2024 Game Industry Insights: Can AI "Make Games Great Again"?

A comprehensive analysis of the 2025 global esports landscape — covering market growth, audience trends, regional developments, and emerging opportunities shaping the industry’s next phase.

By 2025, esports has blossomed from a quirky pastime into a multi-billion-dollar worldwide enterprise, forging bonds between gamers, enthusiasts, and corporations the globe over.

Whether it's heaving stadiums in Seoul and Riyadh or smartphone showdowns drawing millions in South-East Asia, esports is fundamentally altering the face of international sporting traditions.

Drawing on insights into market scale, viewer profiles, territorial shifts, and fresh prospects, this analysis reveals esports as far more than mere amusement—it's a burgeoning virtual economy propelled by camaraderie and ingenuity.

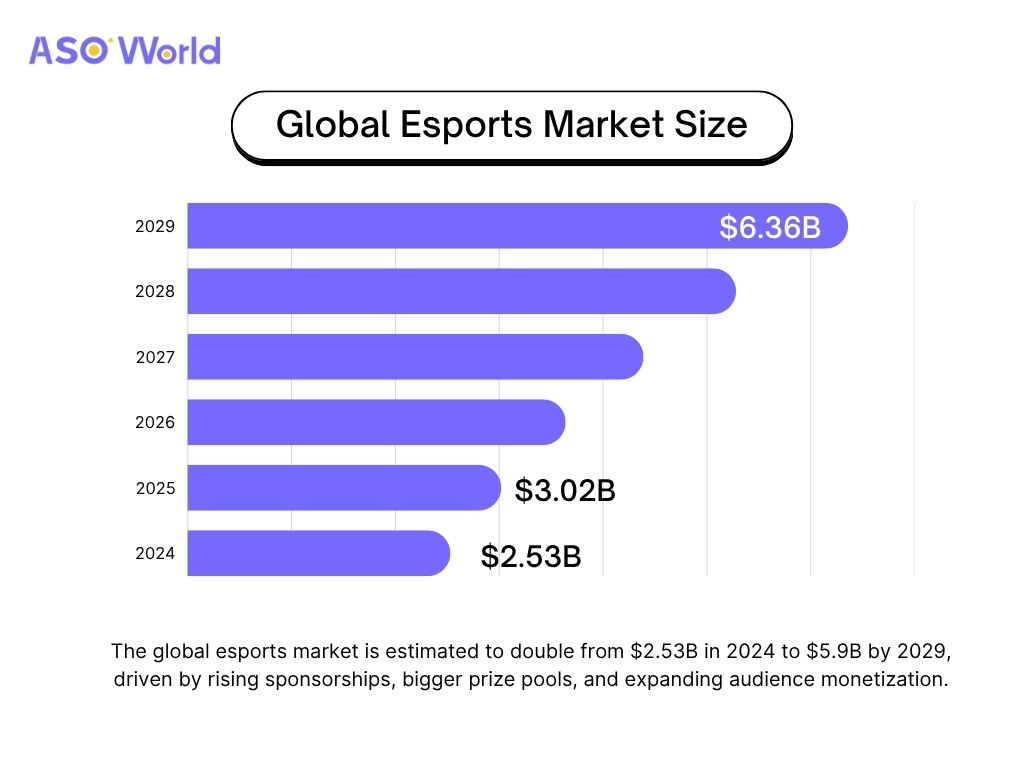

The worldwide esports sector presses on with its remarkable surge. Come 2025, its value hovers at approximately $3.0 billion, a leap from the $2.53 billion of 2024—a testament to a sturdy compound annual growth rate (CAGR) of almost 19%.

(Global Esports Market Size 2024-2029 | Source: The Business Research Company)

Such brisk momentum signals the sector's shift from specialised rivalries to everyday spectacle, sparked by heightened public curiosity, booming live-stream interactions, and the persistent escalation of worldwide contest rewards.

