The Future of Sports Apps Marketing in 2026: What to Expect Next

Middle East fintech industry set to triple by 2025, driven by investments, market diversity, and robust regional economic performance.

The Middle East and North Africa (MENA) region has become a hotbed for fintech innovation, with the sector poised for exponential growth in the coming years. According to McKinsey & Company, the industry, which stood at 1.5 billionin 2022,is expected to surge to a value between 3.5 billion and $4.5 billion by 2025, effectively tripling its size. This growth will elevate fintech's share in the overall financial services industry from 1% to approximately 2.5%.

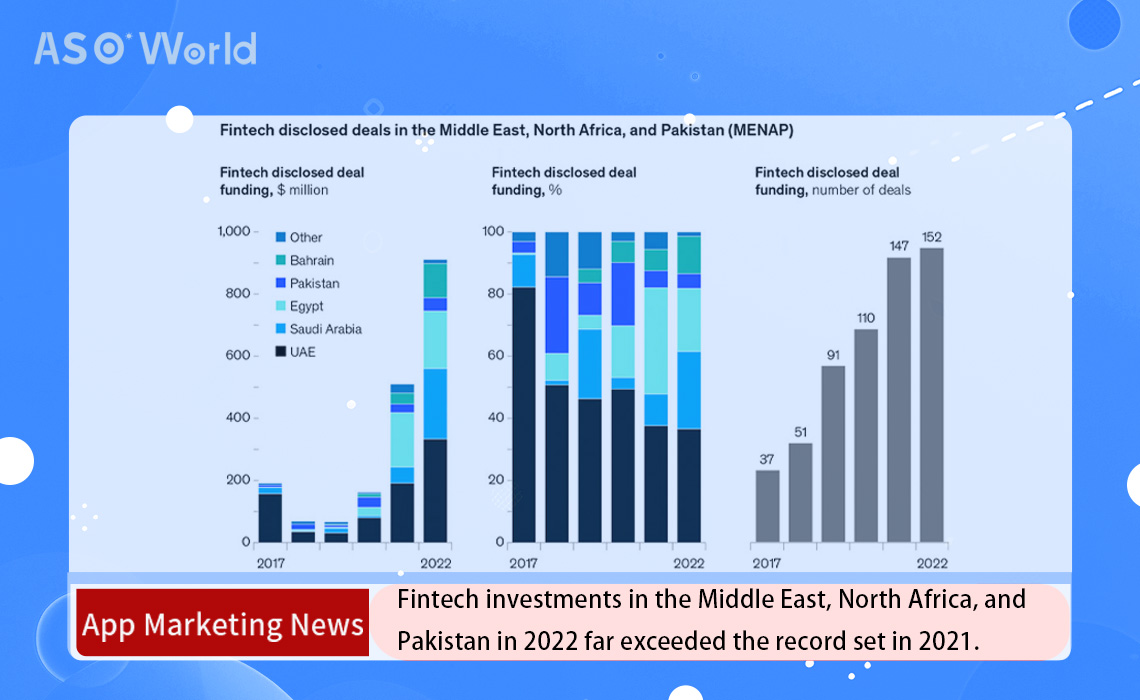

McKinsey's analysis encompassed the MENA region along with Pakistan, recognizing their close ties and referring to the combined area as MENAP. While the UAE was the primary hub for fintech in 2017, the sector has witnessed a significant influx of players from Bahrain, Egypt, Saudi Arabia, and Pakistan, indicating a region-wide surge in fintech activity.

Investor funding for fintech startups has skyrocketed, surpassing 885millionin2022, a substantial increase from approximately 200 million in 2020. Notably, the bulk of these investments has been directed towards companies in Saudi Arabia, Egypt, the UAE, and Bahrain, with an annual increase of around 36% from 2017 to 2022.

This surge in funding reflects a growing confidence in the region's fintech potential and its ability to transform daily transactions and wealth management.

