The Future of Sports Apps Marketing in 2026: What to Expect Next

US video game industry rebounds, driven by enhanced hardware supply and blockbuster releases, sparking growth in the market.

The US video game industry has navigated a decade of upheavals, marked by shifts in player engagement and spending patterns. From the pandemic-induced surge in gaming to subsequent declines in spending on experiences, the industry has undergone notable fluctuations. However, a series of pivotal changes are propelling the market towards growth once again.

⚡ Mobile Game Market Outlook: How to Win your Game Business and Turn a Crisis into Opportunity in 2023?

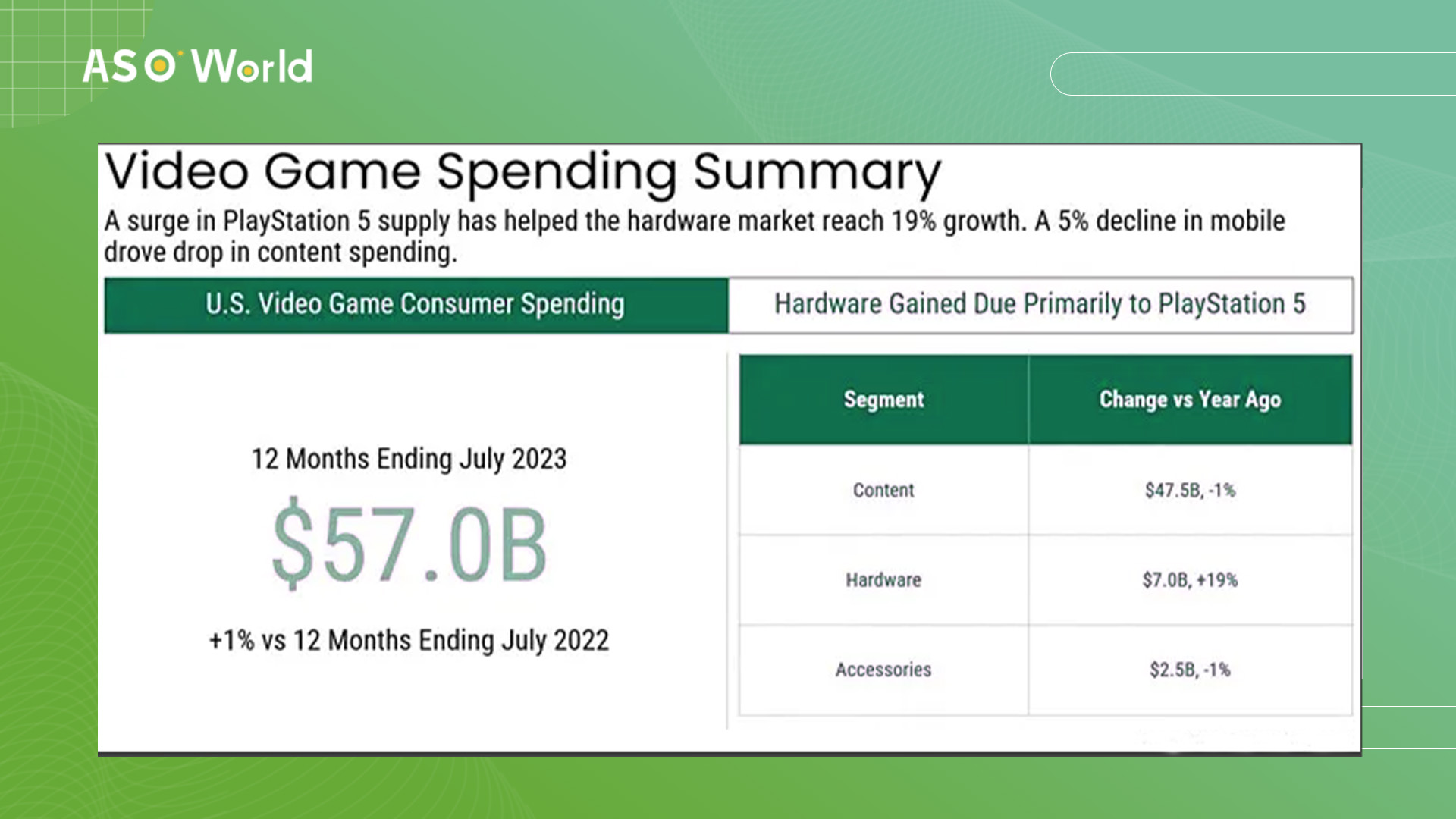

Over the past year, the resurgence of the US video game market has been largely attributed to advancements in hardware. New generation hardware sales have played a crucial role, contributing a remarkable $7 billion to the overall $57 billion video game spending in the country. This constitutes a noteworthy 19% increase compared to the previous year.