(Global Esports Market Revenue Segmentation 2025 | Source: Esport Stats)

Endorsements and broadcasting privileges hold firm as the chief earners, making up about 40% of overall earnings.

At the same time, entry fees and online wares have climbed steadily, as supporters flock back to in-person gatherings and embrace novel income streams.

This swift broadening also mirrors a worldwide fusion of play, media, and commercial networks—with developers, networks, and promoters now regarding esports as integral to their online agendas.

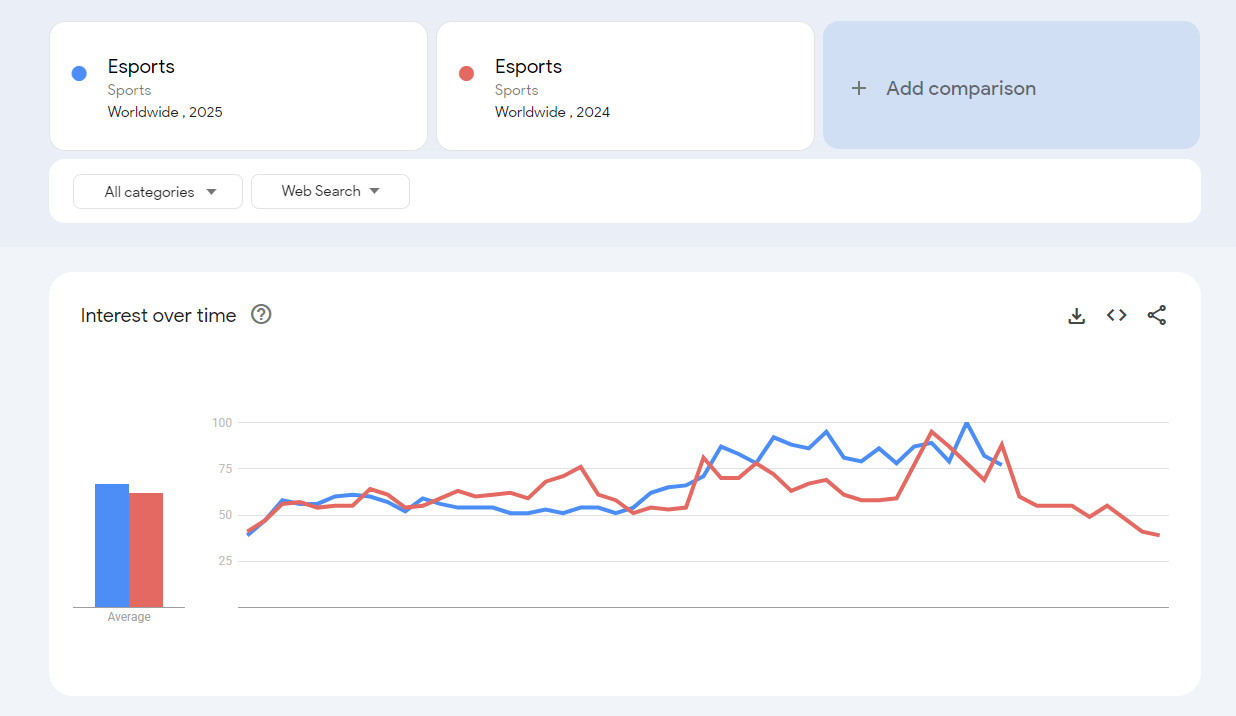

Google Trends data indicates a marked uptick in worldwide curiosity for "esports" in 2025 over 2024. The mean global search metric hit 67 by 28 October, climbing from 62 the previous year—a sign of mounting popular intrigue and enduring involvement in prime territories.

(Global Search Trends of Esports Topic 2025 vs 2024 | Source: Google Trends)

Peaks in both years fell in October, syncing neatly with the League of Legends World Championship, which points to blockbuster global clashes as the prime catalyst for esports' online prominence.

This rising pattern emphasises the ongoing stretch of esports' online presence, where heightened queries signal not just swelling crowds but deeper ties from press and sponsors within the network.

