Google has updated Play Store policies in the EEA to comply with the Digital Markets Act, introducing new fee structures for developers and external transactions amid antitrust scrutiny.

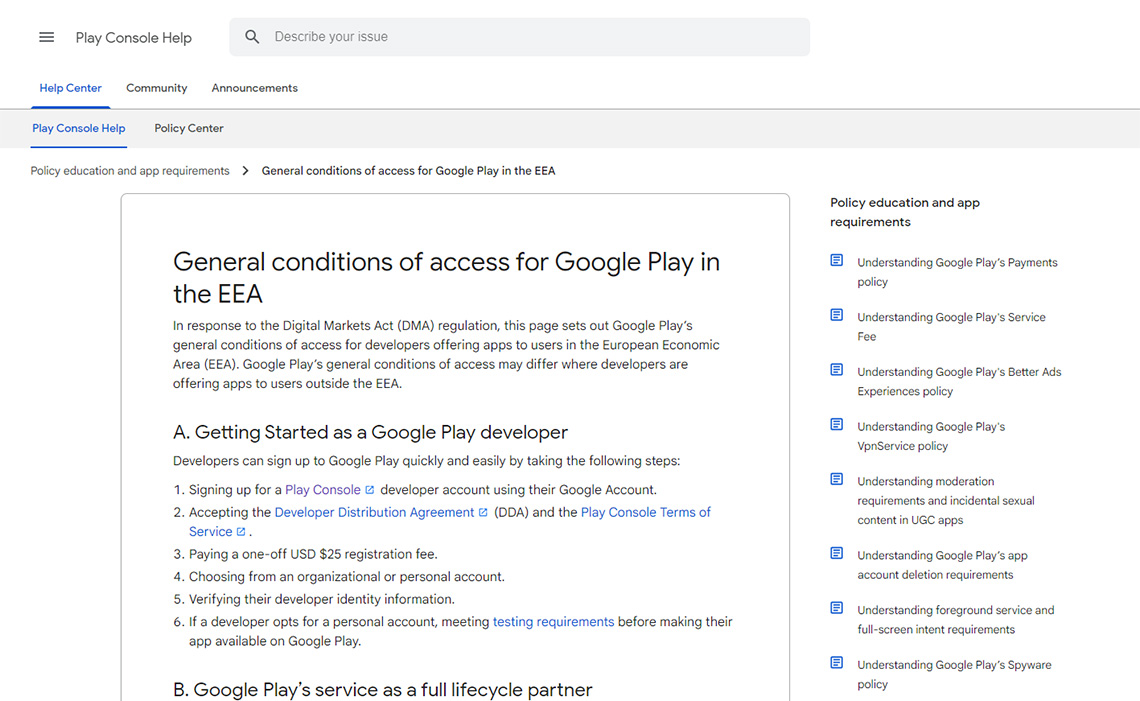

In a move to address ongoing regulatory scrutiny from the European Union, Google has announced revisions to its Google Play Store terms.

These changes, effective in the European Economic Area, aim to comply with the Digital Markets Act by offering developers more options for payments and external transactions whilst ensuring user safety.

The Digital Markets Act, enforced since March 2024, targets major tech firms like Google to promote fair competition.

It designates such companies as gatekeepers and requires them to avoid favouring their own services, allow alternative payment systems, and permit developers to direct users to external offers without barriers.

In March 2025, the European Commission issued preliminary findings against Google for breaching these rules.

The accusations centred on restrictions that prevented app developers from directing users to cheaper alternatives outside the Play Store and imposing unfair fees on external transactions.

Google faces potential fines of up to 10% of its global revenue if found non-compliant, building on past EU antitrust penalties exceeding €8 billion.

On 19 August 2025, Google updated its Play Store conditions for developers in the EEA, which includes the EU, Iceland, Liechtenstein, and Norway.

The revisions stem from discussions with the European Commission, developers, and experts, balancing flexibility with concerns about user exposure to harmful content.

Developers can now choose Google’s billing, alternative systems, or a combination.

Options include User Choice Billing, where users select between Google or alternatives with a 4% fee reduction, and the EEA Programme for alternative-only billing with a 3% reduction.

Transactions must be reported, and user experience rules apply to prevent misleading or unsafe practices.

The External Offers Programme allows easier promotion of external deals and in-app links to external purchases.

Developers must alert users to potential security risks when leaving the app.

Google introduced a new fee model for external transactions:

Initial Acquisition Fee: 5% for auto-renewing subscriptions and 10% for other in-app offers, limited to two years.

Ongoing Services Fee: 7% for subscriptions and 17% for other offers; opt-out possible after two years with user approval.

These adjustments build on standard service fees of 15–30%, with reductions for alternatives. Compared to previous structures, the updates lower some initial fees and add opt-out flexibility.

| Fee Type | Pre-Update (General) | Post-Update (EEA External Offers) |

|---|---|---|

| Standard Service Fee | 15% (first £800,000 revenue) or 30% | Unchanged, but adjustable for alternatives (3–4% reduction) |

| Initial Acquisition Fee | Not specified (part of service fee) | 5% (subscriptions), 10% (other offers) – capped at 2 years |

| Ongoing Services Fee | Not applicable | 7% (subscriptions), 17% (other offers); opt-out after 2 years |

| Subscriptions | 15% | Lowered in external contexts |

Developers gain greater freedom to avoid full reliance on Google’s fees, potentially increasing direct earnings, particularly for smaller firms through lower costs and opt-outs.

However, compliance requirements such as reporting and warnings add complexity, and ongoing fees may still favour Google’s ecosystem.

Users in the EEA could benefit from promotions of cheaper external options, leading to savings, but face risks such as malware from unverified sites, which might affect app experiences.

On a broader scale, these changes support DMA goals of increased competition in app distribution.

They may influence policies in other regions like the UK or US, helping Google avoid fines whilst protecting Play Store revenue.

The timeline includes DMA enactment in 2023–2024, March 2025 charges, and the August 2025 updates, with ongoing EU reviews.

This adjustment by Google mirrors patterns seen in Big Tech’s responses to global regulations, similar to Apple’s changes under the DMA.

Whilst the updates provide incremental relief for developers, critics argue the fees remain high, potentially stifling genuine competition.

Past cases, such as Google’s earlier EU fines, suggest enforcement will intensify.

Looking ahead, if the Commission deems these changes insufficient, further revisions or penalties could follow by late 2025, possibly inspiring similar reforms worldwide amid rising antitrust actions.

The updates respond to EU pressure under the Digital Markets Act, addressing accusations of restricting developer options and imposing unfair fees, as discussed in tech forums on X where users note regulatory impacts on app ecosystems.

Who do these policy changes apply to?

What are the new fees for external transactions?

How do the changes benefit developers?

What risks do users face with these updates?

Will these changes expand beyond the EEA?

How does this compare to Apple’s DMA responses?

What happens if Google doesn’t fully comply?

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.