The Future of Sports Apps Marketing in 2026: What to Expect Next

Dream11 dominated fantasy-app downloads in 2024, driven by IPL viewership and the rise of live-score apps, reshaping engagement and revenue.

Dream11 — a fantasy cricket app tied to the Indian Premier League (IPL) — was the most-downloaded fantasy sports app globally in 2024, surpassing major US and European competitors as the IPL’s vast audience continues to drive app adoption and related services.

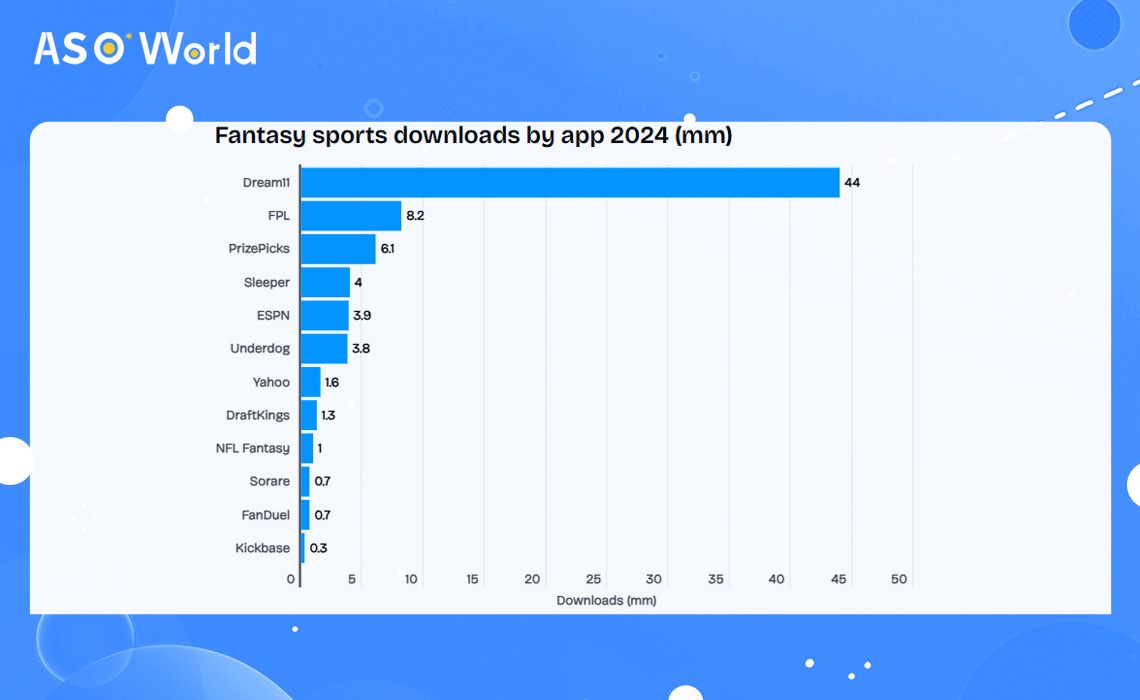

Dream11 achieved approximately 44 million installs in 2024, making it the most-downloaded fantasy sports app that year, outstripping the combined downloads of leading US fantasy apps. By contrast, the Fantasy Premier League (FPL), a favourite among UK football fans, and other prominent Western apps trailed significantly.

The IPL’s immense reach — reportedly exceeding one billion viewers across television and digital platforms in recent seasons — creates a passionate, cricket-focused user base that naturally translates into fantasy-app installs and engagement spikes during tournament periods. Fierce competition among broadcasters and platforms has further boosted the visibility and distribution of cricket-related apps.

While Dream11 led in downloads, high install numbers do not always equate to sustained usage.

