The Future of Sports Apps Marketing in 2026: What to Expect Next

eSports, typically referring to competitive video gaming, is an online sport mediated by computers. It is not merely an adjunct to gaming but is forming an independent industry chain through the progressive perfection of leagues.

eSports, typically referring to competitive video gaming, is an online sport mediated by computers. It is not merely an adjunct to gaming but is forming an independent industry chain through the progressive perfection of leagues.

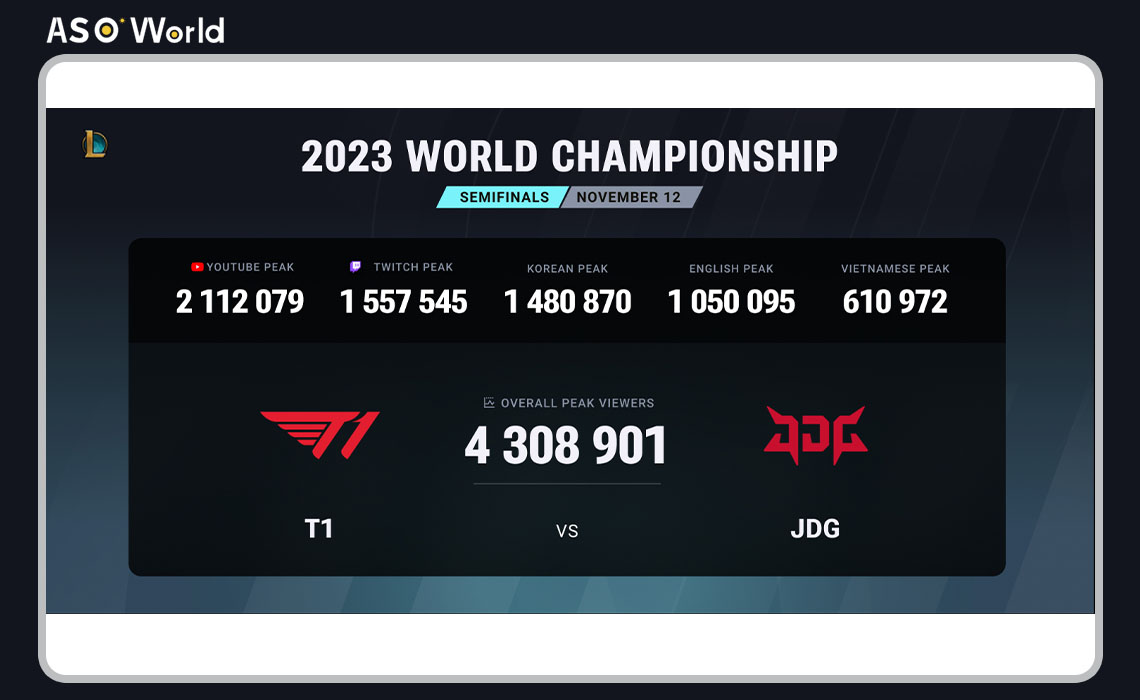

The massive audience it attracts brings substantial business opportunities and exposure. This report will provide a macro perspective on the status and development trends of the eSports industry in 2023.

In 2023, the global eSports audience is projected to increase to 574 million. Of this, core eSports enthusiasts will constitute 283 million, with the remaining 291 million being occasional viewers. By 2025, this figure is expected to grow at a compound annual growth rate of 8.1% to 641.1 million.

As a popular culture, eSports has embedded itself into the daily entertainment lives of netizens worldwide.

Research shows that even respondents unfamiliar or uninterested in eSports may unknowingly participate in related activities, such as reading or watching eSports IP content.

In all countries surveyed, except Japan, less than 10% have not participated in any eSports activities, with China's proportion being just 0.9%. This highlights the significant role of eSports in the entertainment lives of netizens worldwide.

Several companies are leading the rapidly growing eSports industry. Below is a summary of the top ten largest eSports companies globally:

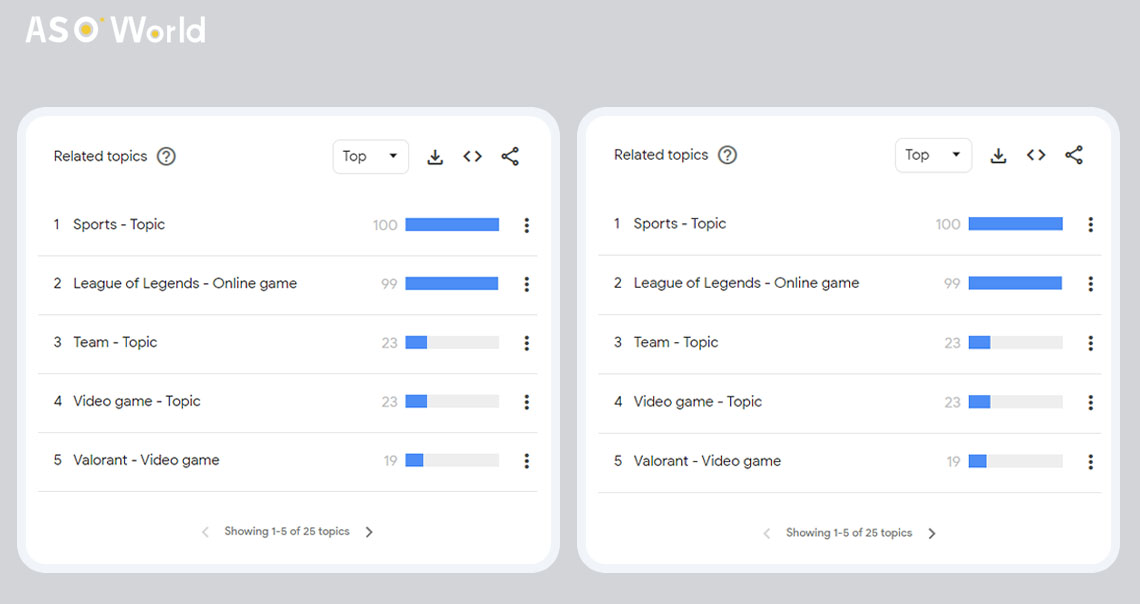

Tencent: Based in China, Tencent is a major player in the eSports industry. It owns Riot Games, the creator of the popular game League of Legends, and has stakes in other major companies like Epic Games and Activision Blizzard.