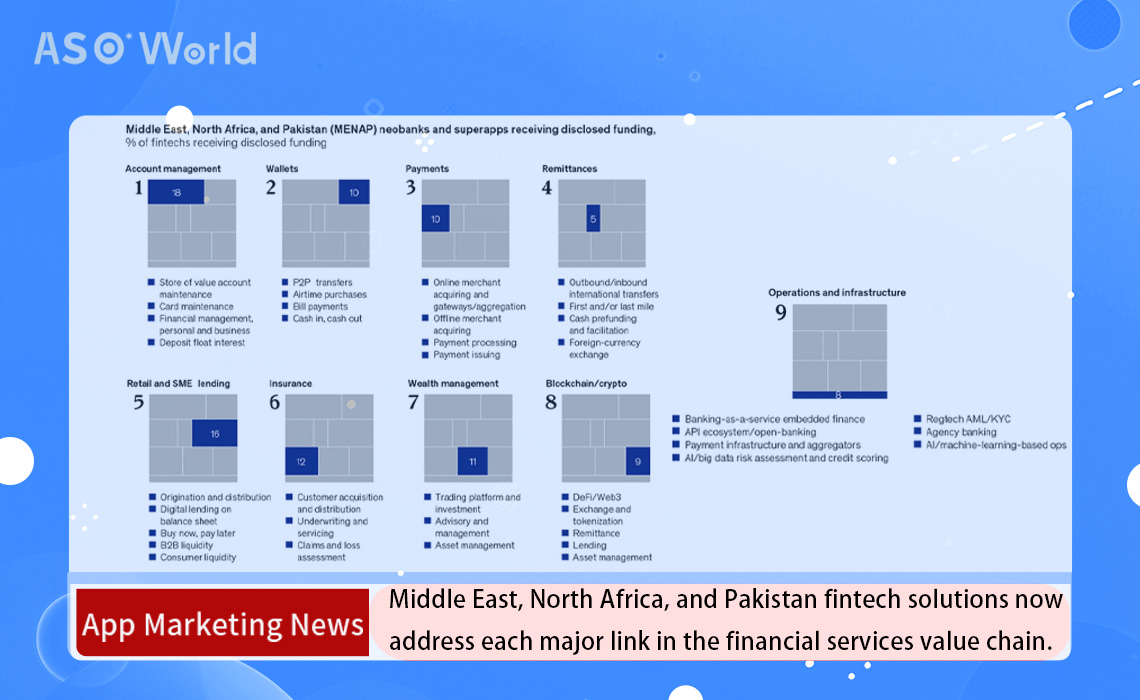

The influx of new fintech companies has led to a diversification of subcategories, catering to both end users and businesses with an array of services. While the past focus was on pragmatic offerings such as mobile wallets and payment apps, the latest entrants in MENAP provide a broad spectrum of services, including both B2C and B2B solutions.

Notable newcomers include Saudi Arabia's Tamara, a buy-now-pay-later service, and Emirati working capital tool Lnddo. Additionally, digital investment platforms like Sarwa in the UAE and Thndr in Egypt have further enriched the fintech ecosystem.

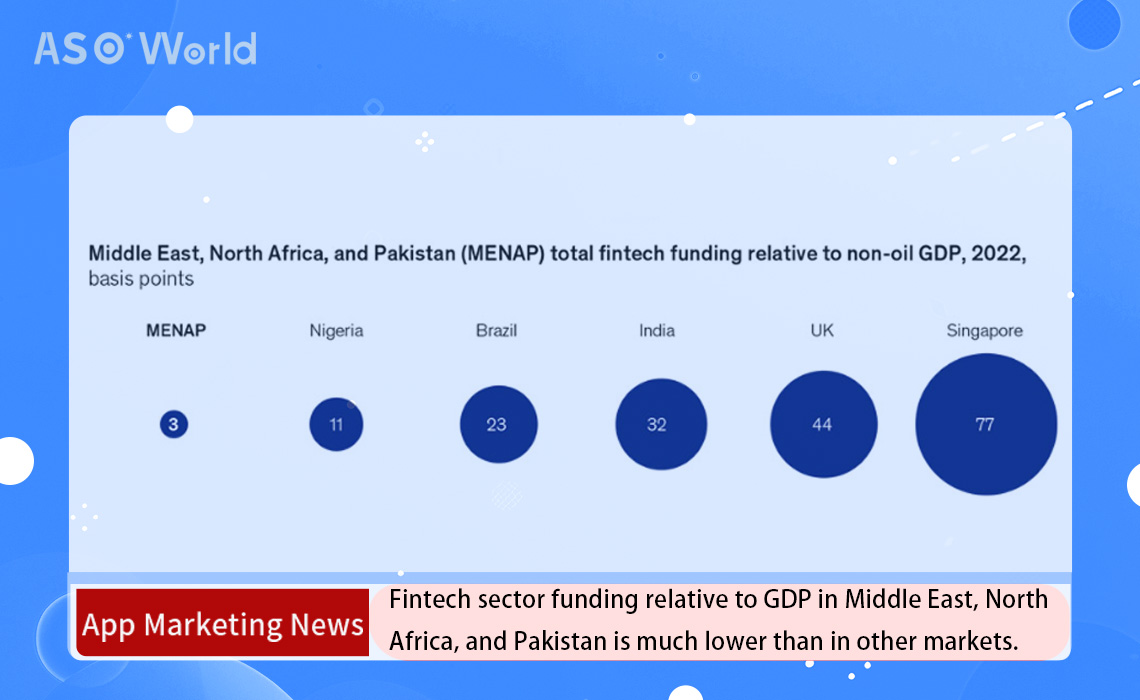

The MENAP region's strong economic performance, driven by high commodity prices and diversification efforts in oil-rich nations, sets the stage for continued fintech expansion. With projected year-on-year growth of 2% to 5%, the region outpaces Europe, which is expected to see a mere 1% growth.

The report underscores the substantial room for further growth, as the fintech sector in MENAP continues to evolve, mature, and attract significant funding.

👉 Growth opportunities for Fintech Apps

Banking has emerged as a robust sector in certain Middle Eastern countries, particularly the UAE, as these nations seek to diversify their economies away from oil.

Ambitious pledges to reach net zero and phase out oil in the Gulf Cooperation Council (GCC) countries highlight a commitment to economic transformation, potentially driving further fintech innovation and investment.

In conclusion, the MENAP region is poised to become a fintech powerhouse, with ample room for growth and innovation. The sector's rapid evolution, coupled with the region's strong economic performance, sets the stage for a transformative period in financial technology, positioning MENAP as a key player in the global fintech landscape.

Click "Learn More" to drive your apps & games business with the ASO World app promotion service now.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.