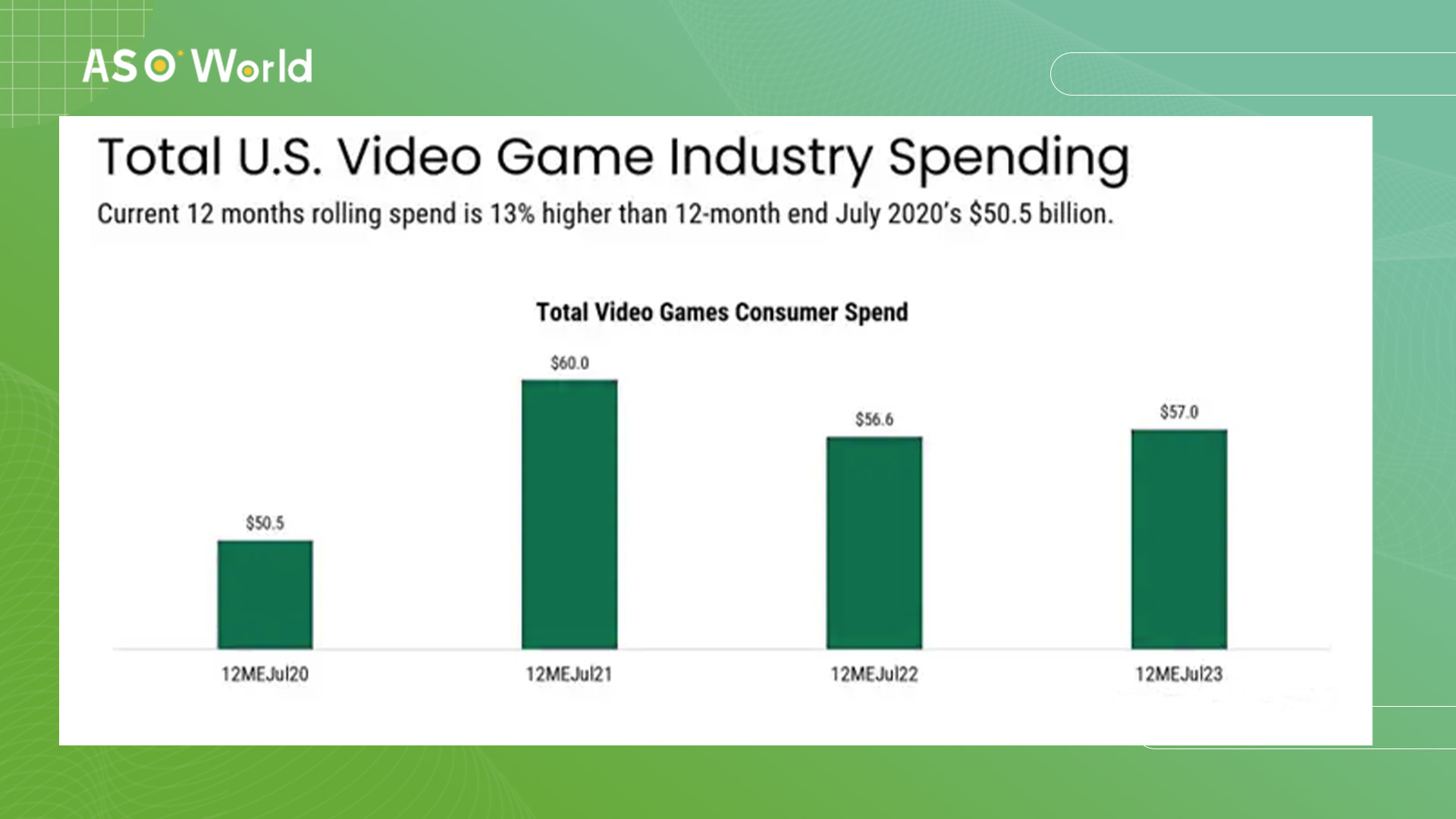

In contrast to the turbulent fluctuations of the past, the industry's spending of $57 billion over the past 12 months reflects a more stable trajectory. This accounts for a 1% increase compared to the previous year and an impressive 13% growth when compared to the pre-pandemic period ending in July 2020.

The challenges posed by post-launch hardware constraints have now evolved into a more favorable situation. The availability of new hardware has improved significantly, particularly for the PlayStation 5. This console has showcased substantial progress since July 2022, positioning it as a leading contender in the hardware market until at least 2025.

Comparatively, both the PlayStation 5 and Xbox Series consoles have fared well against their predecessors. PlayStation 5's unit sales are 5% ahead of PlayStation 4 and a remarkable 87% ahead of PlayStation 3. Similarly, while Xbox Series trails Xbox One by 10%, it maintains a 6% lead over Xbox 360.

Throughout 2023, the Nintendo Switch has maintained its robust performance, benefiting notably from the launch of The Legend of Zelda: Tears of the Kingdom. Impressively, the cumulative sales of Switch hardware in the US market have now outpaced those of the Wii, a milestone achieved in July 2023. Presently, Switch's lifetime sales fall slightly short of the Xbox 360 by less than a million units and the PlayStation 2 by fewer than five million units.

