The Future of Sports Apps Marketing in 2026: What to Expect Next

2023 witnessed a surge in mobile games adapting popular IPs, with RPGs leading revenue.

In the realm of mobile gaming, leveraging well-known Intellectual Properties (IPs) has become a strategy of paramount importance. The year 2023 witnessed a surge in the adaptation of popular IPs into mobile games, accompanied by emerging trends reshaping the landscape. This report meticulously examines the trends that dominated the global IP gaming domain in 2023.

Among all mobile games developed from intellectual properties (IP), Role-Playing Games (RPGs) top the charts in revenue generation, accounting for 36% of the total income from all IP-based mobile games globally. The monetization strategy of these games often revolves around collecting and interacting with beloved IP characters.

Riding on the wave of the popular Fate anime series, "Fate/Grand Order" leads the pack in revenue among RPGs developed from video game IPs. Similarly, "Uma Musume Pretty Derby," another mobile game based on a popular anime, has effectively capitalized on the character gacha monetization model.

In the board game adaptation category, Scopely's "MONOPOLY GO!" stands out as the frontrunner in revenue, setting a benchmark for the genre.

As for sports IPs, "EA Sports FC" has become a flagship title. Following the end of its partnership with FIFA, EA has shifted to collaborate with FIFPRO to operate "EA Sports FC" and other football titles.

⚽ EA Sports FC 24: Unleashing Next-Level Football Gaming with Enhanced Gameplay and Platform Thrills

While RPGs dominate Asian markets for manga adaptations, action games prevail globally, particularly in the US and European markets.

⚡ Game App Development Insights(2023): 6 Types of Gaming App Trends to Watch

💡 Expert Insights: Whether you're targeting the Asian market with video game IPs or tapping into the diverse European preferences, ASOWorld can guide you through the complex landscape of ASO. Learn how our ASO Strategies can expand global markets for the game.

Video game IPs enjoy remarkable popularity in Asia, standing as the most favored IP media type globally, with this trend being even more pronounced in the Asian region. In Asia, mobile games adapted from video game IPs account for a staggering 70% of all downloads among IP-based mobile games.

While the IP-adapted mobile game "MONOPOLY GO!" has swept the charts in Western markets, ranking high on bestseller lists in the UK and the US, it only secures the 24th position in Asia.

Despite video game IPs being the highest-grossing IP media category across Asia and the world, the top-earning IP-adapted mobile game in Asia does not originate from a video game IP. Instead, it is the anime IP mobile game "Uma Musume Pretty Derby."

In the US and European markets, mobile games derived from video game IPs are the most downloaded, followed by those adapted from board game IPs. Asia presents a different landscape, where anime/manga ranks as the second most downloaded IP media type, showcasing the region's unique consumption preferences.