On a regional level, Asia-Pacific holds sway in both follower numbers and takings, spearheaded by China, South Korea, and Japan, as North America and Europe wield considerable structural and trading clout.

The Middle East and South Asia are carving out as fresh expansion zones, boosted by public funding and grand spectacles like the Esports World Cup in Riyadh.

Set against this international canvas, local scenes chart distinct trajectories of advance—each moulded by native customs, funding focuses, and supporter involvement.

North America's esports arena stands as one of the ripest for commerce, powered by solid backings, university initiatives, and ties to established sports channels.

Licensed circuits like the Call of Duty League and Valorant Champions Tour Americas keep pulling in big names such as Red Bull, Mastercard, and Intel.

That said, turning a profit lingers as a hurdle, prompting squads to pivot to varied earning paths—such as goods sales, media making, and occasion staging.

Europe's esports domain flourishes through steadiness and legacy. Nations including Germany, France, and Sweden serve as pivotal centres for fixtures and groups, whereas Eastern Europe nurtures fervent followings for Dota 2 and CS2.

The area's forte rests in its setup—local networks, fixture planners, and press reach—yet climbing running expenses and policy wrangles keep moulding the terrain.

China persists as the planet's biggest esports domain by followers and returns, with home-grown sites like Bilibili and Huya stoking live and bite-sized fare.

South Korea endures as the emblematic core of esports expertise, above all in League of Legends and StarCraft, while Japan has swiftly warmed to contest gaming after rule tweaks, with brisk rises in brawler titles and console clashes.

In unison, these domains etch the tech and societal nucleus of worldwide esports.

South-East Asia claims the swiftest esports boom in 2025. Handset-centric setups rule supreme, with Mobile Legends: Bang Bang and PUBG Mobile heading vast country-wide leagues in Indonesia, the Philippines, and Malaysia.

Budget-friendly mobiles, tailored clashes, and robust social network buzz render SEA a testing bed for handset esports earnings and supporter circle creativity.

India has surged as a vibrant hotspot since BGMI's comeback and greater official nod of esports as a proper athletic pursuit.

The nation's sprightly populace, spreading 5G webs, and buzzing maker community have cast it as a worldwide cradle for handset and community-rooted clashes. Home backers and phone firms are pouring funds into fixture planning and broadcast claims.

The Middle East has swiftly morphed into a worldwide esports titan, chiefly via government-stoked funding and colossal occasions like the Esports World Cup in Riyadh.

Saudi Arabia, the UAE, and Qatar are ploughing into bespoke esports venues, drill spots, and developer alliances.

The area's forward-thinking blueprint—casting play as a vital strut of economic variety—has recast it as one of the boldest esports domains on earth.

(2025 LoL World Championship in Beijing, Shanghai and Chengdu | Source: LoL Esports)

Drawing from Tencent's Global Esports Industry Development Report (issued June 2025), which placed urban centres by clash audiences, facilities, guidelines, and societal sway, Shanghai, Los Angeles, and Seoul surfaced as the planet's leading trio of esports locales.

They notched 90.1, 87.2, and 85.7 apiece, underscoring an enlarging split between seasoned and budding esports cores—not in zeal, but in network wholeness and trading viability.

| Rank | City | Country | Index Score |

|---|---|---|---|

| 1 | Shanghai | China | 90.1 |

| 2 | Los Angeles | United States | 87.2 |

| 3 | Seoul | South Korea | 85.7 |

| 4 | Beijing | China | 82.4 |

| 5 | Riyadh | Saudi Arabia | 82.1 |

| 6 | São Paulo | Brazil | 78.7 |

| 7 | Singapore | Singapore | 78.0 |

| 8 | Shenzhen | China | 77.9 |

| 9 | Chengdu | China | 76.3 |

| 10 | Manila | Philippines | 76.2 |

The figures lay bare stark regional variances in appetite and network ripeness:

Asian powerhouses—encompassing Shanghai, Seoul, and Beijing—spearhead in setups, skill pools, and grand fixture hosting, whereas Western bastions like Los Angeles shine in media crafting, leisure blending, and worldwide sponsor ties.