Modern Times Group (MTG): A Swedish digital entertainment company, MTG owns ESL and DreamHack, two of the largest eSports companies in Europe.

Activision Blizzard: The American company behind popular games like Call of Duty and Overwatch, Activision Blizzard has a significant presence in the eSports industry.

Electronic Arts (EA): Known for games like FIFA and Madden NFL, EA has a strong eSports division that organizes tournaments around the world.

Nintendo: A Japanese company famous for franchises like Super Mario and The Legend of Zelda, Nintendo has been increasing its focus on eSports in recent years.

Sony Interactive Entertainment (SIE): Sony, known for the PlayStation brand, is also involved in eSports, mainly through its PlayStation League.

NetEase: Another major Chinese company, NetEase collaborates with Blizzard to publish several popular games in China and runs its own eSports tournaments.

Take-Two Interactive: The American company behind the NBA 2K series, Take-Two Interactive has a strong presence in eSports, particularly with its NBA 2K League.

Gfinity: Based in the UK, Gfinity organizes and hosts eSports events for games like Rocket League, Street Fighter, and Fortnite.

FACEIT: A UK-based company, FACEIT is a leading platform for online multiplayer PvP gamers, hosting millions of game sessions monthly.

These companies represent the forefront of the eSports industry, each contributing to the sector's growth and development in unique ways. As the industry continues to expand, their influence and impact are likely to increase.

Regionally, nearly half of eSports revenue will come from the two largest markets, China and the United States.

The main eSports market revenues are from media rights, advertising, sponsorship, ticket & merchandise, and game publisher fees.

Sponsorship is projected to be the largest source of income, with an expected growth of 12% to reach $895 million. By 2022, this figure is anticipated to grow by 16% year-on-year.

Media rights revenue is expected to grow by 18% to reach $276 million, which is lower than the previous year's growth rate of 21%.

The merchandise and ticketing sectors are expected to experience the largest decline in revenue growth. In 2022, this specific area of the eSports industry is projected to grow by 34% year-on-year, amounting to $180 million.

However, statistics indicate that the growth in 2023 will be less than half of that, with revenue increasing by 16% year-on-year to reach $210.6 million.

The introduction of eSports as a showcase sport at the 2018 Asian Games in Jakarta and Palembang was a major step for the industry.

It gained further credibility when it was announced that eSports would become a medal event at the 2023 Asian Games in Hangzhou, China. These developments greatly enhance the recognition and acceptance of eSports, particularly in Asia market.

The decision to include eSports as a medal event is a strong endorsement of the industry's growth and potential. It not only validates the skill and dedication required in eSports but also aligns it with traditional sports. This recognition can help to eliminate any lingering stigma associated with eSports, promoting its acceptance among a broader audience.

Moreover, the Asian market continues to show promise for the eSports industry. The Asian Games slated for 2026 in Aichi Prefecture and Nagoya, Japan, will also feature eSports as an official event. This consistency in inclusion indicates a sustained commitment to the industry and suggests that eSports will continue to be an integral part of major sporting events in the region.

The consistent inclusion of eSports in the Asian Games is indicative of the industry's growth and its acceptance in mainstream culture. It also reflects the region's willingness to embrace new forms of entertainment and competition.

This continued support is likely to fuel further growth in the eSports industry, making it an increasingly attractive market for investors and companies.

The announcement by Saudi Crown Prince Mohammed bin Salman to host an eSports World Cup represents a significant development for the eSports industry. This move signifies a new direction for the industry, particularly in the Middle East region.

The decision to host an eSports World Cup in Saudi Arabia is a strong endorsement of the industry's global appeal and growth potential. It not only acknowledges the rising popularity of eSports but also recognizes its potential to attract a diverse and international audience.

This initiative aligns with the Crown Prince's Vision 2030, which aims to diversify the Saudi economy and create a vibrant society with a broad range of cultural and entertainment options.

The eSports World Cup project is set to be a massive global event, bringing together players and fans from all around the world.

It will not only boost the visibility of eSports on a global scale but will also position Saudi Arabia as a major player in the eSports industry. The event could potentially attract significant investment, sponsorship deals, and media attention, contributing to the growth and development of the industry.

This initiative is likely to stimulate the local eSports scene in Saudi Arabia and the wider Middle East region. It could inspire a new generation of gamers, encourage the development of local eSports talent, and promote the creation of eSports-related infrastructure and businesses.

The global eSports industry is experiencing remarkable growth and mainstream recognition, with expanding audiences, major company involvement, and integration into traditional sporting events.

Key developments in Asia and the Middle East, such as eSports' inclusion in the Asian Games and Saudi Arabia's plan to host an eSports World Cup, signal a promising future.

As technology advances and cultural perceptions shift, the eSports sector will likely create more investment, collaboration, and participation opportunities, bolstering the global digital economy.

>>> Register to learn more about eSports and Gaming Marketing Analysis

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.