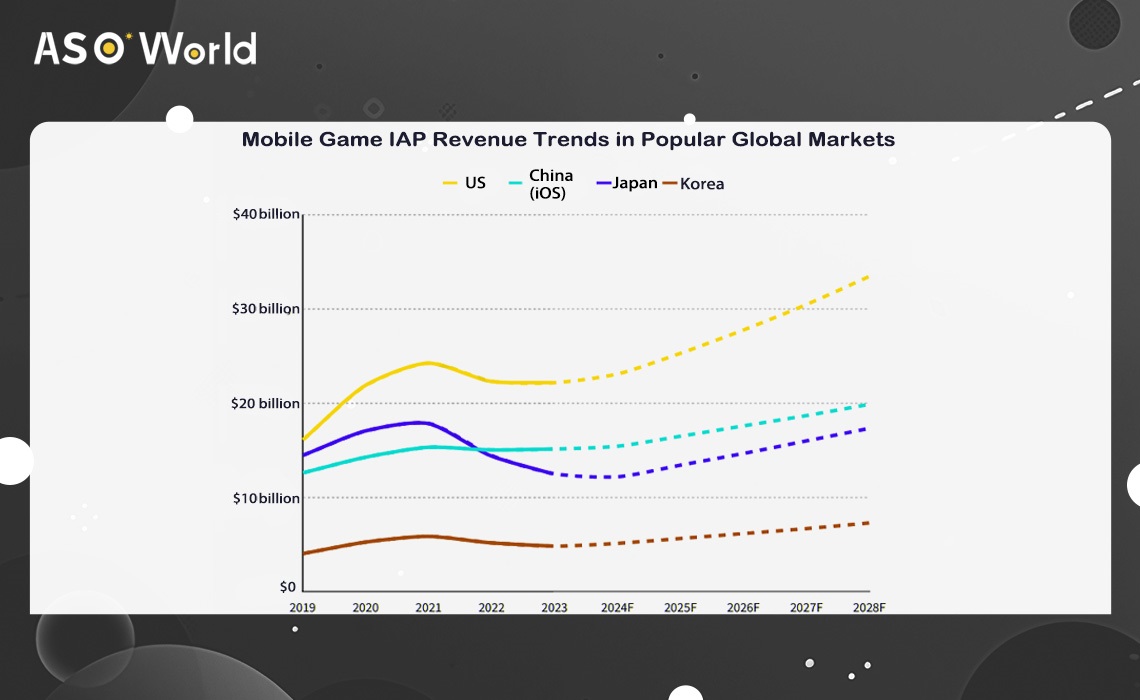

⚡ 2023 Global Mobile Gaming Market Insights: Trends and Opportunities

In the European market, video game IPs generally maintain a dominant position, with France being a notable exception. In France, mobile games based on anime IPs have surpassed those based on video game IPs in revenue, with the top two highest-grossing anime IP mobile games both belonging to the "Dragon Ball Z" franchise. Spain and Italy also show a higher revenue share for anime IPs, significantly more than the UK and Germany. Across the European Union and most of its member states, video game IPs are the most lucrative IP media category.

In the majority of European countries, the second and third highest-grossing IP media types are anime/manga IPs and board game IPs, respectively. However, the UK deviates from this trend, with board game IPs generating more revenue than anime/manga IPs. The fourth highest-grossing IP media category varies by country; in the UK and Germany, it is television IPs, while in France, Spain, and Italy, comic book/American comics IPs take this spot.

In 2023, "MONOPOLY GO!" has propelled the revenue share of board game IPs in the US mobile gaming market, now claiming nearly one-third of the total revenue. Mobile games based on celebrity and television IPs are experiencing a continued decline in downloads, and toy IPs have also seen a downturn this year. In contrast, sports IPs have maintained a stable performance. The six leading IP media types have captured 76% of the market share in 2023.

The US and Asia are pivotal markets for sports IP mobile games. With EA's partnership with FIFA having come to an end, FIFA's ranking in the mobile gaming space is expected to plummet significantly.

South Korea stands as the top revenue-generating market for FIFA mobile games, while also ranking second for MLB mobile game revenue. China has surpassed the United States to become the market generating the highest revenue for NBA mobile games. The vast majority of NFL mobile game revenue is sourced from the US market.

WWE enjoys popularity in the US and Europe but does not share the same level of enthusiasm in Asian countries compared to other sports IPs.

💡 Expert Insights: Understanding the preferences of your target market is crucial, but so is making sure they can find your game. We can help you align your IP strategy with best practices to drive downloads and revenue.

👉 Explore our Gaming App Marketing Solutions now.

Optimal alignment between IP media types and game genres yields the highest revenue. In the realms of video games and anime/manga IPs, RPGs are the most popular mobile game genre. These IPs are inherently suited for RPG development, as fans long to immerse themselves in the worlds depicted and interact with characters from the games or anime - strengths inherent to RPGs. Fans are often willing to pay for gacha mechanics to obtain their favorite characters, a spending behavior particularly prominent in the Asian market.

Sports IPs are well-suited for simulation games, some simulating the sports themselves, while others focus on the management aspect of sports franchises.

In the board game IP category, "MONOPOLY GO!" ranks as the highest revenue-generating mobile game in the US market. The gameplay of "MONOPOLY GO!" doesn't stem directly from traditional board game mechanics but has been optimized for mobile platforms with a focus on social interaction and monetization.

Comic book/American comics IPs naturally lend themselves to action games, while anime/manga IPs from Asia are more frequently adapted into RPGs. This demonstrates that the preferences for game genres can significantly vary among audiences of different IP media types.

💡 Expert Tips: At ASOWorld, we understand that every game is unique. Our tailored ASO strategies are designed to match your game's genre and IP media type for maximum revenue. 👉 Find out more about our Customized User Acquisition Solution.