It's worth noting that up-and-coming spots such as Riyadh, Singapore, and Manila are swiftly closing the gap via rule backing, capital, and vibrant age groups.

This evolving panorama implies that esports' command posts ahead will stem not solely from storied giants, but from ascending urban spots wedding shrewd policy, digital flair, and societal drive.

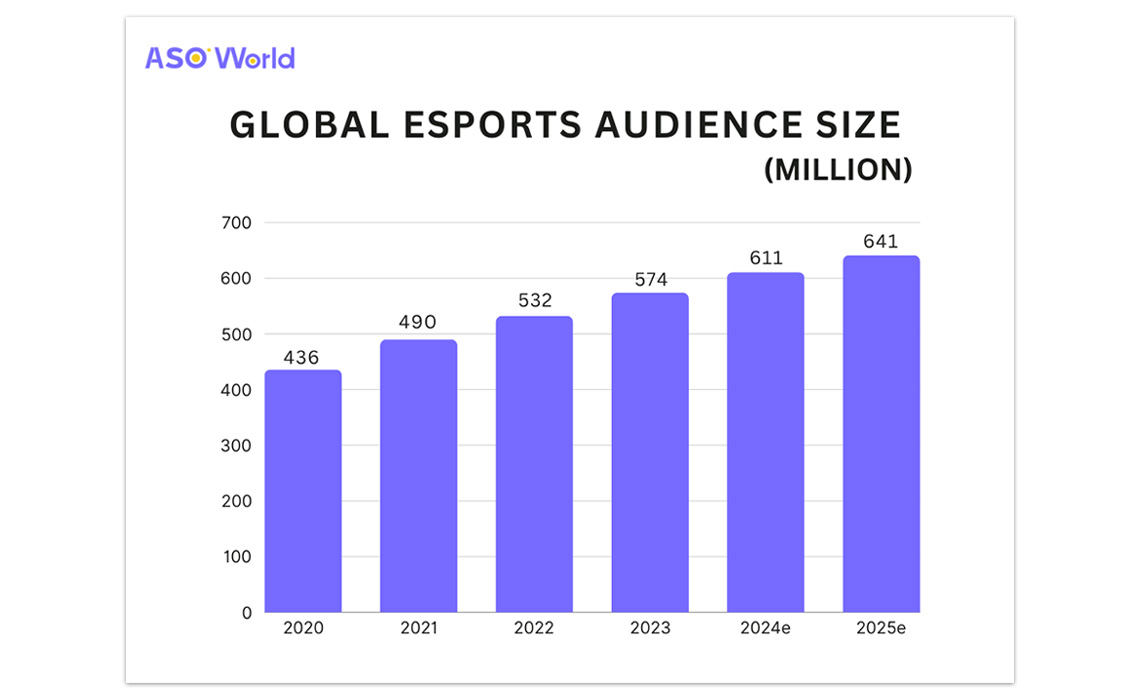

(Global Esports Audience Size 2020-2025 | Source: ASO World)

The worldwide esports following is projected to touch roughly 641 million watchers in 2025, encompassing some 320 million devoted adherents who track clashes routinely.

This marks a reliable yearly rise of 7–8%, chiefly urged by handset ease, broadcast sites, and broadening neighbourhood leagues in budding zones.

As planetary web backbones advance and 5G grids widen, follower upticks in Africa, Latin America, and South Asia ought to quicken, folding in scores of millions of fresh devotees by 2026.

Asia-Pacific stays the hotbed of esports spectatorship, claiming over 55% of planetary followers.

China and South Korea press on leading in broadcast span, while South-East Asia and India flaunt the briskest year-over-year follower swells—particularly in handset fare like Mobile Legends: Bang Bang and BGMI.

By contrast, North America and Europe uphold lofty involvement ratios per watcher, with firm overlaps betwixt esports and classic sports crowds.

