This report offers a broad overview of the eSports industry in 2024, examining its current status and emerging trends.

eSports refers to competitive gaming where individuals or teams contest in organised video game tournaments.

It has evolved beyond a mere offshoot of gaming, establishing itself as a standalone industry through the continuous development of professional leagues and competitive structures.

This report provides a comprehensive overview of the global eSports market and emerging trends in 2024.

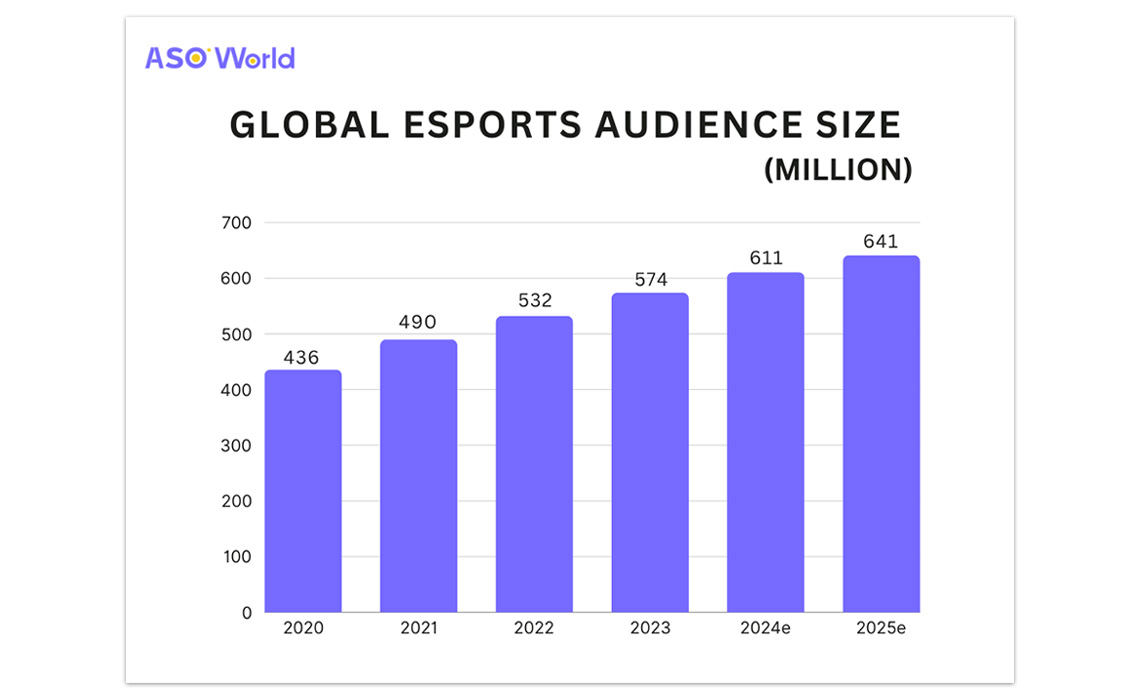

In 2024, the global eSports audience is estimated at 611 million, comprising 302 million core viewers and 308 million occasional viewers.

By 2025, this number is projected to grow at an annual rate of approximately 5%, reaching 641.1 million.

The North American eSports market continues to be a major contributor to the global industry, supported by strong infrastructure, high internet penetration, and a large viewer base.

The United States and Canada lead in revenue generation and competitive gaming, with titles such as League of Legends, Fortnite, and Call of Duty drawing substantial audiences.

In 2024, the U.S. eSports market is set to reach approximately $1.07 billion in revenue, maintaining a leading role in the global sector.

It is expected to grow at a compound annual growth rate (CAGR) of 15.4% from 2024 to 2029, reaching $1.595 billion. The eSports betting segment alone is projected at $721.2 million in 2024.

The U.S. eSports user base is also expanding, with projected users reaching 72.5 million by 2029 and penetration rising from 15.4% to 20.7%. The average revenue per user (ARPU) is expected at $20.32.

This growth is reflected in the increasing number of professional teams and dedicated fans, reinforcing the U.S.'s position as a global eSports leader through innovation and investment.

