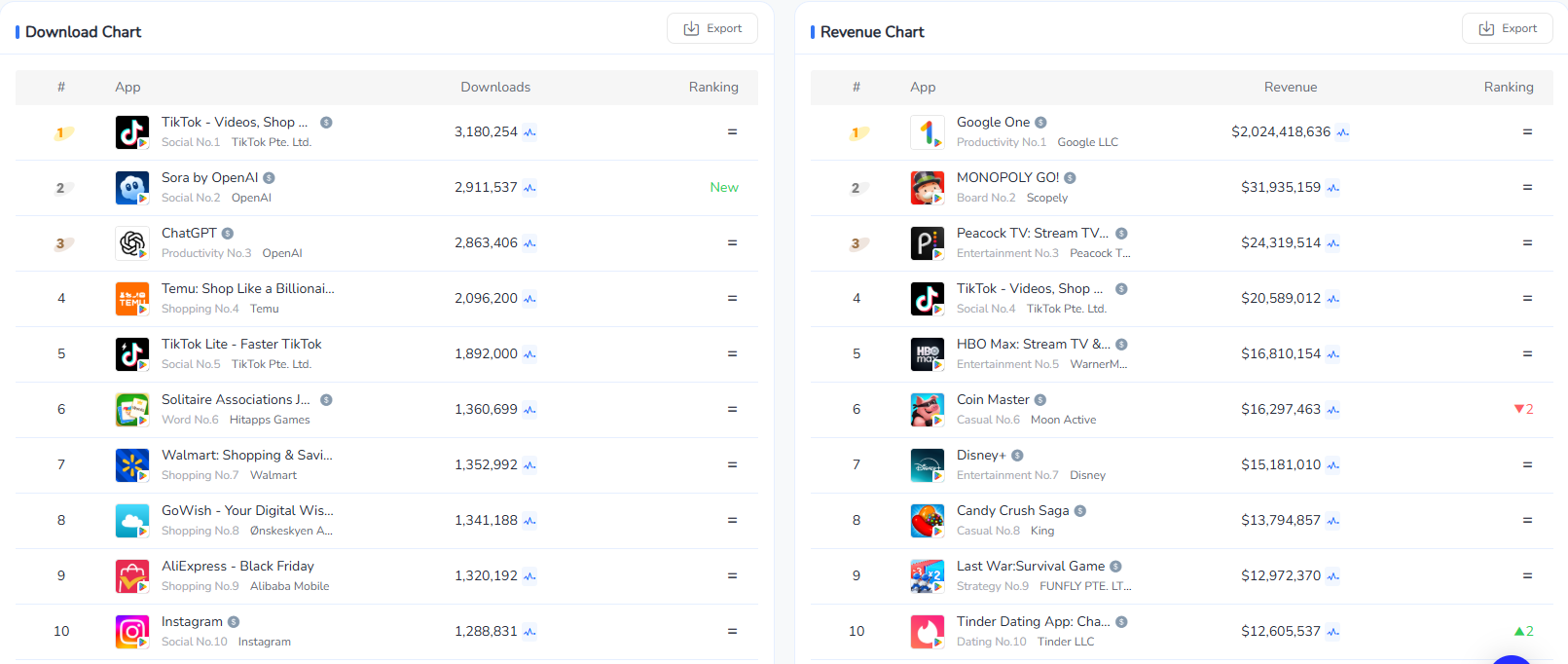

Analyzing the App Store and Google Play Top Charts reveals clear winners and shifting trends:

Free downloads were dominated by ChatGPT, Google Gemini, and social apps such as Threads and Instagram. Paid charts were led by iconic games like Minecraft and Geometry Dash, while grossing charts highlighted ChatGPT, YouTube, and TikTok, indicating strong revenue from subscriptions and IAP-driven models.

(Source from FoxData)

ChatGPT, Temu, TikTok, and TikTok Lite led free downloads, while new apps in the Free/Paid charts exhibited rapid short-term volatility. Grossing charts were stabilized by Google One and IAP-heavy games like MONOPOLY GO!, showing that recurring revenue models are critical.

Games maintain a strong presence, particularly in grossing charts, but social and AI apps are steadily climbing in both downloads and revenue, showing users’ willingness to engage and pay for innovative experiences. Utility and tool apps, while experiencing rapid turnover in visibility, can benefit from short-term ASO campaigns and feature positioning.