⚡ Game App Development Insights(2023): 6 Types of Gaming App Trends to Watch

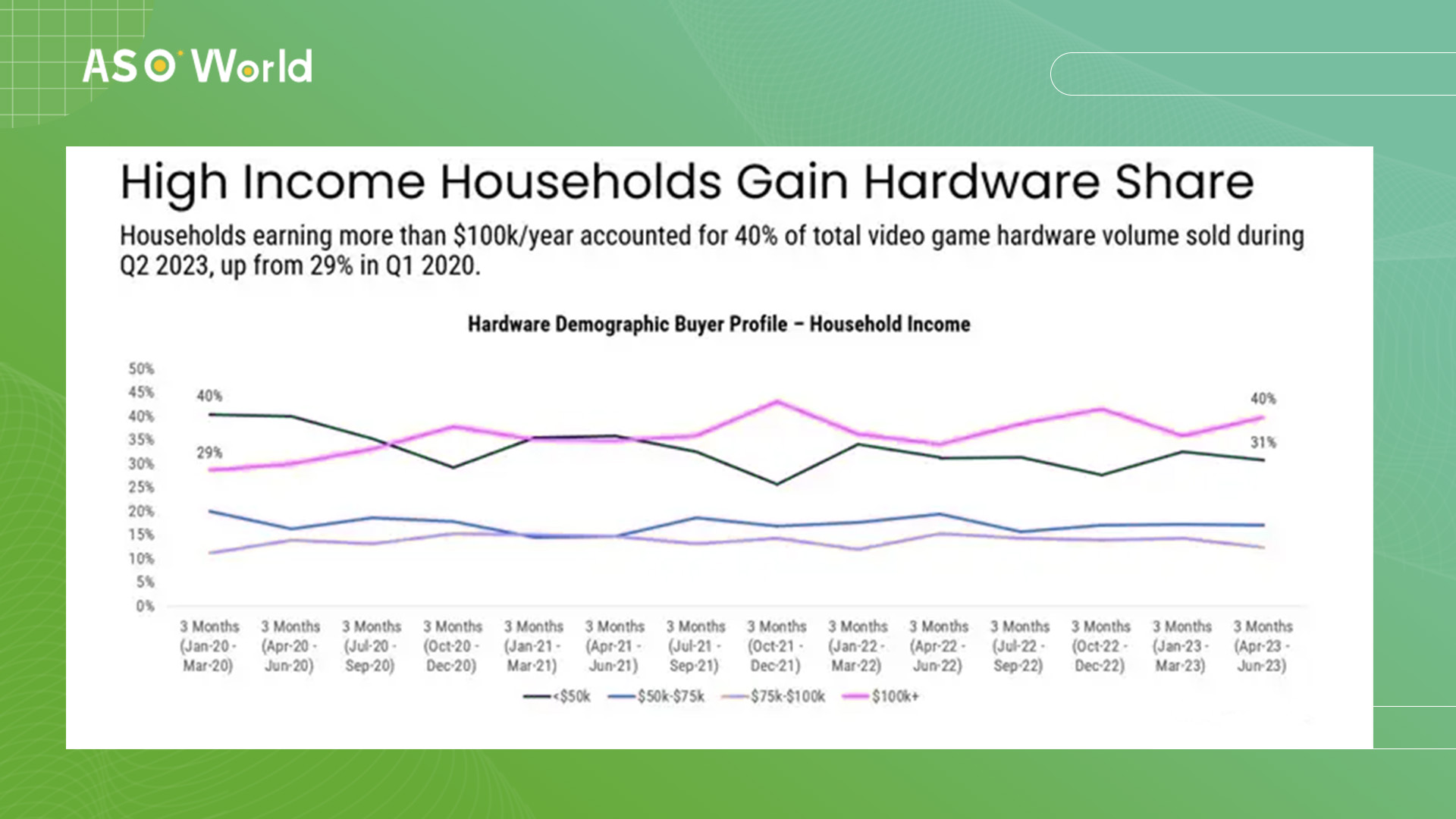

A notable transformation has been observed in the consumer base for new video game hardware. High-income households, earning over $100k/year, have emerged as the primary contributors to hardware sales. This shift from the market's landscape at the start of 2020 can be attributed to factors such as increased prices in essential spending categories like food and fuel, alongside a transition from Switch consoles to the pricier PlayStation 5.

The dominant force driving content performance this year has been the surge in digital premium full game downloads. This upward trajectory owes much to the impact of noteworthy new releases, orchestrating substantial growth. Concurrently, the industry has seen an ongoing shift towards digital premium downloads, at the expense of physical discs.

The pivotal role of blockbuster game launches is underscored by their ability to counterbalance the downturns observed in mobile gaming and a minor setback in digital add-on content spending.