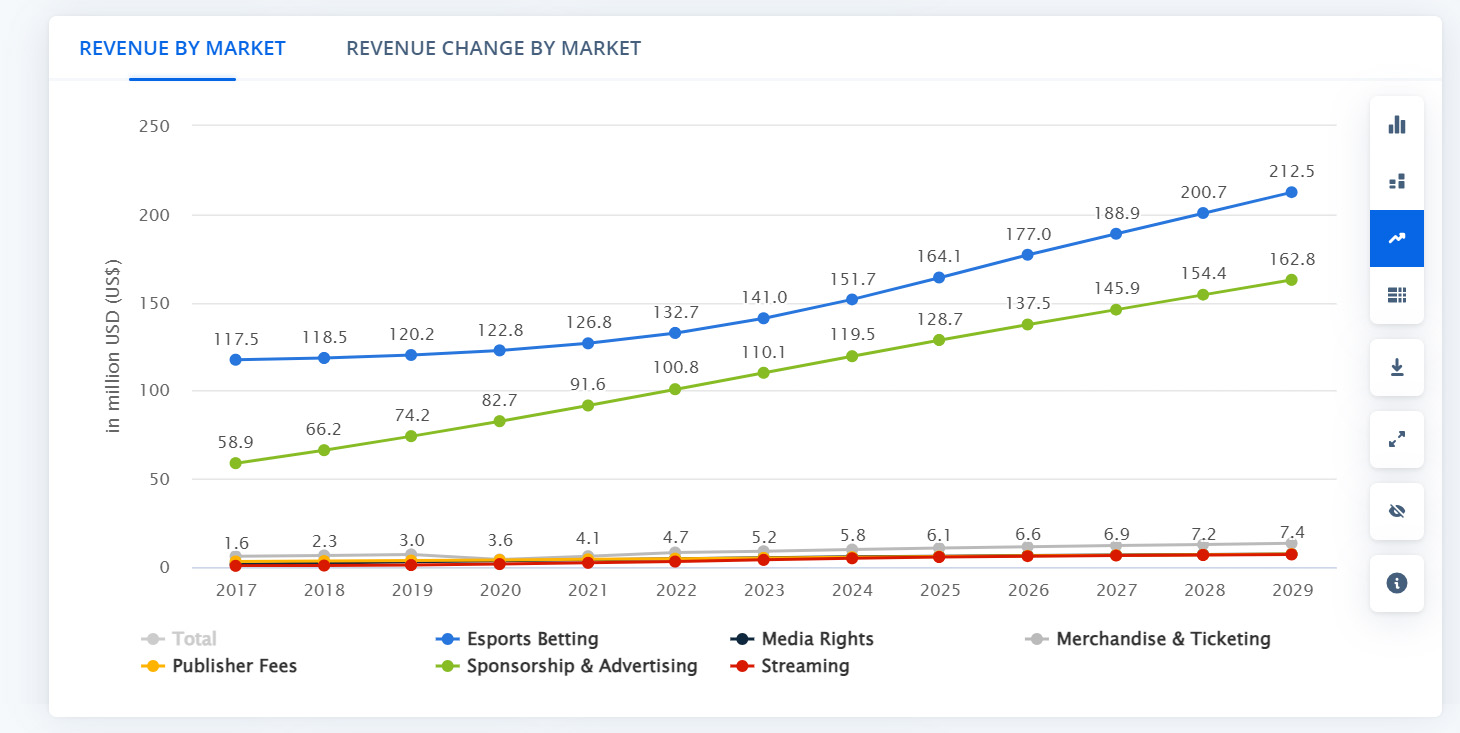

Canada's eSports market is projected to generate around US$138.9 million in 2024, with eSports betting representing the largest segment at US$108.3 million.

The market is expected to grow at a CAGR of 5.92% to US$185.2 million by 2029.

Canada is building its niche with an expanding user base, expected to reach 15.2 million by 2029, with penetration increasing from 32.3% to 37.4% and ARPU at US$10.98.

Investment in infrastructure and professional teams is driving Canada's rapid growth, positioning it as a key participant in the global eSports ecosystem.

Europe's eSports market is projected to earn US$1,440 million in 2024, making it a major global player.

Revenue streams include sponsorships, media rights, and eSports betting, which dominates with US$923.5 million.

Countries such as Germany and Poland lead with strong government support and a growing number of professional teams, fostering competitiveness and attracting investment.

East Asia, particularly South Korea and China, remains a global powerhouse in eSports.

South Korea boasts a mature eSports ecosystem with dedicated arenas, professional leagues, and a passionate fanbase.

(Data Source: Statista)

Revenue is projected at US$297.2 million in 2024, with CAGR of 6.68% reaching US$410.6 million by 2029. Esports betting is expected to be the largest segment at US$151.7 million.