Takeaway: Developers should combine retention-focused chart strategies for top apps with aggressive ASO campaigns to seize mid-tier opportunities, as these can translate into meaningful downloads and monetization.

👉 How To Hack App Store & Google Play App Ranking Factors?

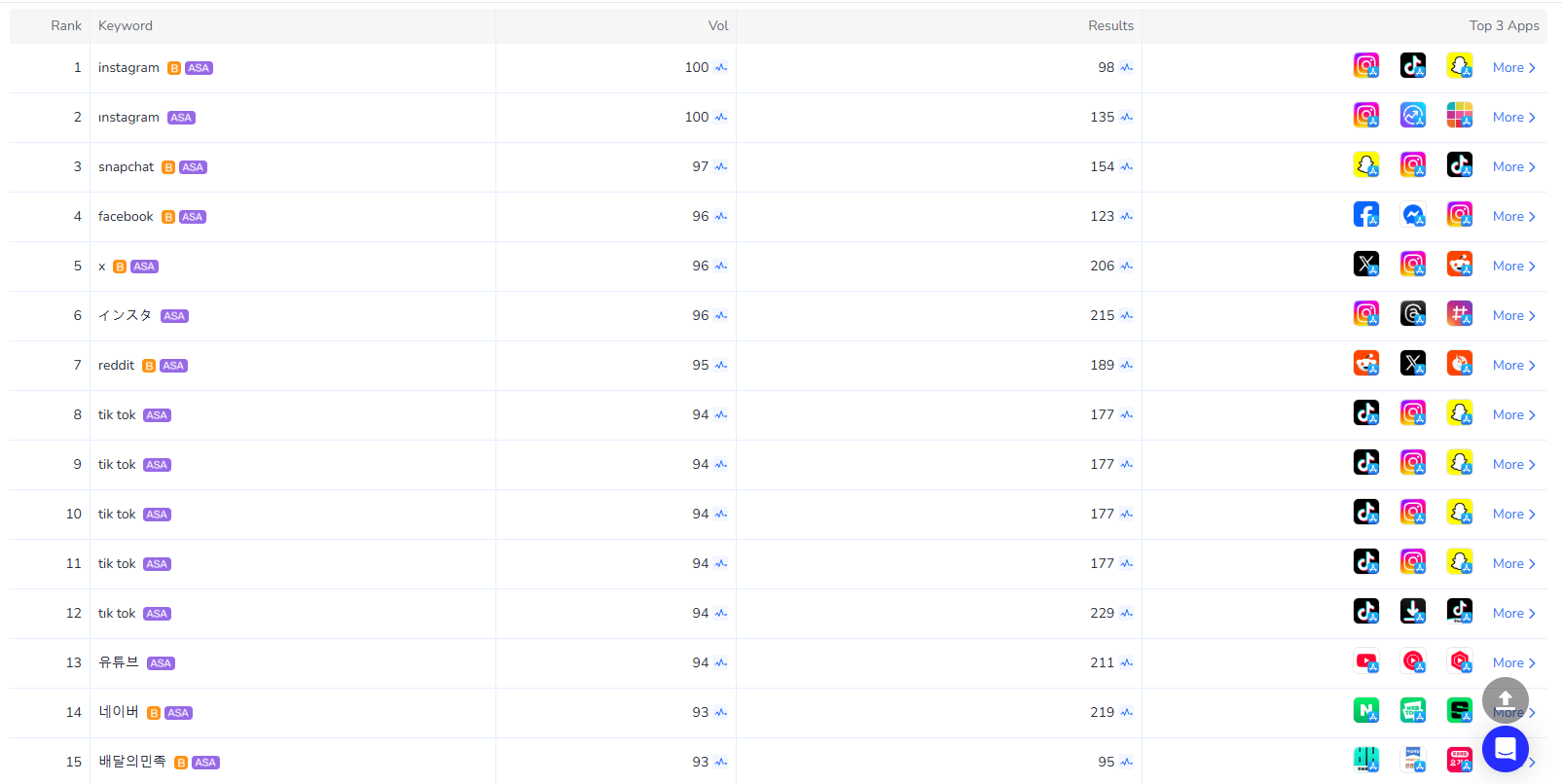

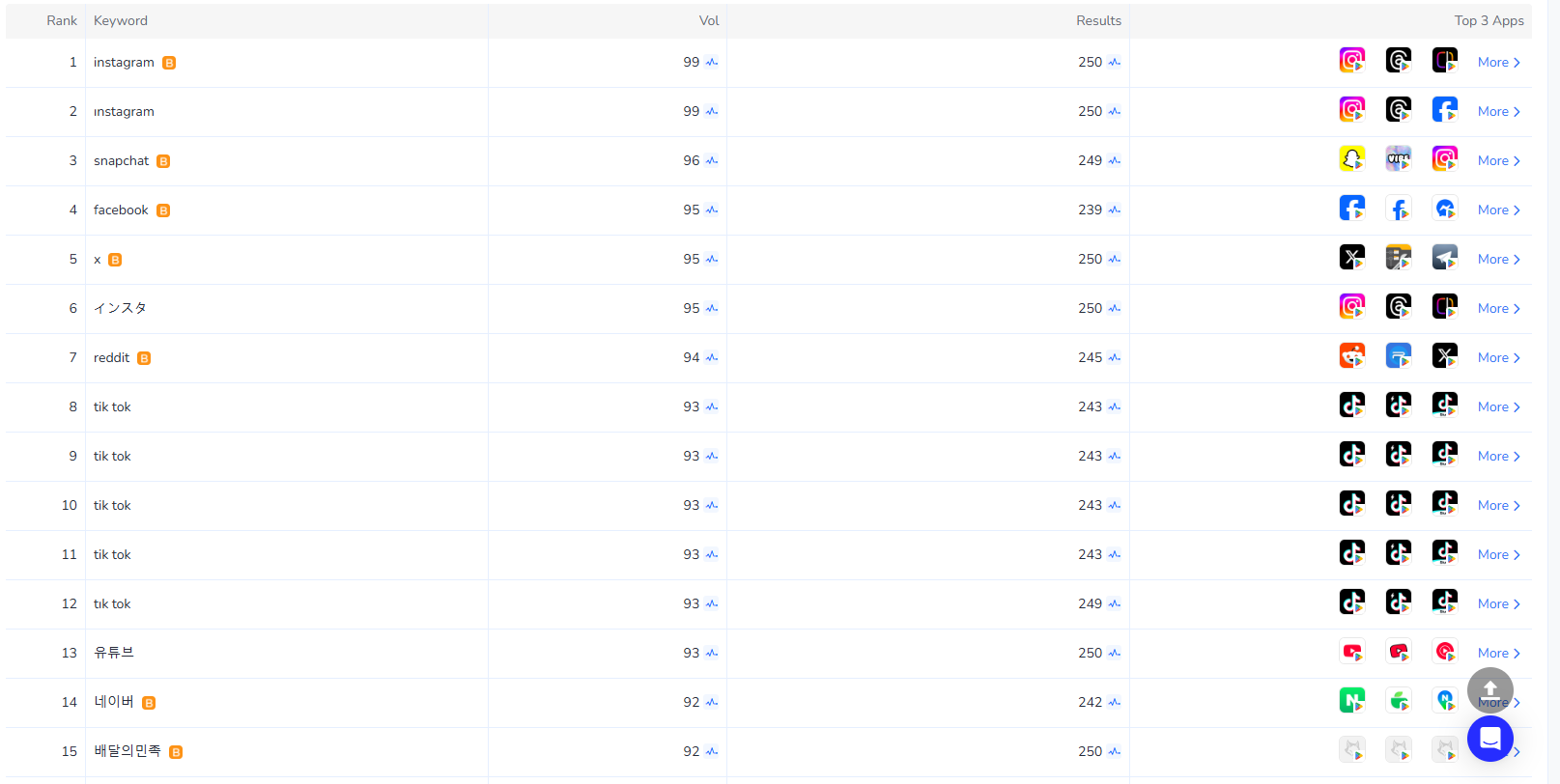

High-volume keywords reveal where user interest is concentrated:

Beyond visibility, keywords serve as a lens into user behavior. For instance, high search volume for social apps coupled with rapid churn in free app rankings suggests that users are exploratory but also selective, which makes optimizing conversion from search critical.

👉 How To Enlarge Your App Store Searching Traffic With Keyword Research & Keyword Optimization?