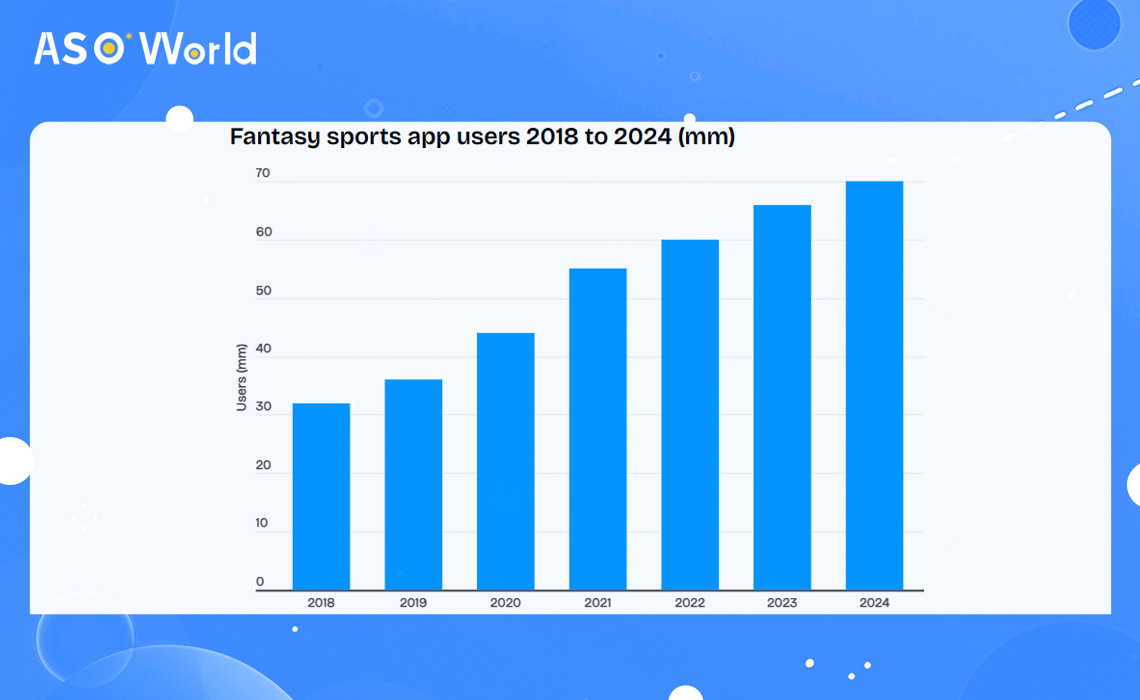

Industry data indicate around 70 million active fantasy-sports users in 2024, a modest increase from the previous year. Established Western apps, such as ESPN, Yahoo, and DraftKings, tend to maintain larger, more consistently engaged user bases.

The fantasy-sports app market generated approximately £1.8 billion in app revenue in the last reported year, with income derived from advertisements, personalisation, and peer-to-peer or group contests (platforms typically take a percentage of such contests).

Meanwhile, demand for real-time scores and news surged: approximately 450 million people accessed sports score and news apps in 2024, an increase of ~72 million year-on-year, benefiting live-score platforms like 365Scores, Flashscore, and Sofascore.

Monetisation strategies vary: while contests and entry fees can drive high average revenue per user (ARPU) for fantasy operators, advertising and data-driven personalisation remain key revenue streams, particularly for score/news apps and platforms combining live data, fantasy, and social features.

The IPL’s growth demonstrates how major sporting events combined with broadcast distribution create platform opportunities. As broadcasters and new streaming services compete for rights, consolidated distribution and promotional partnerships will continue to influence how users discover fantasy products.

However, regulatory changes, particularly around betting and paid contests, pose a significant risk to business models reliant on wager-like mechanics.

The 2024 data highlight a key point: global reach outweighs league familiarity. An event with the IPL’s scale can propel associated apps above established Western competitors in raw downloads — but downloads alone are not a complete measure of success. Sustainable value stems from consistent engagement, diversified monetisation, and regulatory adaptability.

Looking ahead, three trends are likely to shape the next 24 months:

Publishers and advertisers should view 2024 figures as both an opportunity and a caution: major tournament periods deliver scale, but long-term monetisation and retention require consistent product value, cross-platform distribution, and the ability to navigate evolving regulations.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.