Profile-wise, esports clings to a youthful, web-born collective. Almost 65% of watchers fall between 18 and 34, with Gen Z backers displaying the keenest brand devotion and social web buzz.

Gender mix is advancing too: women now form about 25–30% of the planetary crowd, with loftier join-in rates in handset and laid-back contest modes.

Site by site, Twitch and YouTube Gaming grip Western realms, while Bilibili, Huya, and DouYu helm in China.

Bite-sized clip apps like TikTok and Instagram Reels are turning pivotal for unearthing snippets, squad fare, and gamer tales—hinting that esports uptake is veering from drawn-out airs to a nonstop, social-led media loop.

In 2025, the contest gaming field lingers ruled by a blend of enduring PC behemoths and briskly swelling handset offerings.

Though veteran titles keep hauling vast crowds, the sector's fulcrum is unmistakably tilting towards handiness, multi-device frolic, and local variety.

(Top Esports Games in 2025 by Viewership | Source: Esports Charts)

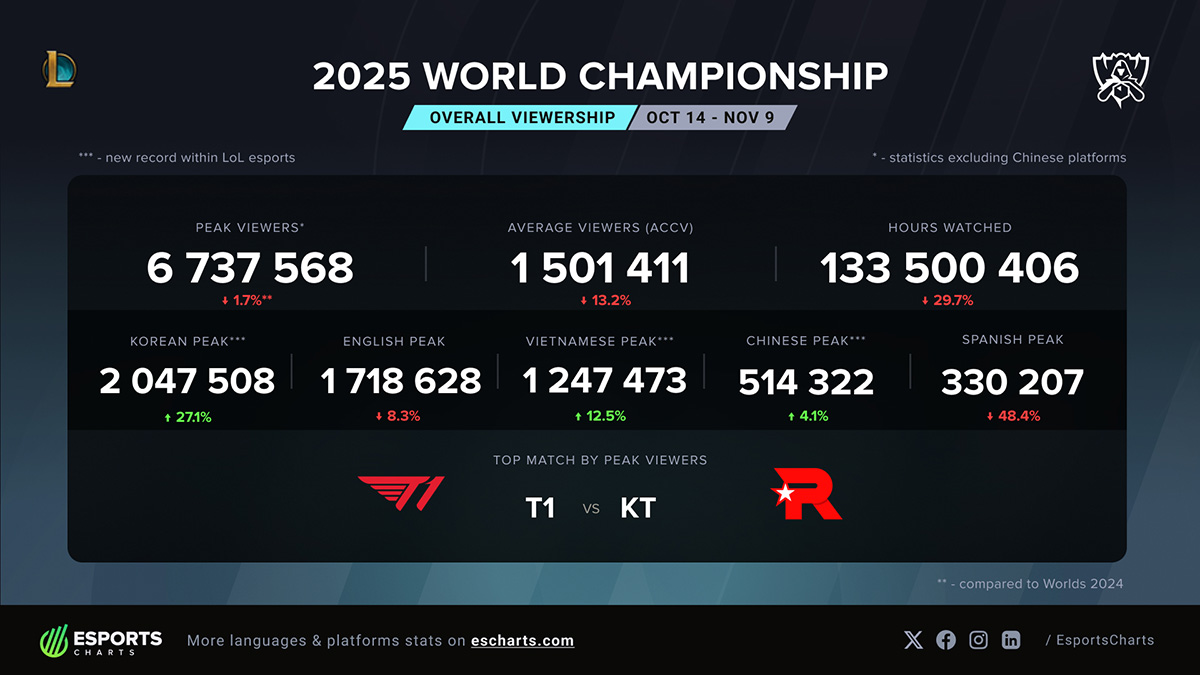

As the 2025 Worlds plods on, peak watcher stats span merely to the last-four ties.

Yet, per Esports Charts, this year's turnout reveals a 25% dip in the Swiss Stage. Such a slide might stem from setup weariness and slimmer big-name local feuds in the tourney's dawn.