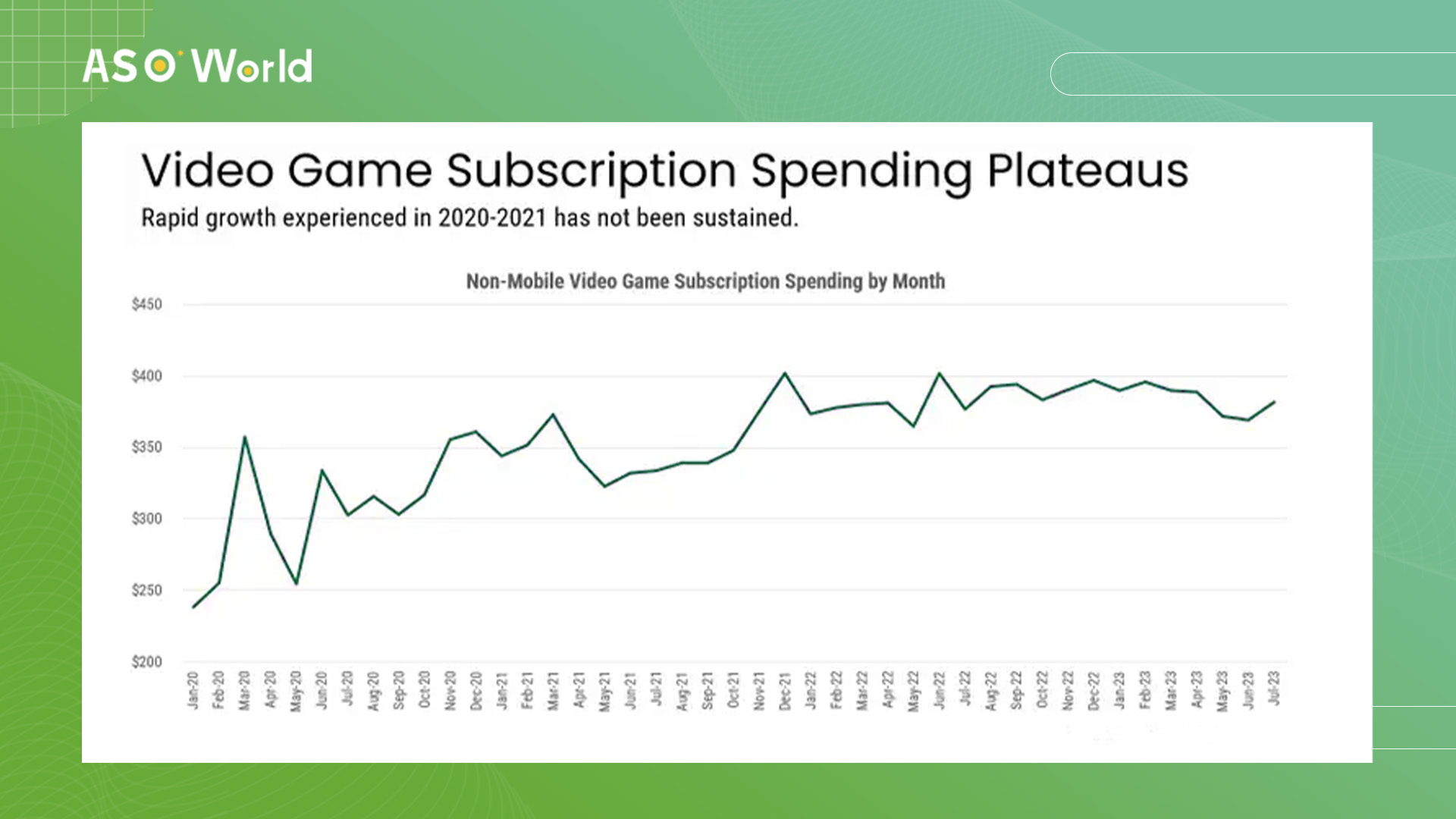

A significant success story in the years 2020 and 2021 centered around subscription services. The convergence of fresh service offerings, a constrained release calendar due to delays, and a consumer demographic with ample leisure time collectively propelled subscription spending into double-digit percentage growth, marking the early years of the decade.

However, a recent phase has seen subscription spending reach a plateau. US consumer expenditure on video game subscription services has stabilized at an approximate monthly average of $400 million since first attaining this level in November 2021. Several factors might account for this deceleration, including subscription fatigue, reduced disposable income due to escalated costs in essentials like food and fuel, the gradual adoption of cloud gaming within the broader market, and the allure of a robust lineup of premium game releases.

The accessories segment has also contributed to the industry's revival. The surge in remote work and learning during 2020 led to increased spending on accessories, particularly headsets and headphones. The availability of PlayStation 5 and Xbox Series consoles, along with the replacement demand for aging headsets, has bolstered headset sales by 2% in 2023 year-to-date compared to the previous year.

The PlayStation DualSense Edge and Xbox Elite gamepads have also been well-received by the market, showcasing a favorable response to premium gamepads.