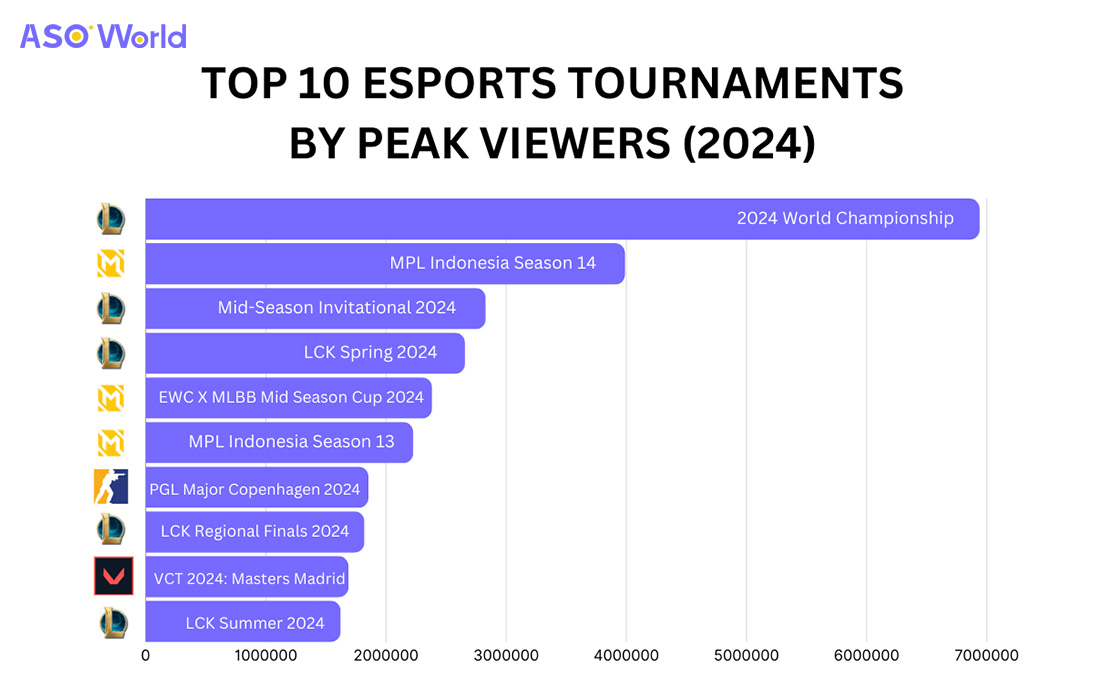

User numbers are forecast to rise to 12.2 million by 2029, with ARPU of US$29.19. The LCK Spring 2024 ranked as the third most-watched professional tournament worldwide, highlighting Korea's global influence.