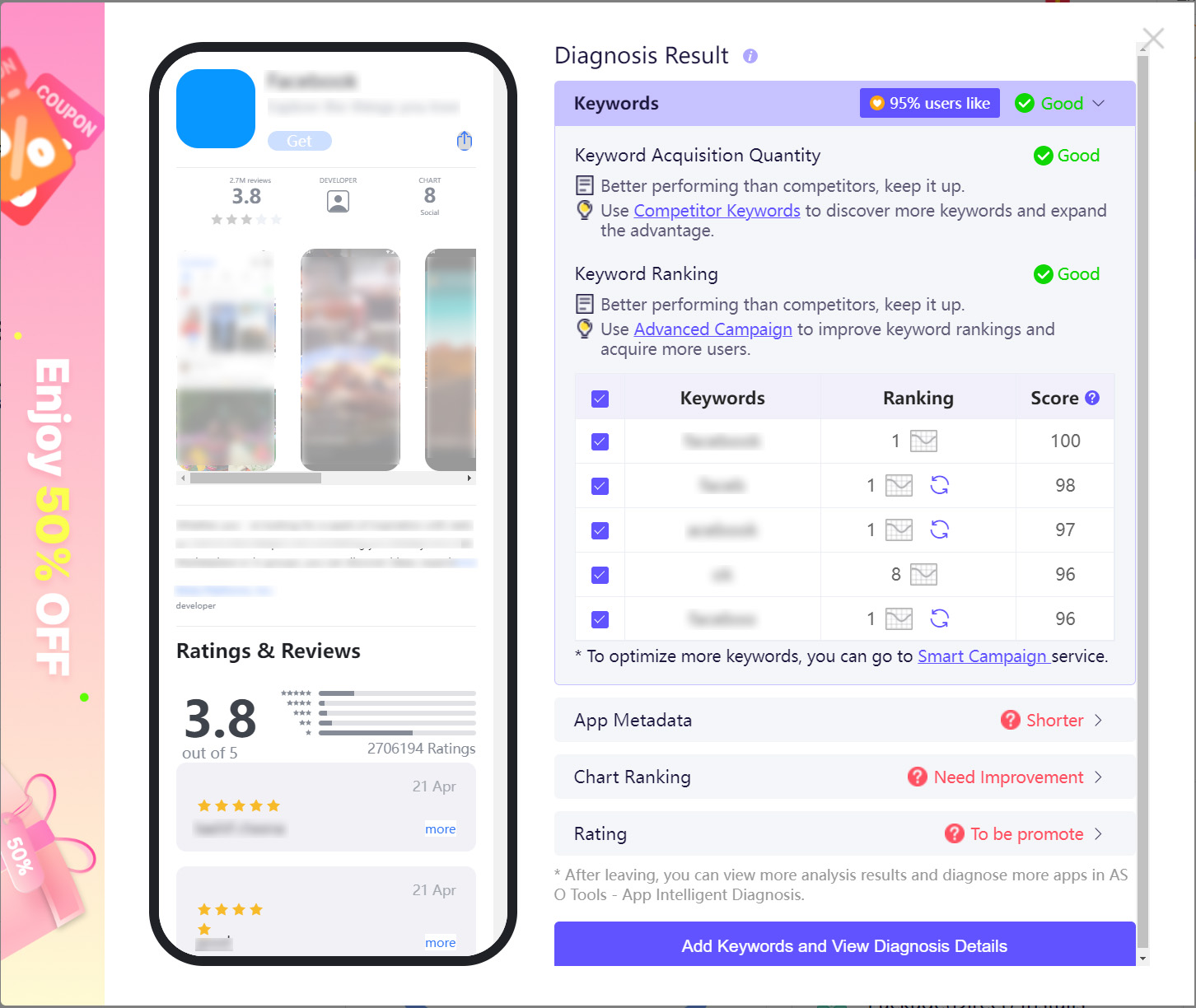

* Grow with our app growth solutions - choose a guaranteed app ranking service for the TOP 5 app ranking acquirement, and maximize your app traffic. Or click the image above (to increase app installs service for app visibility).

* What Is the Keyword Guaranteed Ranking Service? What Is the Advantage of It?

Within the top ten hottest celebrity-licensed IPs, internet personalities claim five spots, while traditional celebrities hold two. Additionally, there are two virtual idols and one Korean pop group making up the list.

Ellen DeGeneres has licensed a series of social mobile games under the "Ellen" IP, including "Heads Up!", "Psych! Outwit Your Friends", and "Heads Up! Charades for Kids".

Of the five internet personalities, three are YouTube influencers focusing on children and family content: Ryan's World, FGTeeV, and Vlad and Nikki.

Furthermore, Hatsune Miku is an anime virtual idol whose IP-based rhythm game is the highest-grossing celebrity IP mobile game in the United States and across the globe.

Click the image above to drive your apps & games business with the ASO World app promotion service now.

Click the image above to drive your apps & games business with the ASO World app promotion service now.

Get FREE Optimization Consultation

Let's Grow Your App & Get Massive Traffic!

All content, layout and frame code of all ASOWorld blog sections belong to the original content and technical team, all reproduction and references need to indicate the source and link in the obvious position, otherwise legal responsibility will be pursued.