💡 Expert Tips: ASOWorld offers free keyword research tools that provide all the information you need about keywords, greatly assisting in your keyword research efforts.

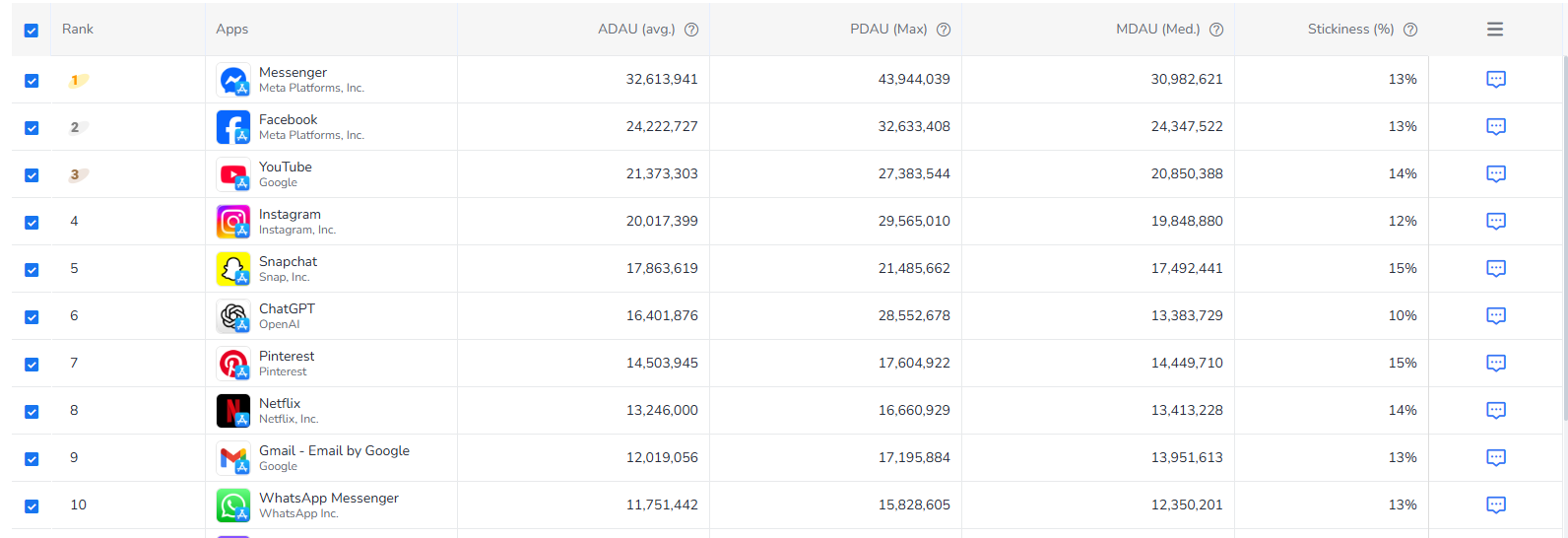

November data reveals that download volume, revenue, and active user trends do not always align:

TikTok, Temu, ChatGPT, and Solitaire apps drove the highest download counts. iOS adoption for AI and social apps is particularly strong, whereas Android downloads are more spread across shopping and casual games.

ChatGPT’s iOS revenue exceeded $93M, illustrating the monetization potential of AI-driven subscription apps. Games like MONOPOLY GO! and Royal Match dominate revenue charts on both platforms. Subscription apps such as Google One continue to provide predictable, high-margin income on Android.