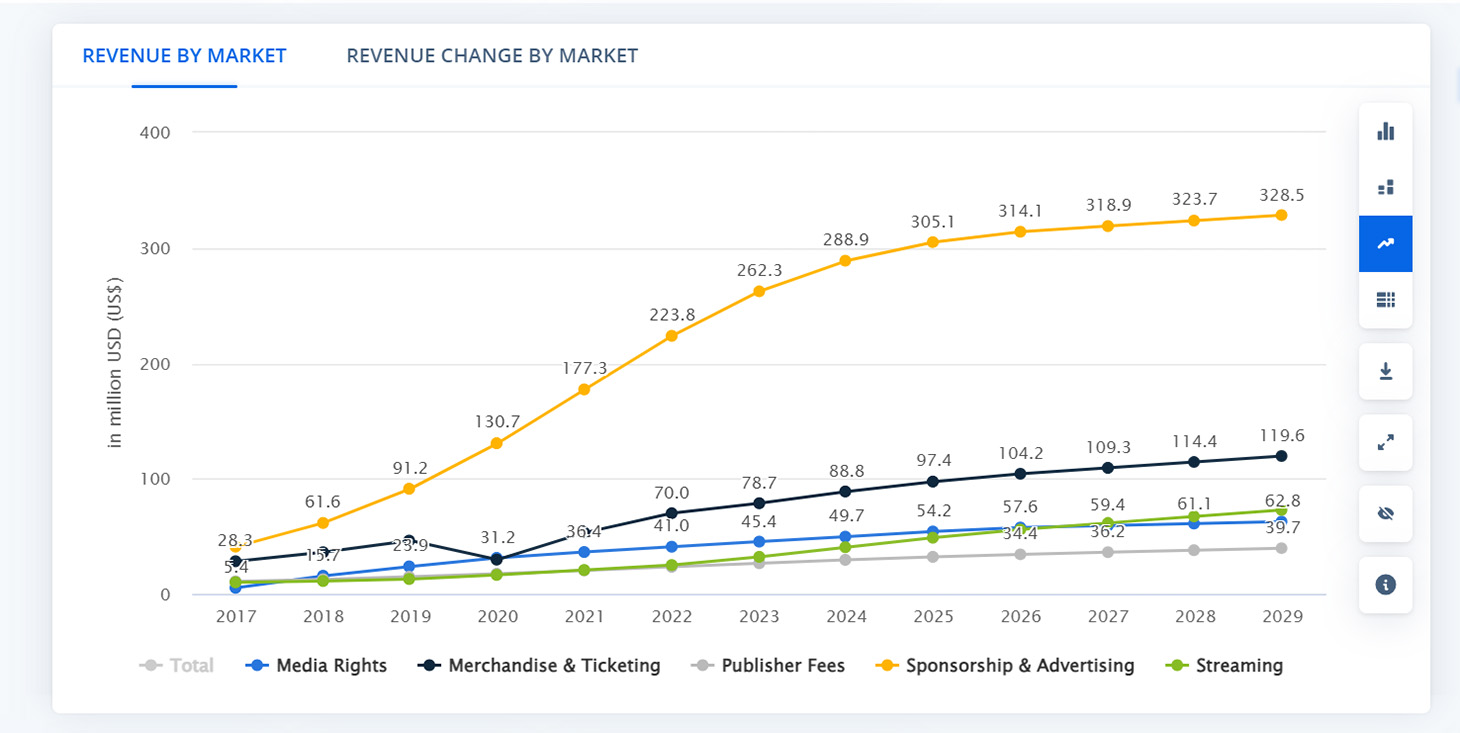

China's eSports market, driven by a massive player base and tech investment, is expected to reach US$497.6 million in 2024.

With a CAGR of 4.61%, the market is projected at US$623.5 million by 2029.

(Data Source: Statista)

Sponsorship & Advertising represents the largest segment, projected at US$288.9 million. User numbers are set to reach 245.6 million by 2029, with ARPU of US$2.40.

The Southeast Asian eSports market is projected at $79.7 million in 2024, with eSports betting dominating.

CAGR from 2019 to 2024 is 20.8%, driven by Indonesia, Malaysia, Thailand, Vietnam, and Singapore.

Emerging Middle Eastern markets show significant growth potential. Saudi Arabia is investing heavily, hosting the 2024 eSports World Cup, featuring 22 major titles and teams worldwide.

The top ten global eSports companies include:

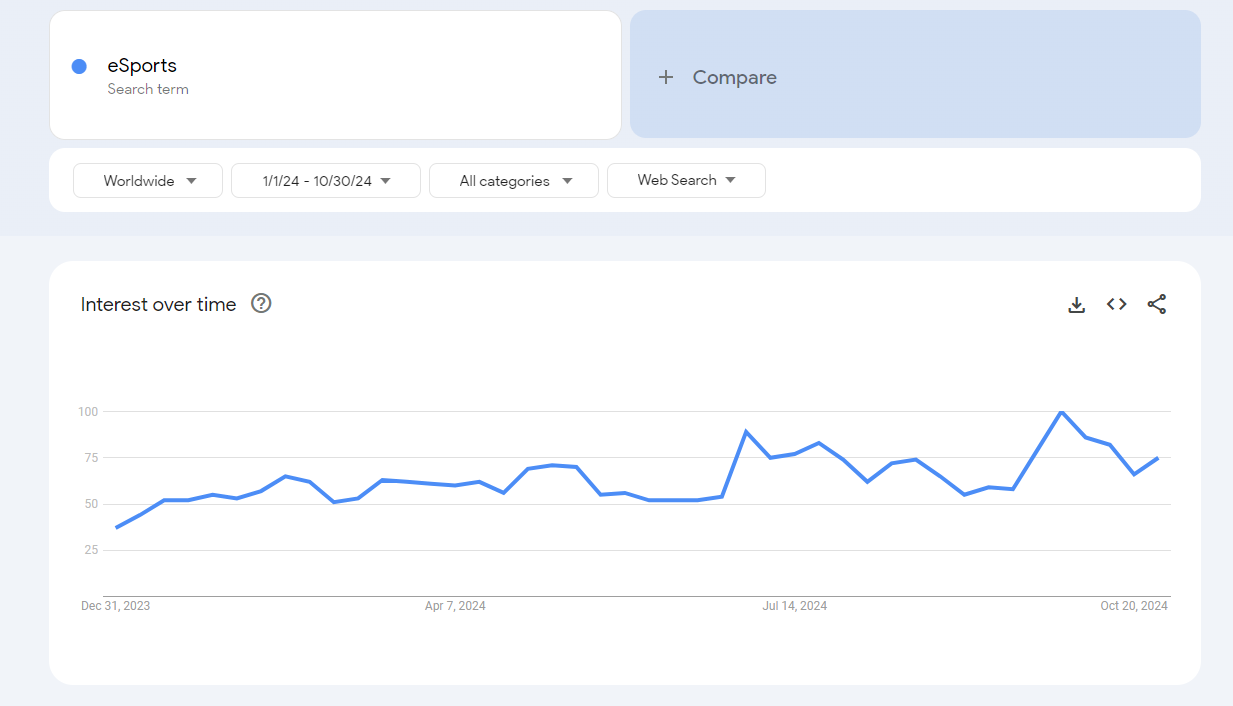

According to Google Trends 2024, October peaks in interest, coinciding with the League of Legends World Championship (Worlds 2024).

(Data Source: Google Trends)

Top games by search popularity include:

Notable tournaments ranking high in searches include "2024 Esports World Cup" and "Olympic Esports Series".

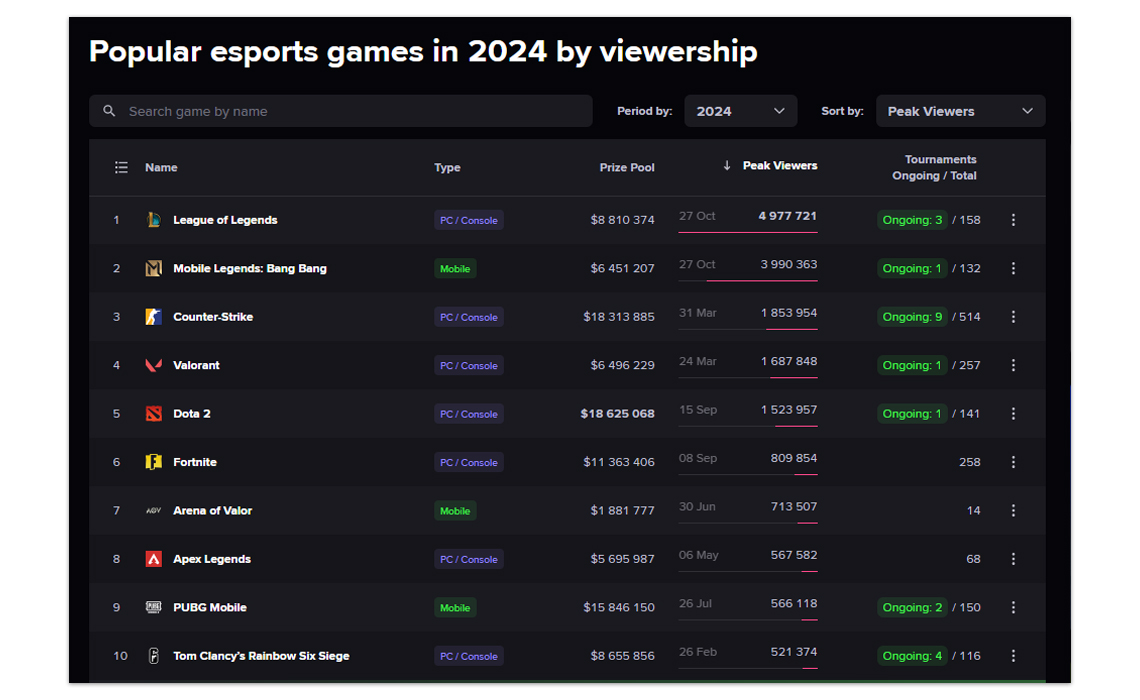

(Data Source: Esports Chart)

MOBA and shooting games continue to dominate the eSports landscape.

According to Esports Chart, LoL, MLBB, CS2, and Valorant were the most-watched tournaments in 2024, with LoL Worlds 2024 peaking at 6.94 million viewers.

In July 2024, the International Olympic Committee (IOC) announced the launch of the Olympic Esports Games, with the first edition set for 2025 in Saudi Arabia.

The Esports World Cup will return in summer 2025 in Riyadh. Valorant participation is speculated but not yet confirmed by Riot Games.

The 33rd SEA Games will take place from 9–20 December 2025 in Thailand. eSports is officially included as a sporting discipline.

The global eSports market in 2024 demonstrates strong growth potential as an independent industry.

With mature leagues, substantial investment, and a growing global audience, eSports has cemented its role in entertainment and competitive sport.

Major companies like Tencent, Activision Blizzard, and EA drive growth, while games such as League of Legends and Valorant dominate the sector.

Upcoming events, including the Olympic Esports Games, are expected to further integrate eSports into mainstream culture.

Global eSports Market Report 2023

Register to access in-depth eSports and gaming marketing insights.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.