Notwithstanding the early lull, involvement spiked anew in the knock-out phases, fanned by headline bouts and plot-packed reprisals.

The Grand Final, KT vs. T1, reached highest peak viewership this year of 6.7 million, keeping League of Legends most-watched esports game title in 2025.

(LoL 2025 World Championship Grand Final Overall Viewership | Source: Esports Charts)

The banner of handset esports keeps lording over South-East Asia. The MLBB M5 World Championship lured history-making crowds over Indonesia, the Philippines, and Malaysia, affirming the broad appeal of handset-led rivalry.

👉 Mobile Game Insights: Why MLBB But Not Wild Rift Can Win in Southeast Asia?

Valve's fresh iteration of the timeless series breathed new vigour into contest FPS.

The 2025 Major fixtures kept smashing tallies over Twitch and YouTube, spotlighting a resurgence of Western esports bones and backer zeal.

Though The International's reward pot has levelled off from prior pinnacles, Dota 2 still wields profound allegiance from backers and squads. Its web stays a cornerstone of the PC esports realm, notably in Eastern Europe and South-East Asia.

Riot's ploy shooter has solidly bedded down as the speediest-blooming FPS esport. The Valorant Champions 2025 notched crest watchers topping million at once, urged by robust local leagues in the Americas and EMEA.

Handset survival royales linger as titan titles in South Asia, the Middle East, and Latin America. BGMI's fresh launch in India and state-fostered fixtures in the Gulf have rekindled involvement and backer returns.

Epic's inventive thrust via Fortnite Festival and within-game occasion modes has sustained the web's sparkle. While contest turnout has flattened, its weaving of tunes and social fare keeps reimagining esports leisure.

👉 Mobile Game Insights: Can Fortnite's iOS Comeback Reclaim the Battle Royale Crown?

Tencent's overseas twin to Honor of Kings keeps mooring handset esports over South-East Asia and Latin America.

The Arena of Valor International Championship (AIC) 2025 yielded sturdy pan-zone involvement, affirming the title's endurance and draw past China. Its mix of handset handiness and squad ploy secures it amongst the most-watched handset MOBA happenings planet-wide.

PUBG's PC guise endures as a bedrock title for survival royale esports, buoyed by steady local leagues and crowd-led fixtures.

Though its broad spotlight has waned versus its handset kin, PUBG clings to a steadfast contest scene, especially in Korea and Eastern Europe, with the 2025 Global Series bolstering its lasting esports heritage.

China's prime handset MOBA presses on churning huge home returns and swelling overseas limelight via the Honor of Kings Invitational Series. Its stretch into planetary zones, including the Middle East and South America, quickens in 2025.

All told, these leading titles illuminate how the esports web has grown more varied than at any point—bridging types, devices, and locales.

The poise 'twixt PC, console, and handset rivalry hints that the upcoming growth leg will hinge on multi-device involvement and the merging of play, leisure, and live fixtures.

The 2026 esports docket promises to be among the busiest to date, laced with planetary clashes fusing rivalry, leisure, and heritage.

Back in Riyadh from 6 July to 23 August, the Esports World Cup will once more rally top squads over LoL, Dota 2, VALORANT, and CS2. Underpinned by Saudi Arabia's Vision 2030, it gears up for landmark reward pots and broadened leisure displays.

Esports will reprise as an official medal branch at the 2026 Asian Games in Aichi–Nagoya, Japan, etching another benchmark for its mainstream sports acclaim.

The slate boasts 11 titles, from League of Legends and Honor of Kings to Mobile Legends: Bang Bang, Pokémon UNITE, and Gran Turismo 7, mirroring a even split of PC, console, and handset rivalries.

Set in South Korea, the League of Legends MSI will limelight elite local victors, with Riot Games rolling out novel air styles and AR-boosted staging.

The LoL Worlds 2026 eyes a North American homecoming, with a tweaked local setup and sharpened cross-league slots. Backed by Riot’s steady pour into live staging, it lingers as one of the globe's most-viewed yearly esports fixtures.