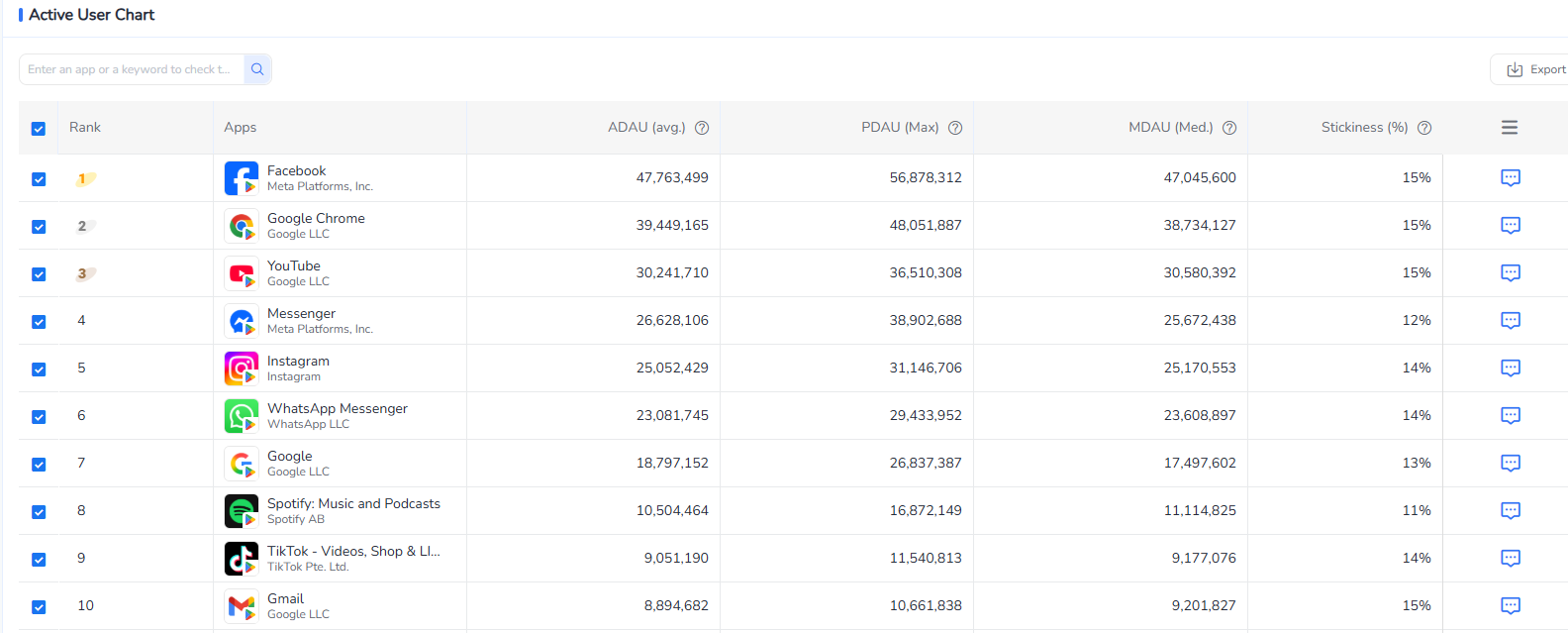

Facebook, Messenger, Instagram, and ChatGPT lead in daily active users (DAU), with stickiness rates between 10–15%. While engagement is strong, the numbers indicate opportunities to improve retention and long-term loyalty, especially in mid-tier apps.

Expert Insights: Downloads alone are insufficient to drive revenue. Developers must focus on converting high-interest users into paying subscribers or in-app purchasers, and maintain engagement through regular feature updates and content personalization.

You can achieve the same results 👉 To-Do List App Case Study: +50% App Stickiness by Improving User Experience

November 2025 underscores a two-tier opportunity landscape in the U.S.:

For app marketers and developers, the key strategies include:

Q1: Which app categories saw the highest growth in the U.S. in November 2025?

A: Social networking and AI-driven productivity apps led growth in the U.S., with iOS users showing particular interest in AI tools like ChatGPT. Casual games remained popular but generated less revenue.

Q2: How do top apps monetize in the U.S. market?

A: Subscription services and in-app purchases (IAPs) dominate revenue, while free downloads are driven mainly by social and AI apps. High download numbers don’t always guarantee high revenue.

Q3: What are the most effective keyword strategies for U.S. app stores?

A: Focusing on high-volume, long-tail, and localized keywords helps improve visibility in competitive categories. Monitoring keyword trends in social and AI apps is crucial for maximizing search conversions.

Q4: How can developers use ASO to improve app engagement and revenue?

A: By combining retention-focused chart strategies, targeted ASO campaigns, and optimized keyword placement, developers can convert downloads into active users and increase monetization potential.

By integrating downloads, keyword strategy, and user engagement insights, U.S. developers can more effectively navigate the competitive landscape. Social and AI apps continue to dominate downloads, while subscription and IAP monetization remain essential levers for financial success.

Get a good start for your app optimization with practical ASO guideline!

Want to get the latest Guides & Insights from ASOWorld?

Related posts