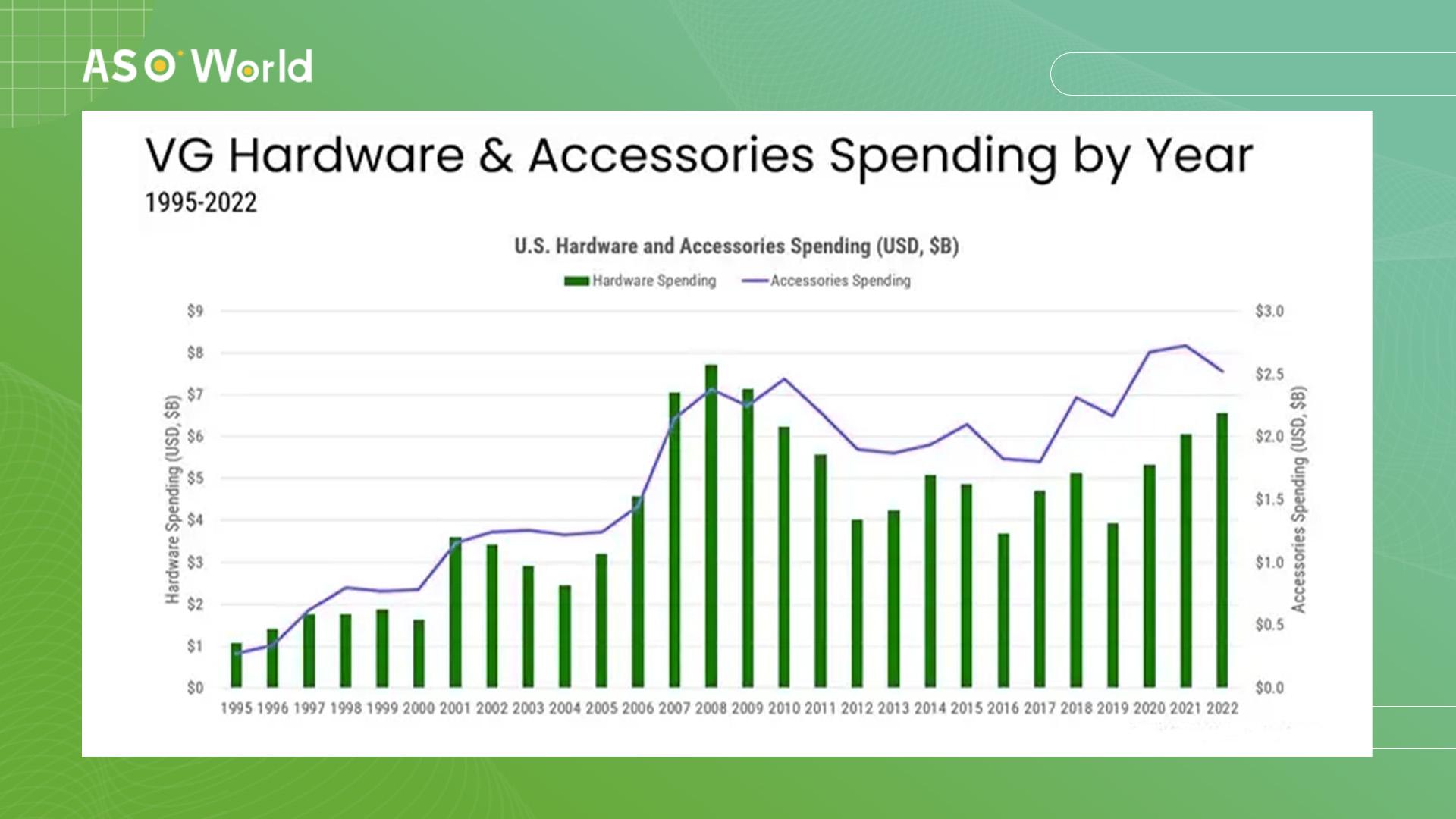

By leveraging the comprehensive insights, a consistent correlation between shifts in video game hardware and accessories spending becomes evident. Notably, in 2022, despite increased hardware sales, there was a dip in accessories spending. This anomaly is attributed to factors that spurred early-decade accessories demand. Expectations are aligned for accessories and hardware expenditures to realign more closely in the forthcoming years, as market dynamics naturally balance out over time.

The US video game market's dynamics continue to evolve rapidly, with several trends warranting attention.

Click "Learn More" to drive your apps & games business with ASO World app promotion service now.

The US video game industry's journey through the past decade has been characterized by resilience and transformation. Despite the anticipated 3% growth in 2023, the industry remains susceptible to fluctuations.

However, these changes are now likely to stem from evolving player demographics, shifting business models, and the creative visions of game developers. This dynamic and ever-changing landscape holds both short-term optimism and long-term promise.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.