The MLBB M6 unfolds in Manila, cementing the game's sway in South-East Asia. After history-shattering crowds in 2025, Moonton widens fan precincts, maker tie-ups, and local trials to fortify overseas involvement.

Valve's Dota 2 loop endures beneath the fresh open-trial guise. The 2026 The International beds in Singapore, while Major halts in Europe, South America, and China act as chief preludes to the year-end.

With the introduction of new franchise partnerships, the 2026 VALORANT competitive season is set to expand its global footprint.

Masters events will take place in Santiago, Chile, and London, England, before the season reaches its grand finale at the VALORANT Champions tournament in Shanghai, China.

A pair of grand titles—Spring Major in Copenhagen and Fall Major in Dallas—will moor the CS2 docket, propped by ESL and BLAST. Both eye elite turnout and planetary gaze.

Slated for November in Riyadh, this country-squad contest spotlights esports' swelling sync with planetary sports frames.

The Global Esports Federation's prime deciders land in Los Angeles on 4 December, etching a team-up 'twixt esports and Hollywood's leisure web.

Key stops in Brazil (April), the U.S. (May), and China (November) will moor the CS2 rivalry loop, reaffirming IEM's planetary stature.

Together, these fixtures sketch esports' shift to a full-year planetary loop—where rivalry, press, and heritage meet.

The planetary esports sector in 2025 perches at an intriguing juncture—ever more mercantile, ever more worldly, and ever more woven into broad culture than hitherto.

As novel techs, crowds, and trading guises keep steering its course, the coming years stand poised to recast the essence of "contest gaming" on a planetary canvas.

Handset esports have definitively burst their local bounds. Crowns like Mobile Legends, Free Fire, and Honor of Kings propel the heftiest gaze swells, notably in South-East Asia, India, and Latin America.

Developers lean ever harder into multi-device clash frames, letting PC, console, and handset players share one rivalry web—a stride that widens handiness and backer span.

In 2025, the boundary 'twixt esports and leisure hazed further still. Fixtures like the Fortnite World Cup and Twitch Rivals showed how maker-led clashes can rival—or at times outpace—classic esports gaze.

Bank on more hook-ups 'twixt pro gamers, streamers, and press marks as esports welds deeper with mass culture and maker webs.

Man-made nous swells as a prime mover in esports number-crunching—from instant feat tracing to AI-fueled drilling and auto-snippet forging.

Esports outfits tap data to hone gamer prep, hunt fresh skill, and tailor backer jaunts. By 2026, AI-aided drill gear eyes standard status over elite squads.

With esports slipping into core learning, state alliances, and Olympic-tier acclaim, uniform rules emerge.

Nations like South Korea and the UAE etch yardsticks for sportsman handling, pass rules, and anti-boost codes. This budding frame aids in legitimising esports as a viable trade route—not mere a zeal quest.

Esports' tomorrow may shun mere screens. AR and VR clashes gain pull, tendering deep hybrid jaunts that fuse fleshly and digital frolic.

Moreover, big tech outfits probe metaverse-like esports dens—where crowds can watch, mingle, and even sway bouts live.

Esports has matured from specialist leisure into a planetary sector moulding today's web heritage. With billion-dollar booms, swelling crowds, and nods from spectacles like the Asian Games, it now vies with classic sports in breadth and pull.

As handset frolic, AI, and cross-press team-ups spur the fresh surge, esports gears to emerge not just as rivalry—but a pivotal drive in tomorrow's planetary leisure.

If our analysis catches your eye, do kindly track our formal channels:

Twitter/X: @ASOWorldcom | @ASOGameNews

LinkedIn: ASOWORLD

Facebook: ASO World

Instagram: @asoworldcom

👉 Register to delve deeper into eSports and Gaming Marketing Analysis

Our previous Global Esport Market Report:

👉 Global Esports Market Report (2024)

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.